Sea Limited’s SE digital finance expansion is accelerating, but the sharp rise in credit loss provisions raises concerns about the sustainability of growth.

In the third quarter of 2025, Sea Limited’s provision for credit losses jumped 76.3% year over year, significantly outpacing its 38.3% revenue growth. The rise reflects aggressive expansion within Digital Financial Services (DFS) as consumer and SME loan balances climbed close to 70% year over year. As lending takes up a larger portion of DFS revenues, credit costs increasingly impact profitability.

DFS growth is increasingly being driven by aggressive customer acquisition, as the company continues to onboard a large number of first-time borrowers and expand its active user base. While this strategy is supporting strong revenue momentum in the segment (60.8%), the rising share of newer, less-seasoned customers increases credit risk.

Despite management’s assurance that portfolio quality remains stable at an NPL90+ ratio of 1.1%, provisioning trends indicate heightened caution as the loan portfolio expands rapidly. At the same time, the DFS cost of revenues climbed 37.5% year over year in the third quarter, driven by higher collection activity, transaction-related fees and infrastructure build-outs, further constraining margins.

As DFS becomes a larger profit driver, the ability to control credit losses will determine whether growth remains sustainable.

SE Faces Strong Rivals in Digital Financial Services

Grab HoldingsGRAB is a tough rival in digital financial services, leveraging its super-app ecosystem to compete directly with SE. GRAB has expanded beyond ride-hailing into payments, lending, insurance and digital banking through GrabPay and its bank platforms. In the third quarter of 2025, GRAB’s Financial Services revenues grew 39% year over year, led by stronger lending contributions from GrabFin and its digital banks, intensifying competitive pressure.

PayPalPYPL is a leading global digital payments platform connecting consumers and businesses across more than 200 markets. In the third quarter of 2025, PYPL reported approximately 7% revenue growth to about $8.4 billion and strong transaction volume gains, underscoring its scale and trusted brand. PYPL’s large user base, cross-border reach and robust risk technology make it a powerful rival to SE’s digital financial services.

SE’s Price Performance, Valuation & Estimates

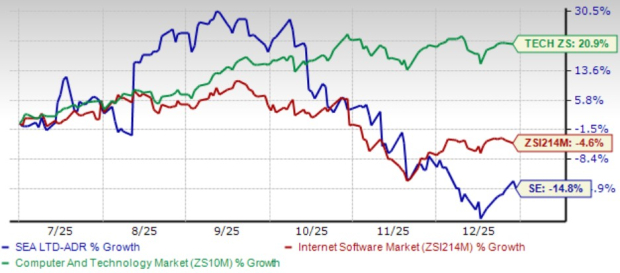

Sea Limited’s shares have declined 14.8% in the past six months, underperforming the broader Zacks Computer and Technology sector’s growth of 20.9% and the Zacks Internet – Software industry’s fall of 4.6%.

SE’s Six Months Price Performance

Image Source: Zacks Investment Research

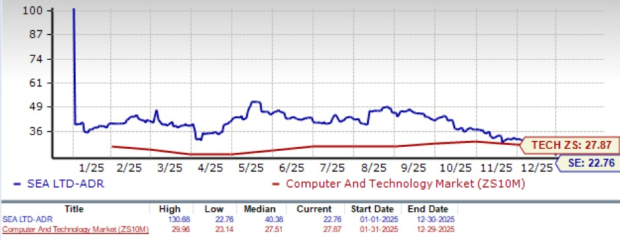

From a valuation perspective, SE stock is currently trading at a forward 12-month price-to-earnings ratio of 22.76, lower than the sector’s 27.87X. SE carries a Value Score of F.

SE’s Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for SE’s 2025 and 2026 earnings is pegged at $3.54 and $5.64 per share, down 1.4% and 3.3%, respectively, over the past 30 days. However, these estimates imply strong year-over-year growth of 110.71% and 59.32%, respectively.

Image Source: Zacks Investment Research

SE stock currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sea Limited Sponsored ADR (SE): Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Grab Holdings Limited (GRAB): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).