- In early February 2026, a wave of brands including Wavytalk, being, Bloomeffects, Make Time Wellness, CNP, Mediheal, and SickScience expanded onto Ulta Beauty’s online and in-store platforms, broadening its assortment across haircare, skincare, and wellness.

- This cluster of launches highlights Ulta Beauty’s push into science-led, wellness-forward, and clinically oriented beauty solutions that could strengthen its relevance with ingredient-conscious consumers.

- We’ll now explore how Ulta Beauty’s broadened wellness and clinical skincare lineup at Ulta.com and in stores may influence its investment narrative.

Uncover the next big thing with 29 elite penny stocks that balance risk and reward.

Ulta Beauty Investment Narrative Recap

To own Ulta Beauty, you need to believe its broad, omnichannel beauty platform can keep pulling in shoppers even as costs rise and digital competition intensifies. The recent cluster of science-led wellness, clinical skincare, and haircare launches looks incremental rather than a clear swing factor for near term earnings, but it does speak directly to the biggest short term catalyst: keeping Ulta’s assortment relevant as the Target shop in shop wind down and rising store costs remain key risks.

Among the recent announcements, SickScience’s launch into 757 Ulta stores and Ulta.com is especially relevant. It reinforces Ulta’s push into biotech and clinically focused skincare, an area many analysts view as important for basket sizes and customer loyalty. How well brands like SickScience, CNP, Mediheal, and Bloomeffects resonate with wellness and ingredient focused shoppers could matter for offsetting cost pressures and supporting the profit profile that underpins current expectations.

But in contrast, investors should be aware that rising digital competition and higher store costs could still weigh on…

Read the full narrative on Ulta Beauty (it’s free!)

Ulta Beauty’s narrative projects $13.8 billion revenue and $1.3 billion earnings by 2028.

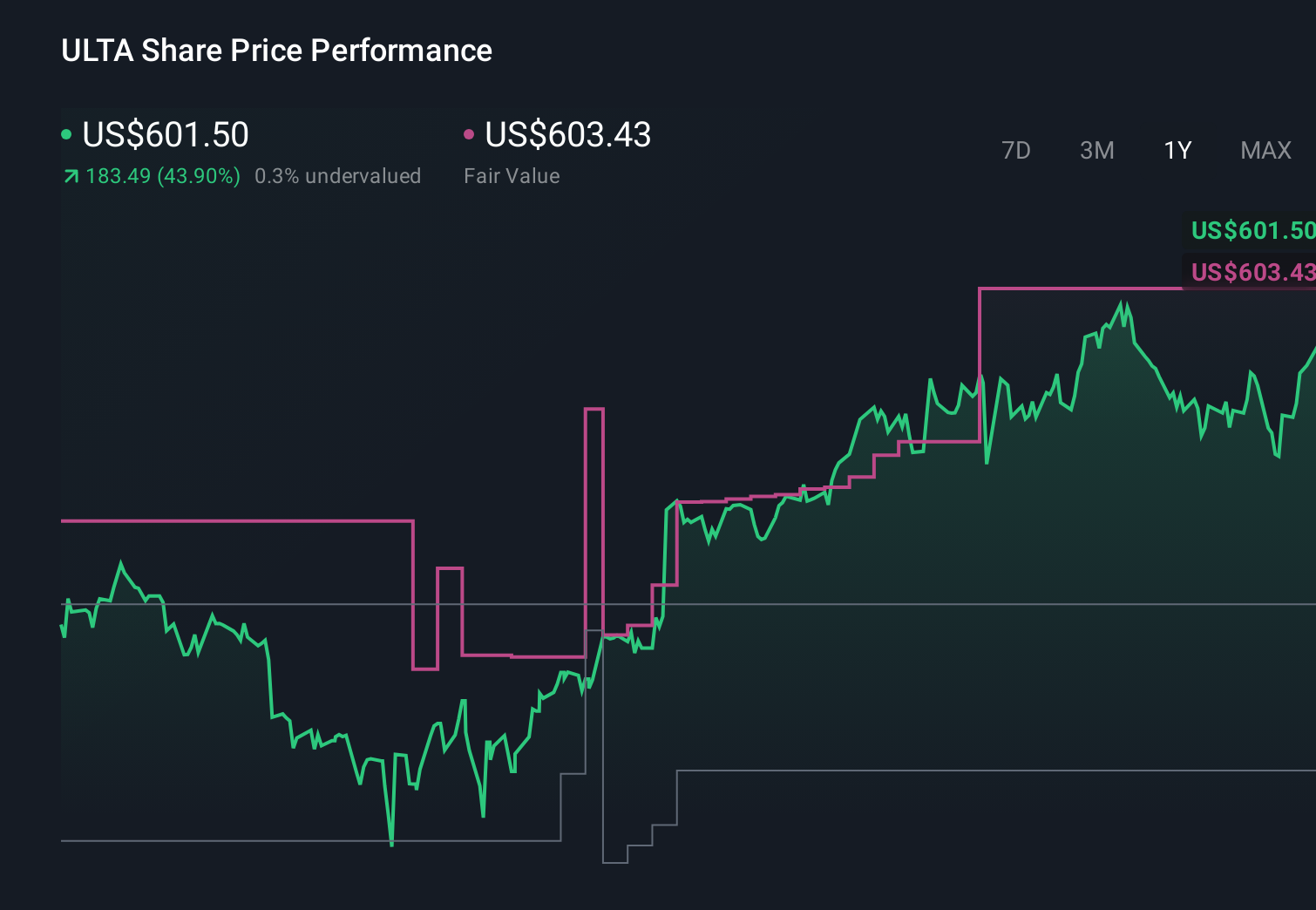

Uncover how Ulta Beauty’s forecasts yield a $674.58 fair value, in line with its current price.

Exploring Other Perspectives

While consensus focuses on wellness expansion, the most pessimistic analysts see heavier digital competition pushing margins down toward 7.9 percent and earnings near US$1.0 billion by 2028, so you should weigh how this new wave of clinical and wellness brands might shift those assumptions before deciding which narrative feels closer to your own.

Explore 9 other fair value estimates on Ulta Beauty – why the stock might be worth 44% less than the current price!

Build Your Own Ulta Beauty Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ulta Beauty research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ulta Beauty research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Ulta Beauty’s overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com