Help yourself to a free subscription to all four posts at larrykotlikoff.substack.com. I’ll immediately make it a lifetime free subscription. Paid subscriptions come with a one-hour, free financial consultation with me. Just unsubscribe, resubscribe on a paid basis, and then email kotlikoff@gmail.com to set up a meeting time. Thereafter, just unsubscribe and resubscribe forever for free. Also, please sign up kids, friends, employees, bosses, students, … !

-

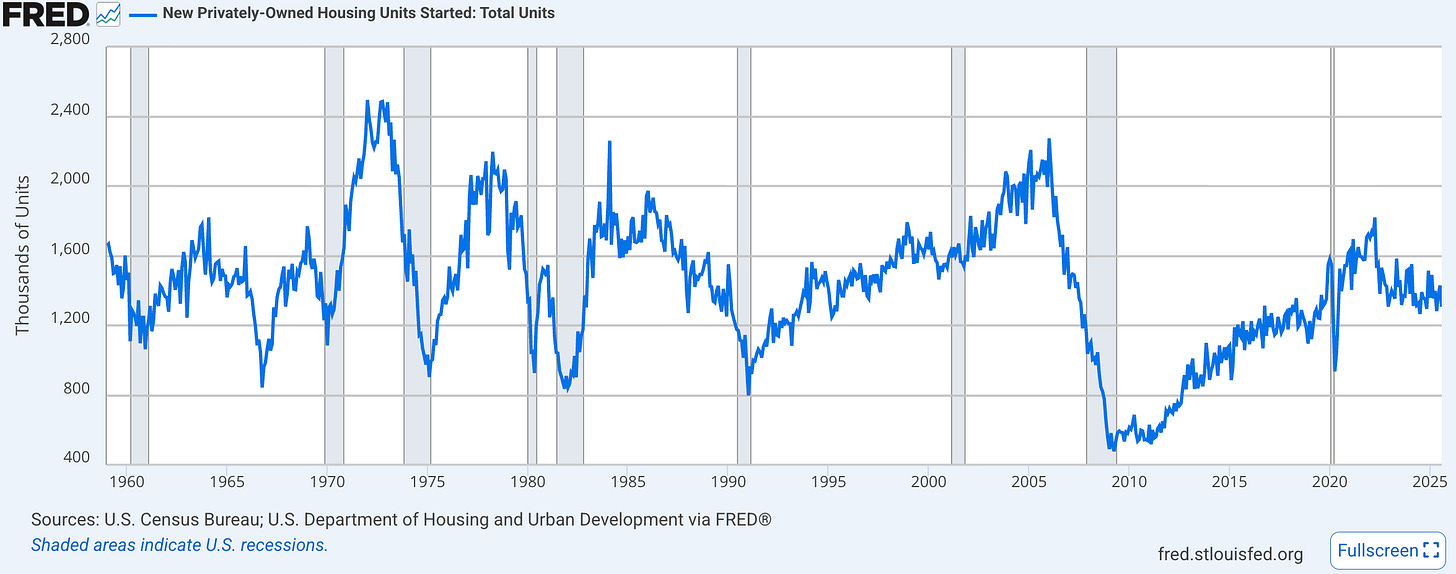

The US population has almost doubled since 1960. How have annual housing starts changed since 1960?

a. They’ve tripled.

b. They’ve doubled.

c. They’ve increased by one third.

d. They’ve declined by 10 pecent.

And the answer is …

They’ve declined by 10 percent.

-

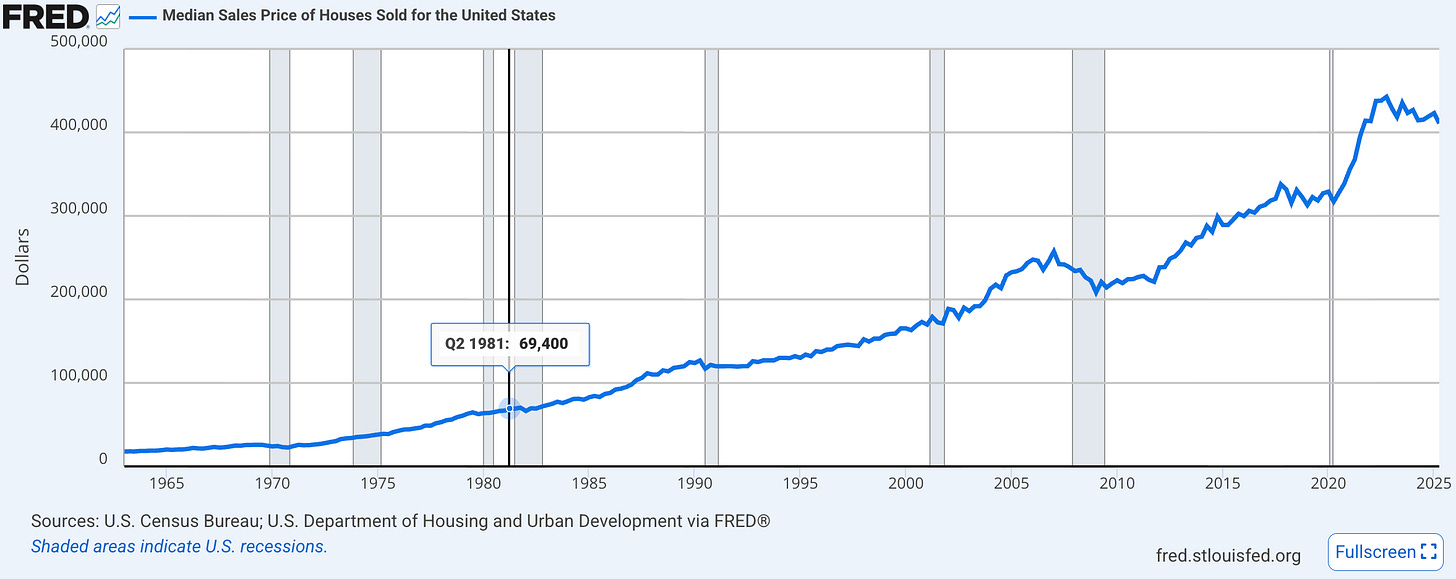

By what percentage has the real median US house price risen since 1963?

a. It’s quadrupled

b. It’s tripled

c. It’s doubled

d. It’s risen by half

e. It’s fallen.

And the answer is …

The Real median US house price has roughly doubled since the early 60’s. The nominal median home price rose by a factor of 23, while prices, in general, rose by a factor of 10. Thus, buying a home is now twice as expensive — compared with buying everything else — than was the case six decades ago. Or is it? Square footage per person in owner-occupied homes has also roughly doubled. So, the apparent doubling in the relative cost of a house may simply reflect the fact that Americans are demanding larger square footage. This is partly due to many people living in large homes built years, if not centuries ago, for large households when today’s households are much smaller. But it’s also due to the construction of larger homes. So comparing “the” median price of a house today and that of a house 65 years ago is largely comparing apples to oranges.

Two thirds of Americans still own their homes — slightly more than in 1960. Even though housing starts have fallen somewhat, annual starts have been more than enough to keep pace with population growth. Still, housing is unaffordable for many. In 1960, 65 percent of those 35-44 owned their homes. Today’s figure is 58 percent. In short, sorting out whether there is a true housing shortage and its sources is tough sailing.

-

Have manufacturing jobs increased since President Trump began to make America great again again?

a. Yes

b. No

And the answer is …

The answer is no. BLS data indicates 164,000 fewer jobs in manufacturing between January 2025 and November 2025. On the other hand, overall employment rose by almost 500,000. That’s decent, but nothing to write home about. What about tariff-impacted industries? Did they hire more Americans? No. They fired more Americans — roughly 90,000. What about median real wages? Did they rise substantially over the first three quarters for which we have data? They did — by 2.7 percent. But real wage growth rate isn’t much different from that recorded under President Biden post COVID.

-

Is the monthly rate of deportation of illegal immigrants higher, so far, in President Trump’s second term than in President Biden’s term?

a. Yes

b. No

c. Yes and No

And the answer is …

The answer is yes and no. It’s a bit lower than in President Biden’s last year in office. But it’s higher than President Biden’s initial years in office.

-

Were there more US births in 2024 than in 1960?

a. Yes

b. No

And the answer is …

The answer is no. The US recorded 4.3 million births in 1960, but only 3.6 million in 2024 — this despite a population that’s 1.9 times larger.

-

Is St. John’s Canada closer to Venice, Italy than it is to Vancouver, Canada.

a. Yes

b. No

And the answer is …

The answer is yes.

-

How many books are estimated to have been written in the history of the world?

a. 2.7 billion

b. 1.1 billion

c. 971 million

d. 452 million

e. 130 million

And the answer is …

The answer is 130 million.

-

Are there more or fewer bookstores in the US now than in 2000?

a. More

b. Fewer

And the answer is …

Surprisingly, there are almost five times more bookstores now than there were a quarter of a century ago.

-

Is the US in far worse long-term fiscal shape than Italy?

a. Yes

b. No

And the answer is …

The answer is yes. Read this careful study that I wrote with three co-authors, one of whom works for the Bank of Italy. Unlike official debt-to-GDP numbers, it puts all government obligations, present and future, on the book by doing fiscal gap accounting. Standard deficit accounting, of which you hear every day, is a word game, not a description of a country’s underlying fiscal condition. The game is simple — politicians get to decide whether to call a government obligation official or unofficial based on the degree they wish to understate or, indeed, overstate, their degree of long-term fiscal insolvency. Fiscal gap accounting avoids this problem by putting all government obligations on the books.

MaxiFi Planner can help you raise, sustain, and protect your living standard. MaxiFi is now 33 years in the making and getting better by the day. Bankrate ranked MaxiFi Planner “The best financial planning software of 2025.” It’s easy and fun to run, and light years more powerful than any AI tool. It doesn’t guesstimate. It calculates. State differently, it does the right math.

Yes, MaxiFi could be run a zillion times to teach an LLM to get close to the right answer, but using neural networks, based on their current method of training — based on the wrong answers to the wrong questions, to precisely solve the equations of personal finance is akin to using the claws of a hammer to open a bottle of beer. MaxiFi is a bottle opener and can produce internally consistent answers to the entire plethora of household financial decisions in a half second. LLMs, no matter how many hammers they add to their arsenal, will never solve the equations of finance —for a simple reason. They aren’t working using the right math. Nor are they being trained on the right answers based on the right math.

Check out MaxiFi’s decades of top media attention and our extensive customer testimonials. MaxiFi seeks to pad and safeguard your pocket, not pick your pocket — by strictly following the precepts of a century of economics financial science. In nerd speak, this means jointly and instantly solving the equations of finance as postulated by the giants of the field, including Irving Fischer, John von Neuman, Harry Markowitz, William Sharpe, Menachem Yaari, Paul Samuelson, and Robert Merton.

Thousands of everyday households are using MaxiFi, on their own, with my company’s one-on-one help, or with the help of their own MaxiFi-using financial advisor, to do economics-based planning. In the process, they are becoming addicted to improving and preserving their financial lives by making optimal, joint/integrated financial decisions that make both economic and common sense.