- Wondering if Virtu Financial at around US$38.34 is offering genuine value or if the easy money has already been made? This article walks through what the current price really implies.

- The stock has been relatively steady over the last week with a 0.5% decline. The return over 30 days is 3.9%, year to date is 17.6%, 1 year is 6.9%, and the 3 year and 5 year returns sit at 112.4% and 65.4% respectively.

- Recent attention on Virtu Financial has focused on its role as a major market maker and liquidity provider, especially as trading volumes and investor interest in market structure have stayed in the spotlight. Regulatory discussions around market transparency and trading costs have also kept firms like Virtu in the news, providing more context for how investors think about its risk profile and business model.

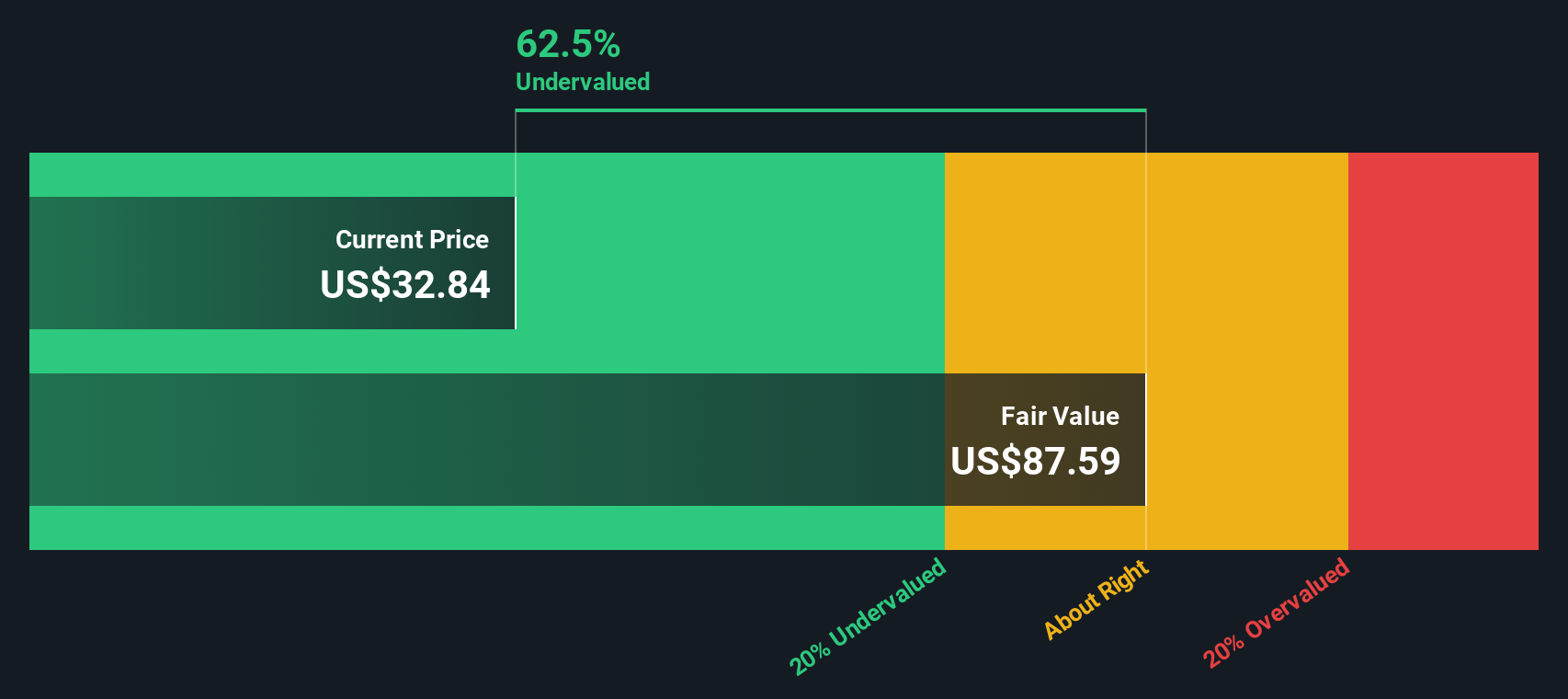

- Our valuation model gives Virtu Financial a score of 5/6 on core value checks. Next we compare the usual metrics such as P/E and cash flow based fair value estimates, and then finish by looking at a more insightful way to think about valuation beyond any single model.

Approach 1: Virtu Financial Excess Returns Analysis

The Excess Returns model looks at how much profit a company is expected to earn above the return that shareholders require, based on the equity invested in the business. Instead of focusing only on cash flows, it tests whether future returns on equity justify the current share price.

For Virtu Financial, the starting point is an estimated Book Value of $23.24 per share and a Stable Book Value of $20.13 per share, based on estimates from 3 analysts. The model uses a Stable EPS of $6.61 per share, sourced from weighted future Return on Equity estimates from 4 analysts, and an Average Return on Equity of 32.85%.

The required return to shareholders is captured by a Cost of Equity of $2.15 per share. Subtracting this from the expected earnings gives an Excess Return of $4.46 per share, which is then projected and discounted to arrive at an estimated intrinsic value of about $81.48 per share.

Compared with a recent share price around $38.34, the Excess Returns model suggests Virtu Financial is 52.9% undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Virtu Financial is undervalued by 52.9%. Track this in your watchlist or portfolio, or discover 53 more high quality undervalued stocks.

Approach 2: Virtu Financial Price vs Earnings

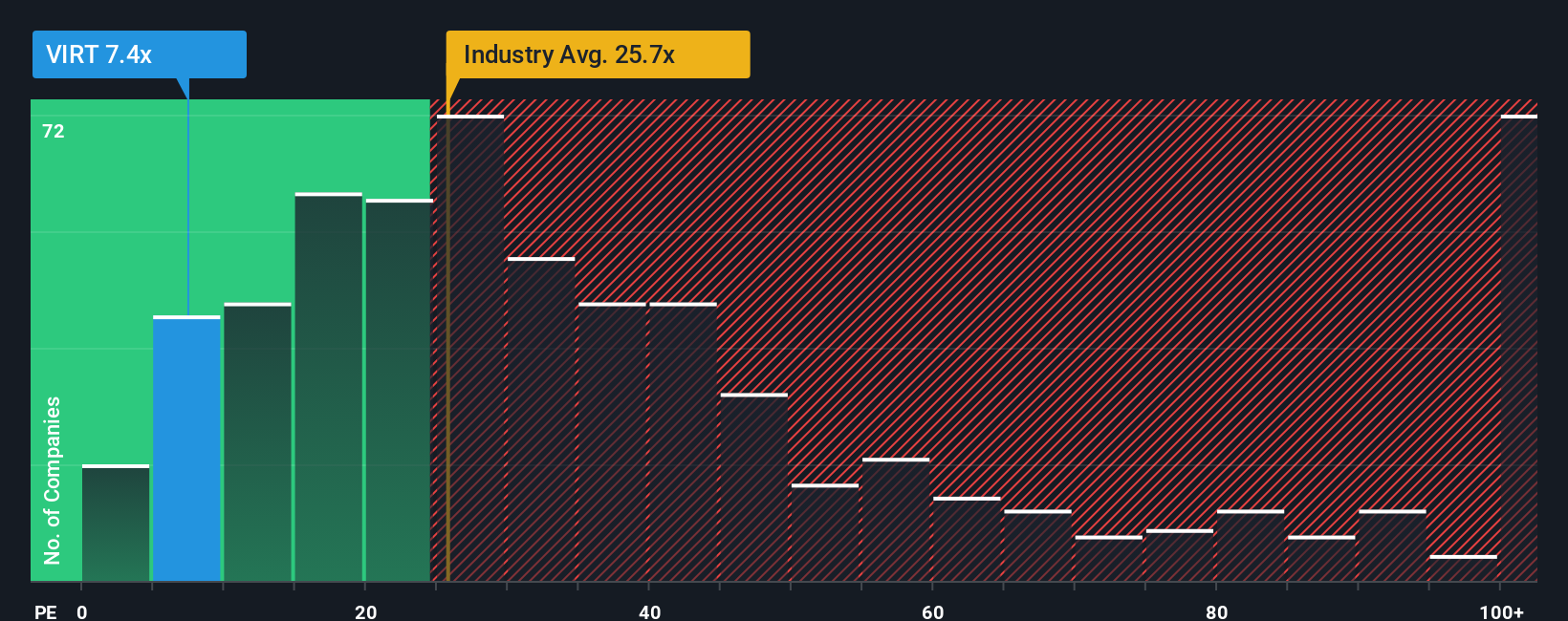

For a profitable company like Virtu Financial, the P/E ratio is a straightforward way to relate what you pay for the stock to what the business is currently earning per share. It helps you see how many dollars investors are willing to pay today for each dollar of earnings.

What counts as a “normal” P/E usually reflects the trade off between growth expectations and risk. Higher expected earnings growth or lower perceived risk can be associated with a higher P/E, while slower growth or higher risk often go with a lower P/E. Virtu currently trades on a P/E of 6.95x, compared with the Capital Markets industry average of 23.12x and a peer average of 22.61x, so it sits well below those broad benchmarks.

Simply Wall St’s Fair Ratio for Virtu is 15.68x. This is a proprietary estimate of what P/E might make sense given factors like its earnings profile, industry, profit margins, market cap and risk characteristics. That makes it more tailored than a simple comparison with industry or peer averages. Since Virtu’s current P/E of 6.95x is materially below the Fair Ratio of 15.68x, this indicates that the shares may be undervalued on this metric.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Virtu Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St you can use Narratives, a simple tool on the Community page where millions of investors connect a clear story about Virtu Financial to their own forecast for future revenue, earnings and margins. They can then translate that into a Fair Value and compare it with the current price to decide whether they see it as an opportunity or a risk. The numbers update automatically when fresh information like news or earnings arrives. For example, one investor might build a cautious Virtu Narrative around a Fair Value near US$10.71, while another might build a more optimistic one closer to US$51, both using the same company data but applying very different assumptions.

For Virtu Financial however we will make it really easy for you with previews of two leading Virtu Financial Narratives:

Fair value in this bullish narrative: US$45.29 per share

Implied discount to fair value versus the recent US$38.34 price: about 15.4% undervalued based on this narrative

Revenue outlook used in this view: 10.17% annual contraction, as per the narrative assumptions

- Analysts in this camp anchor on a fair value around US$45.29, supported by a slightly lower discount rate, a less sharp revenue contraction and broadly similar profit margin assumptions.

- They highlight Virtu Financial’s investments in trading technology and cross asset capabilities, along with expansion in execution services and digital assets, as important drivers for future earnings and diversification.

- Key risks flagged include potential pressure from rising technology costs, regulatory and legal uncertainty around digital assets, competition from other trading firms and possible structural shifts in where and how trading occurs.

Fair value in this cautious narrative: US$10.71 per share

Implied premium to fair value versus the recent US$38.34 price: about 258% overvalued based on this narrative

Revenue outlook used in this view: 6.76% annual contraction, as per the narrative assumptions

- This narrative pegs fair value much lower at US$10.71, reflecting assumptions that Virtu Financial’s revenue contracts, margins sit in single digits and the stock trades on a future P/E near 16x.

- The author frames Virtu as an AI focused financial services firm with algorithmic trading, arguing that headline attention and recent price swings have pushed the shares well above what they see as a reasonable value anchor.

- The focus is on the risk that enthusiasm around recent returns and news flow leads investors to pay too much relative to the cash flow profile implied by the narrative’s fair value estimate.

Put together, these Narratives show how reasonable investors can look at the same Virtu Financial data and land in very different places on value and risk. If you want to see how other investors are connecting their stories, forecasts and fair value estimates, Curious how numbers become stories that shape markets? Explore Community Narratives.

Do you think there’s more to the story for Virtu Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com