Get insights on thousands of stocks from the global community of over 7 million individual investors at Simply Wall St.

-

Robinhood Markets (NasdaqGS:HOOD) is pushing into prediction markets through a controlling stake in MIAXdx, extending its reach beyond traditional trading and crypto.

-

The company has launched a public testnet for Robinhood Chain, an Ethereum Layer 2 solution aimed at broadening its role in blockchain infrastructure.

-

Robinhood is also undergoing a finance leadership change, with Shiv Verma stepping in as CFO, underscoring a wider reset in how the business is being shaped.

At a share price of $75.97, Robinhood Markets is entering this shift after a mixed stretch of performance, with a 16.4% return over the past year, a 30.1% decline over the past month, and a 34.1% decline year to date. The very large 3-year return suggests investors who bought earlier in that period have seen substantial price movement, even with the recent pullback.

For you as an investor, the move into prediction markets, derivatives via MIAXdx, and Layer 2 blockchain infrastructure points to a company seeking to build new revenue lines beyond trading commissions and crypto activity. The CFO transition to Shiv Verma is another element to watch, as finance leadership will help shape how Robinhood funds and prioritizes these newer areas.

Stay updated on the most important news stories for Robinhood Markets by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Robinhood Markets.

We’ve flagged 2 risks for Robinhood Markets. See which could impact your investment.

-

❌ Price vs Analyst Target: At US$75.97, the share price sits about 42% below the US$132.19 analyst target. This signals a wide gap in expectations you should understand before acting.

-

❌ Simply Wall St Valuation: Shares are described as trading 60.2% above estimated fair value, so you are paying a premium based on that model.

-

❌ Recent Momentum: The 30 day return of roughly 30% decline shows weak short term sentiment as this shift in the business model plays out.

There is only one way to know the right time to buy, sell or hold Robinhood Markets. Head to Simply Wall St’s company report for the latest analysis of Robinhood Markets’s Fair Value.

-

📊 The push into prediction markets, derivatives via MIAXdx, and Layer 2 infrastructure means you are assessing Robinhood as a broader fintech platform, not just a trading app.

-

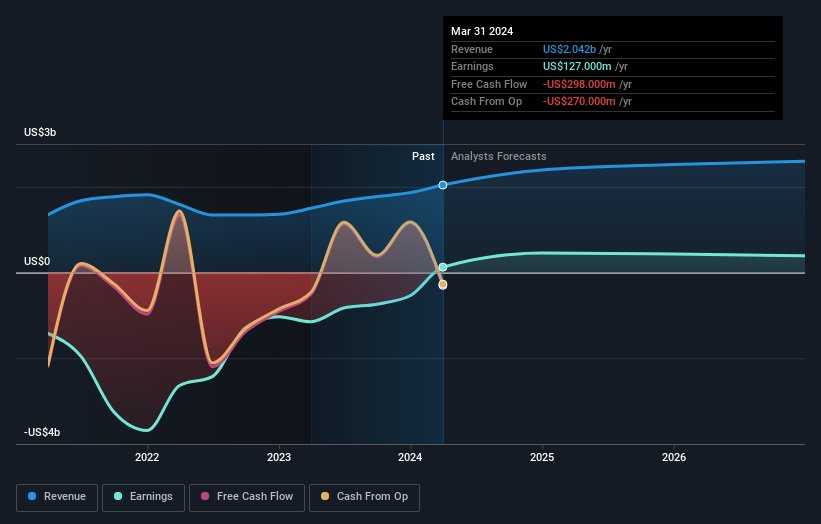

📊 Keep an eye on P/E of 36.4 versus the Capital Markets industry average of 23.1, earnings per share of US$2.09, and how new products contribute to revenue of US$4.47b and a 42.1% net margin.

-

⚠️ Share price volatility and flagged insider selling over the past 3 months make entry timing and position size especially important with this pivot.