Paris has always fiercely guarded its fashion halo. This is the city that gave the world modern couture, crowned designers into legends, and turned everyday dressing into an art form. Which is precisely why Shein’s arrival felt like a plot twist.In November 2025, the Chinese fast-fashion giant made a bold move: it opened its first permanent brick-and-mortar boutique in Paris. Not on the fringes, but inside BHV Marais, the storied department store overlooking the Hôtel de Ville, with Notre-Dame just a glance away.Now, instead of hushed tailoring and heritage labels, the racks are filled with €12 (`1,278.30) bodycon dresses and €20 (`2,130) jeans. Clothes for women, men, kids, home and beauty, sliced into endless subcategories and tagged ‘Bestsellers’ or ‘Crazy Price’. According to the Institut Français de la Mode (IFM), France has emerged as one of Shein’s key European markets, drawn in by ultra-low prices, relentless newness and sizes for everyone.THE OFFLINE GAMBLEShein’s first physical presenceThe Paris store marked Shein’s first permanent physical presence. More than a retail experiment, it was a statement of intent. Instead of testing the waters in secondary cities, the fast-fashion giant chose BHV Marais. The move came through a partnership with Société des Grands Magasins (SGM), which owns BHV Marais. Framed as part of a broader revival of French retail, Shein said the alliance was “more than just a launch – it’s a commitment to revitalise city centres across France, restore department stores and create opportunities for French fashion,” pledging to generate 200 direct and indirect jobs. Announcing the opening, Shein’s executive chairman Donald Tang said the company was “honouring its position as a key fashion capital and embracing its spirit of creativity and excellence.” The strategy reflects market reality. According to the Institut Français de la Mode, Shein, Temu and AliExpress now account for 6% of clothing sales in France by volume, despite representing just 2% by value. An AlixPartners–YouGov survey found that one in ten French consumers now counts Shein among the retailers they shop most, placing it alongside H&M and Zara.

The backlash from fashion’s homeFounded in China in 2008 by US-born entrepreneur Chris Xu, Shein has grown into a fast-fashion behemoth, processing hundreds of thousands of orders daily and listing more than 600,000 products at any time. Once a digital-only player, it now sits at the centre of a global fast-fashion debate the industry cannot ignore.Though active online in France for years, its Paris arrival triggered immediate backlash. The office of France’s minister for small businesses said Shein’s presence sent “a bad signal that should be avoided”. In 2025, French authorities fined the company €40 million for misleading sales practices. Concerns over environmental damage and labour conditions sharpened the criticism. Brands including Dior, Guerlain, Sandro, Maje, Claudie Pierlot, Agnès b., Aubade and Cabaïa pulled their products from BHV Marais in protest. “There would be no sense being sold in the same shop as Shein,” Guillaume Alcan, co-founder of footwear brand Odaje, told Le Monde, a French daily.

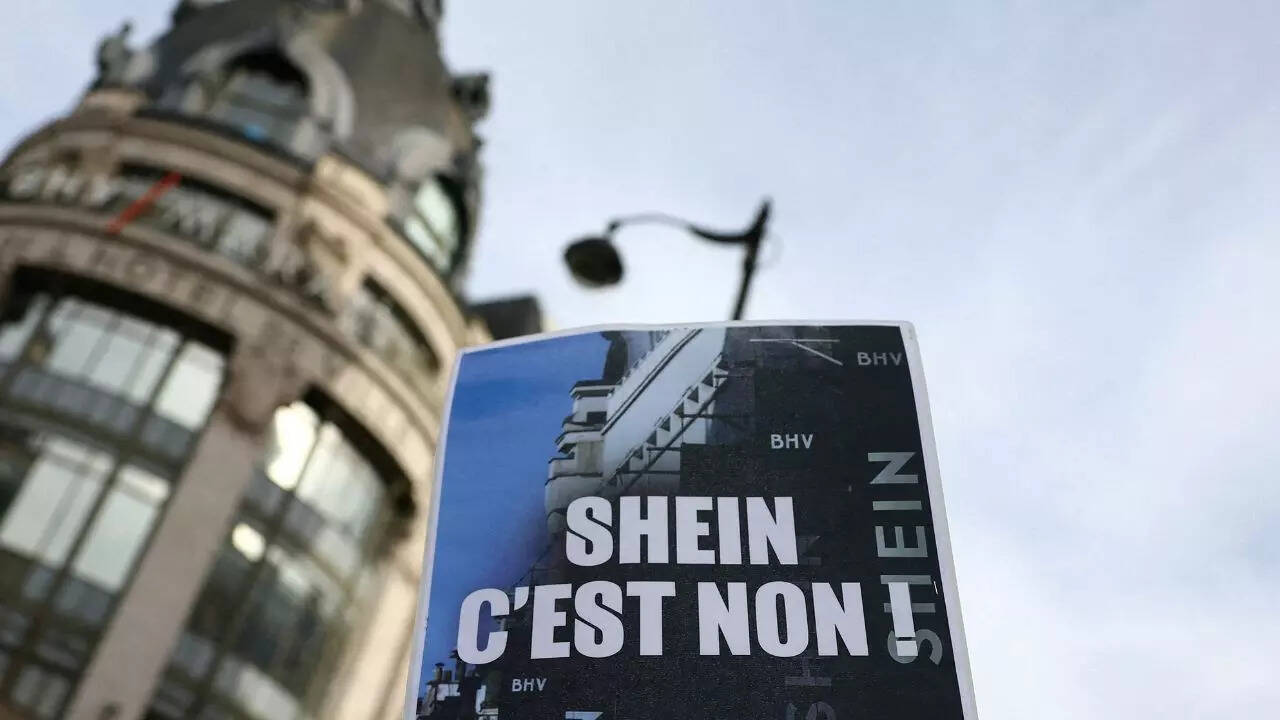

This placard which read “Shein, no way” was held by a protester during a protest against the opening of the first physical space of the Chinese online fast-fashion retailer in Paris.

The fallout spread beyond fashion. After Shein’s arrival was announced, Disneyland Paris scrapped plans for a Christmas pop-up at BHV and withdrew from designing its festive windows, citing “conditions [that] were no longer in place” to “calmly hold Christmas events”. The pushback rippled outward: even temporary pop-ups were met with graffiti reading “Shein kills”.Long queues outside – but are there sales?Despite the backlash, the crowds showed up anyway. In its first month, Shein’s Paris store reportedly drew close to 300,000 visitors. Shoppers sifted through racks, felt fabrics, tried things on and took photos. But few lingered at the checkout, claim reports. Shein declined to share revenue figures, and while staff told Le Monde that sales targets had been “met, even exceeded,” the paper noticed shoppers leaving empty-handed, with just one of seven cash registers in use.SGM’s head of communications insisted this was temporary. “We have listened to negative feedback,” he said in December, promising that within “a few days or weeks” the store would add more men’s, children’s, sports and plus-size clothing, along with cheaper options.

Opening day drew long queues to Shein’s Paris store.

Behind the scenes, however, the numbers told a different story. Industry chatter suggests opening-day sales touched €50,000, before settling at around €7,000 a day through December 2025, numbers well below expectations for the location. By January 2026, daily revenue slipped to about €2,000, claimed Yann Rivoallan, president of the French Federation of Ready-to-Wear.Why did sales stall? Rivoallan told French radio station, Sud Radio, “Crazy selection available online is not replicated in the necessarily limited physical space. Secondly, going to the store involves unavoidable costs, resulting in higher prices than online, thus reducing the incentive to make the trip.” Lower revenues have now slowed the brand’s initial plan to open stores in five other French cities (Dijon, Reims, Grenoble, AngersTHE ONLINE SURGEEU overtakes US in low-value e-commerceThe centre of gravity in global fast fashion is shifting. In 2025, Europe replaced the US as the largest destination for China’s low-value e-commerce exports, marking a decisive rerouting of digital fashion flows.By April 2025, Shein had begun to pivot decisively. Sensor Tower data shows the company sharply ramped up digital ad spending across Europe, pulling focus from the US. Advertising outlay rose 45% in France and 100% in the UK year-on-year, as regulatory pressure mounted stateside.What followed was more than a marketing shift. As sweeping US tariffs on Chinese goods took effect under President Donald Trump’s administration, fashion supply chains quietly rerouted. Products once bound for American consumers began landing on European doorsteps instead. The numbers tell the story. Chinese customs data, cited by The Wall Street Journal, shows the European Union overtook the US in 2025 as the largest market for China’s low-value e-commerce shipments. Deliveries quadrupled to Hungary and Denmark, and jumped more than 50% in France, Germany and the UK.

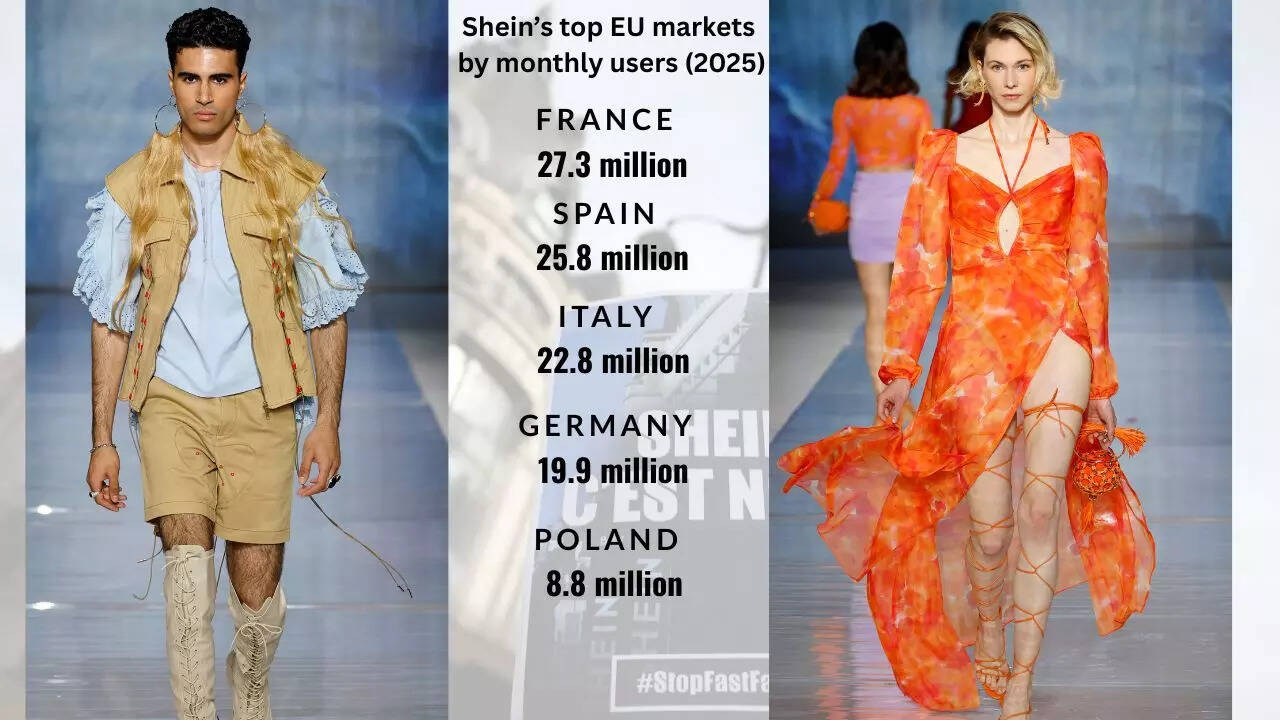

For sellers, the shift has been swift. “Europe is increasing, increasing, increasing,” Bob Liu, a shoe manufacturer from Fujian province, told WSJ. Once reliant on the US for 80% of his business, he now earns nearly 40% from Europe. But even Europe is rethinking low-value imports. From July 2026, the EU will levy a €3 customs duty on parcels worth less than €150, which currently enter the bloc duty-free.How Shein wooed Europe digitally…Shein didn’t woo Europe through glossy billboards or couture-week cameos. It did it the modern way. It recruited popular influencers and university students to promote its clothing on TikTok and Instagram.Across the continent, the app has slipped quietly into daily life. France, Spain and Italy now rank among Shein’s biggest European user bases. According to data compiled by CedCommerce, the platform averaged 145.7 million monthly users in Europe in 2025, comfortably ahead of rival Temu at 115.7 million, though still trailing AliExpress (190 million). Its real power lies in visibility. Open TikTok in Paris, Madrid or Milan and Shein is hard to miss. Haul videos flood feeds with influencers flaunting glittering party dresses, ultra-cheap pyjama sets, and coats that cost less than dinner. A French influencer, Magali Berdah, collaborated with Shein on a series of TikTok videos in which she interviewed young shoppers gushing over Shein’s affordable fashion.

Influencers turn bulk Shein purchases into viral “haul” videos, showcasing fast, inexpensive fashion.

However, Shein’s “addictive design” and the transparency of its recommendation algorithms are now under scrutiny, reported The Guardian, with EU officials probing into the site’s bonus points programmes, gamification and rewards “that may lead to a risk of users’ mental well-being.”… As price changed everythingFrance didn’t fall for Shein because it forgot fashion. It fell for it because fashion got expensive. Paris may stand for Louis Vuitton and Hermès, but fast fashion has long coexisted with luxury. H&M, Zara and Uniqlo are part of the retail landscape. What has changed is how far prices have fallen.On Shein, leggings sell for €5.24 (`558.19), T-shirts for €1.99 (`211.98) and imitation Vans for €6.92 (`737.15). According to the Institut Français de la Mode (IFM), French consumers spend an average of €9 (`958.72) per item on the platform.As the cost of living rises, wardrobes are shrinking. Even as inflation eases, Bloomberg reports, demand for low-cost clothing continues. “The consumer is always going to go for the lowest price,” says Olivier Abtan of AlixPartners. Those prices come from platforms built for speed and scale.Also, the pandemic accelerated the shift online as traditional retailers struggled to keep pace. Shein pulled ahead, mining social media for micro-trends and adding around 7,200 new items a day.Back in India after five years – on new termsOn June 29, 2020, when India banned 59 Chinese apps, Shein vanished overnight from both Google Play and the Apple App Store. The fast-fashion giant, known for its vast selection of low-cost Western fashion, left shoppers mid-order and mid-scroll with only a brief message: “We hope to resume services soon.” At the time, it had more than 100 million Android downloads in India, with some reports estimating over one million daily active users.It took nearly five years to return. In February 2025, Shein re-entered India through a licensing partnership with Reliance Retail, ensuring that all Shein-branded products are designed and manufactured locally. Shein told Reuters the partnership was limited to licensing its brand for domestic consumption.The Indian version of Shein operates under strict guardrails. The app sells only India-made garments, distancing itself from the China-linked supply chains that triggered earlier scrutiny. At launch, Reliance had contracted 150 manufacturers and was in talks with 400 more. The ultimate aim, the company said, was to have 1,000 Indian factories making Shein-branded clothes within a year. The long-term plan includes supplying both India and select global markets.Early traction has been steady. As per Reuters, the app clocked 2.7 million downloads across platforms, with strong month-on-month growth in its first four months. In Feb 2026, a year since the relaunch, the number of app downloads is over 10 million just on Google Play. Yet its catalogue remains modest, with about 12,000 designs compared with roughly 600,000 on Shein’s US site. Prices are competitive. In the women’s dresses category, the cheapest item was priced at `349 ($4), compared with $3.39 on the US site as of June 9, 2025.Reliance is also testing Shein’s on-demand manufacturing model in India, starting with small batches of around 100 pieces and scaling up only if designs sell.