Lam Research Corporation (NASDAQ:LRCX) is one of the best growth stocks to buy for the next 20 years. Earlier on January 29, TD Cowen raised its price target on Lam Research to $290 from $170 while keeping a Buy rating. The firm identified the 2026 Wafer Fabrication Equipment/WFE outlook of $135 billion as a major positive surprise, particularly when considering the current constraints in cleanroom availability.

On the same day, RBC Capital raised its price target on Lam Research to $290 from $260 and maintained an Outperform rating following strong Q4 2025 results fueled by a healthy equipment market and market share gains. While the firm noted that NAND spending remains inconsistent, it highlighted Lam’s solid progress in the Foundry sector and its ability to capitalize on strength in advanced packaging and high-bandwidth memory technologies.

Deutsche Bank also raised its price target on Lam Research Corporation (NASDAQ:LRCX) to $245 from $175 with a Buy rating following the company’s latest earnings report. The firm characterized the company’s current performance as firing on all cylinders.

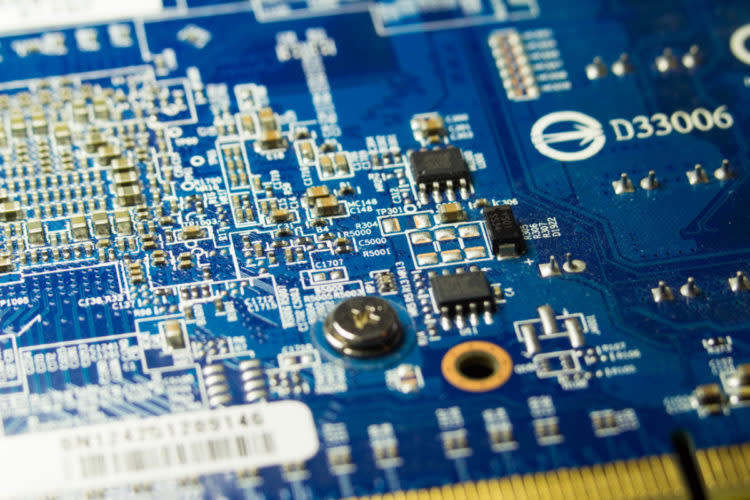

Lam Research Corporation (NASDAQ:LRCX) designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the US, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

While we acknowledge the potential of LRCX as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy Right Now.

Disclosure: None. This article is originally published at Insider Monkey.