As the U.S. stock market enters February with a strong start, evidenced by significant gains in major indices like the Dow and S&P 500, investors are closely monitoring economic indicators such as factory activity and trade developments that could impact small-cap stocks. In this dynamic environment, identifying promising small-cap opportunities often involves looking for companies that demonstrate resilience and potential for growth, particularly those showing signs of insider confidence through recent buying activities.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Let’s explore several standout options from the results in the screener.

Simply Wall St Value Rating: ★★★★★☆

Overview: Corsair Gaming is a company that designs and sells high-performance gear and technology for gamers and content creators, with a market cap of approximately $2.56 billion.

Operations: Corsair Gaming generates revenue primarily from its two segments: Gamer and Creator Peripherals, and Gaming Components and Systems. The company’s gross profit margin has fluctuated over the years, reaching 28.92% in the most recent period.

PE: -58.1x

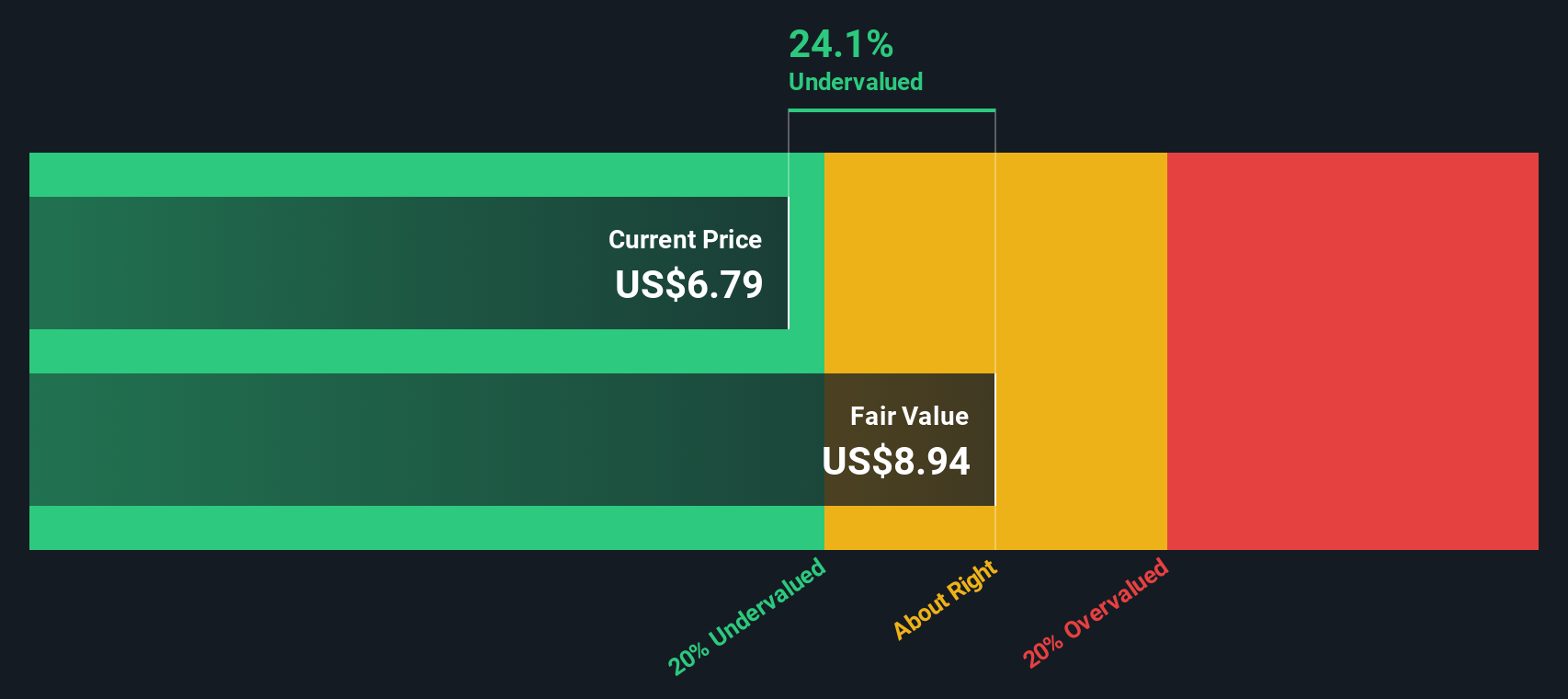

Corsair Gaming, a company with a market capitalization under US$1 billion, has shown potential for growth despite recent challenges. Their Q4 2025 earnings revealed sales of US$436.86 million and net income of US$25.79 million, up significantly from the previous year. The company is focusing on innovation and expansion in gaming peripherals, highlighted by their CES 2026 showcase featuring products like the GALLEON 100 SD. Insider confidence is evident with plans to repurchase up to $50 million worth of shares announced recently on February 12, 2026. However, revenue for Q1 and full-year 2026 is expected to decline slightly due to semiconductor shortages affecting gaming components but offset by growth in peripherals.

Simply Wall St Value Rating: ★★★★☆☆

Overview: Northpointe Bancshares operates as a financial services company providing banking products and services, with a market capitalization of $2.35 billion.

Operations: NPB generates revenue primarily through its operations, with a gross profit margin consistently at 100% over the reported periods. The company’s net income margin has shown an upward trend, reaching 29.89% by the end of 2026. Operating expenses are a significant component of costs, with general and administrative expenses being a major part of this category.

PE: 8.5x

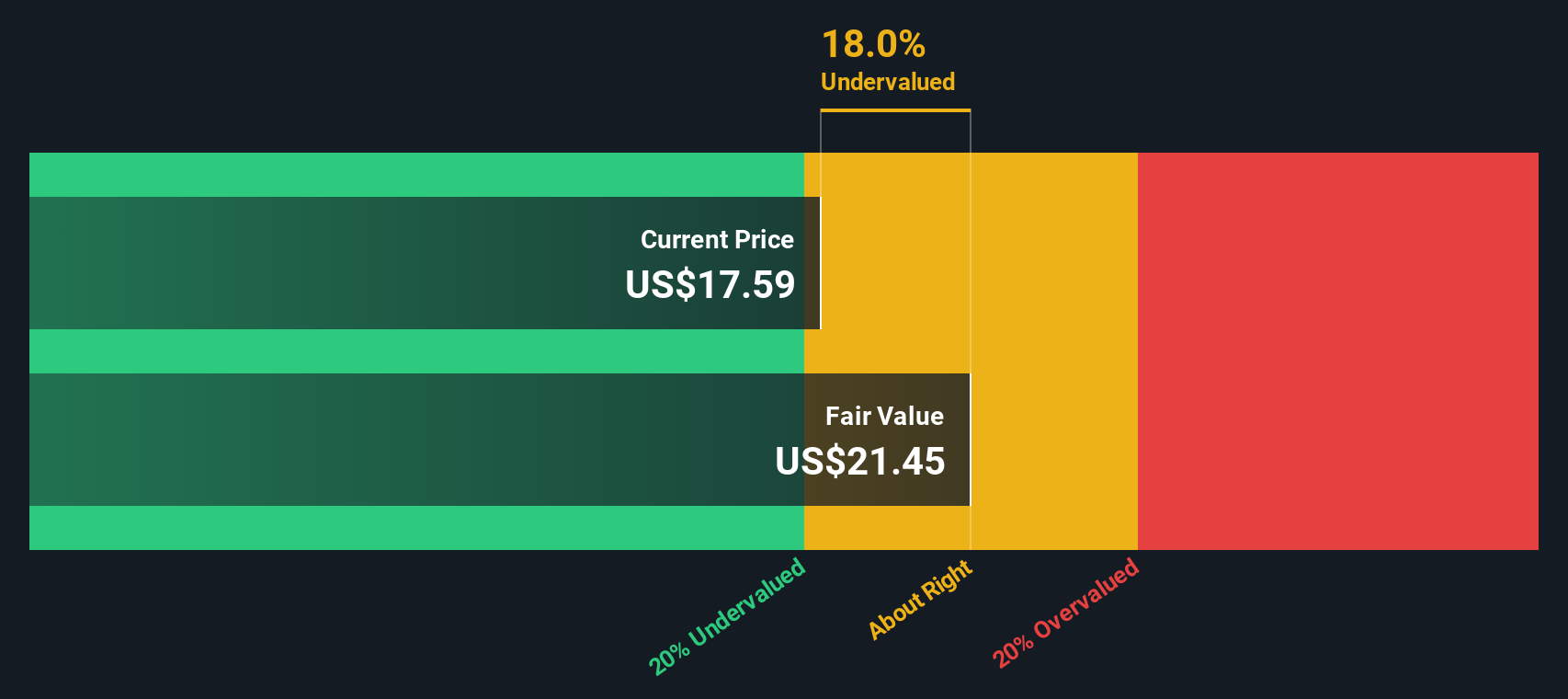

Northpointe Bancshares, a smaller player in the financial sector, recently reported strong fourth-quarter results with net interest income rising to US$43.5 million from US$30.02 million a year ago, and net income more than doubling to US$23.64 million. Despite increased net charge-offs from mortgage and construction loans, insider confidence is evident as insiders continue purchasing shares. The company also completed significant debt restructuring by redeeming preferred stock using proceeds from new subordinated notes issuance, indicating strategic financial management aimed at future growth potential amidst its low allowance for bad loans at 11%.

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NexPoint Real Estate Finance is a real estate investment trust focused on originating, structuring, and investing in mortgage loans and other commercial real estate-related debt, with a market cap of approximately $0.36 billion.

Operations: The company generates revenue primarily from its REIT – Mortgage segment, with a recent revenue of $151.56 million. It has experienced fluctuations in net income margins, with a notable high of 47.64% and periods of negative margins as well. Operating expenses have shown variability, impacting the net income significantly over different periods. Gross profit margin reached up to 99.08%, indicating efficient cost management in certain quarters despite varying operating expenses.

PE: 3.7x

NexPoint Real Estate Finance, a smaller player in the U.S. market, recently completed a fixed-income offering worth US$404.5 million, issuing 16.18 million shares of 9% Junior Senior Preferred Stock at US$25 each with a US$2.5 discount per security. This move highlights their strategic financial maneuvers despite relying solely on external borrowing for funding, which carries higher risk compared to customer deposits. With earnings projected to decline by an average of 28.5% annually over the next three years and no insider confidence through share purchases noted recently, potential investors should weigh these factors carefully when considering future prospects in this sector.

Taking Advantage

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Northpointe Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com