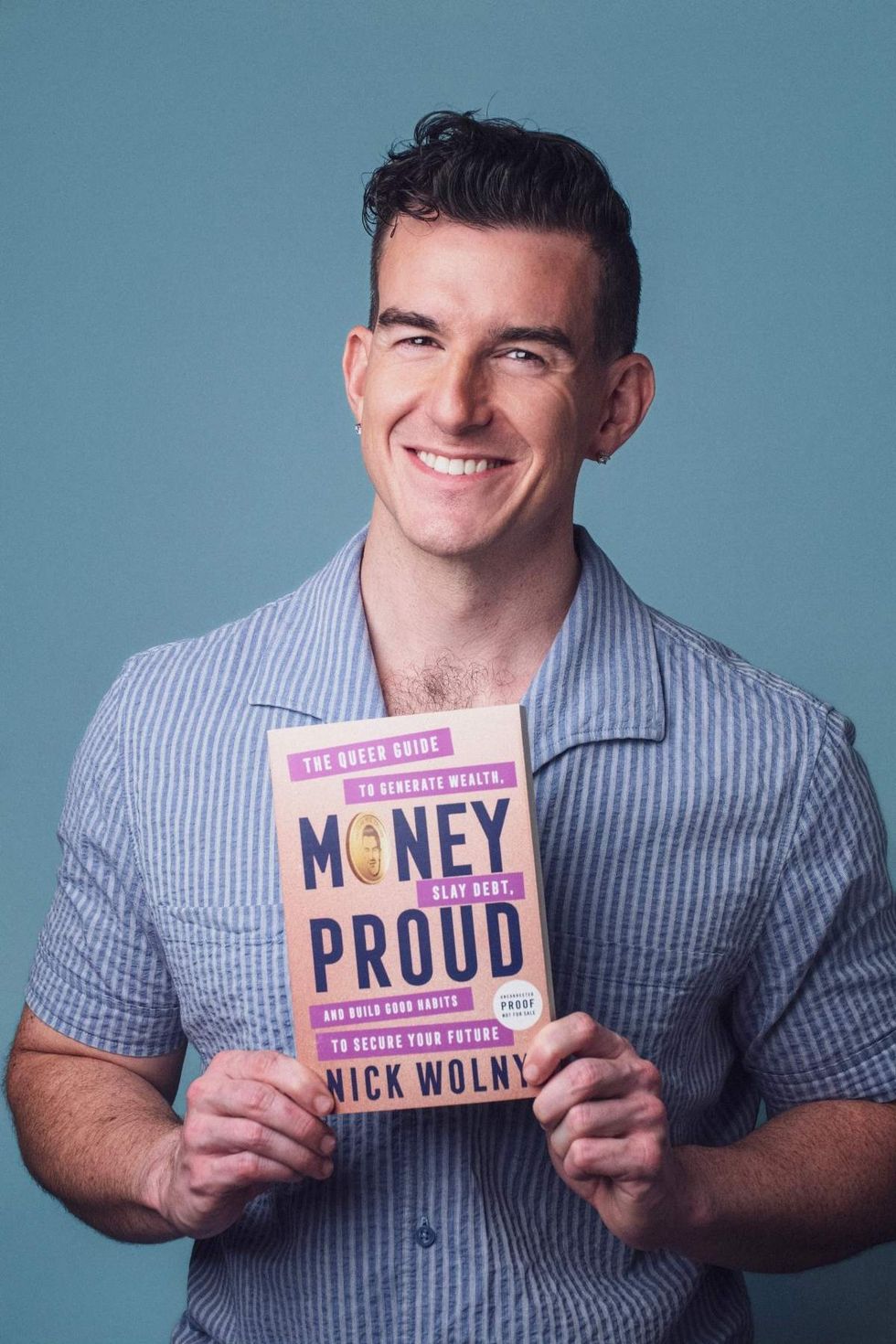

Author of the Financialicious newsletter, Out columnist, and now book author Nick Wolny is here to tell queer people that making choices about money and finance is not only an achievable goal… but it can even be fun!

How can anyone find the fierce in finance, you ask? Well, consider a recent issue from Wolny’s Financialicious newsletter titled “Buy Now Pay Later is very DL.” In it, the author argues that “sometimes financing just enables both consumers and business owners to be messy with their money, and then they’re ashamed of the mess, so they keep quiet about it, and it turns into a mind-f**k.”

Later in the issue, Wolny references the “Online Shopping” episode from Trixie Mattel and Katya’s UNHhhh series, notes the dystopian vibes of food delivery apps partnering with short-term financing platforms to let you “finance your next burrito,” and even quotes wise words from a yoga friend: “Sometimes, feelings lie.” I know that’s right, fam.

Over the years, Wolny has explored a range of topics through his writing about finance not only on his own Financialicious newsletter, but also through his print column for Out magazine. Either way, Wolny is committed to centering queer people as his target audience, Wolny has now released the first book in his career, Money Proud, as a “queer guide to generate wealth, slay debt, and build good habits to secure your future.”

In an interview, Out chats with Nick Wolny about his own journey with finance, why queer people’s relationship with money can be stressful, and what readers can expect from his new book, Money Proud: The Queer Guide to Generate Wealth, Slay Debt, and Build Good Habits to Secure Your Future, now available everywhere books are sold.

Nick Wolny

Cameron Thrower (@camthrow)

Out: You are now a well-known finance columnist, but you didn’t exactly start on Wall Street. How do you explain your background story and that transition period into finance?

Nick Wolny: Yeah, it’s interesting, because my background is not in finance. It’s about as far from finance as you could get. My background is in classical music. After music school, I did a variety of odd jobs, you know, like many people do in their 20s, trying to make it work, make ends meet, things like that. I learned a lot about that transition from what you studied in school versus what your skills actually are, and what you get paid to do, and what you know your value at work.

I was self-employed for almost six years, mainly in writing and marketing. I wanted something more editorial, so I took a position as an editor with a personal finance publication called NextAdvisor. It was a partnership with Time, and that publication helped me get that foundational understanding of personal finance — and of money in general — that there would have been no other way to get.

You’ve mentioned that your relationship with money was shaped early on. What was it like, for you, growing up?

I grew up in rural Illinois. So, you know, my high school was surrounded by corn on three sides — a small town kind of energy. I would never see any gay people. The only gay people were obviously the choir teacher and the gay couple that owned the best cafe in town.

My parents always fought about money and divorced when I was seven. So I grew up with my mom, and she was the one who was the spender. There was always issues with debt. I didn’t know what a debt collector was, but I just knew strangers would call the house all the time.

The rule in the house was, “Don’t answer the phone.” Looking back on that, I’m like, “That’s fucked up.”

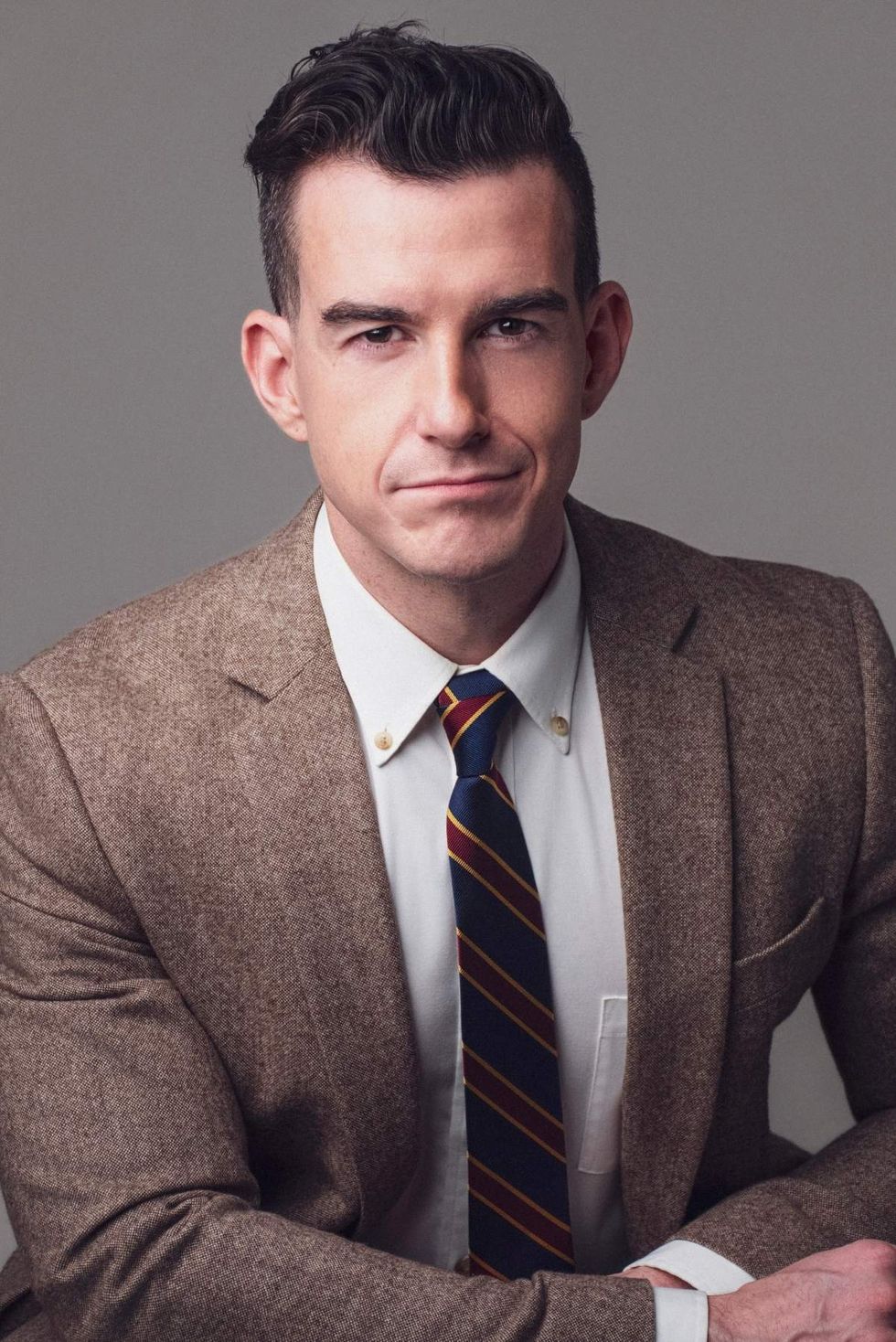

Nick Wolny

Cameron Thrower (@camthrow)

For some people, that mentality — or directive — can really stay with them, even as they grow up.

Yeah, but I also don’t think it is as uncommon or rare as it sounds on its face. I think a lot of households are going through that kind of situation then and now.

When I reflect back on my 20s, and how I worked so hard, and didn’t have much to show for it… It makes me pissed to think about it, too. I didn’t know how to handle the money once I had it. I grew up low income, so I think that was also a part of it, unconsciously: I didn’t know how to handle money when I had it.

You’ve talked about music as an outlet before finance entered the picture. How would you describe your connection with the arts?

Music was the thing that let me express myself during that closeted adolescence. It just developed so much meaning for me throughout school. I had my whole plan architected by the time I was 13. I was like, “I’m going to keep it all in, and then once I get to college, I’m going to be gay from day one.”

My theory is that my passion for music kind of dimmed over time, because my core motivation around it was related to this acceptance of myself, and this expression of myself. As I expressed myself more as a person, naturally, the need to have music in the picture became less and less of a priority.

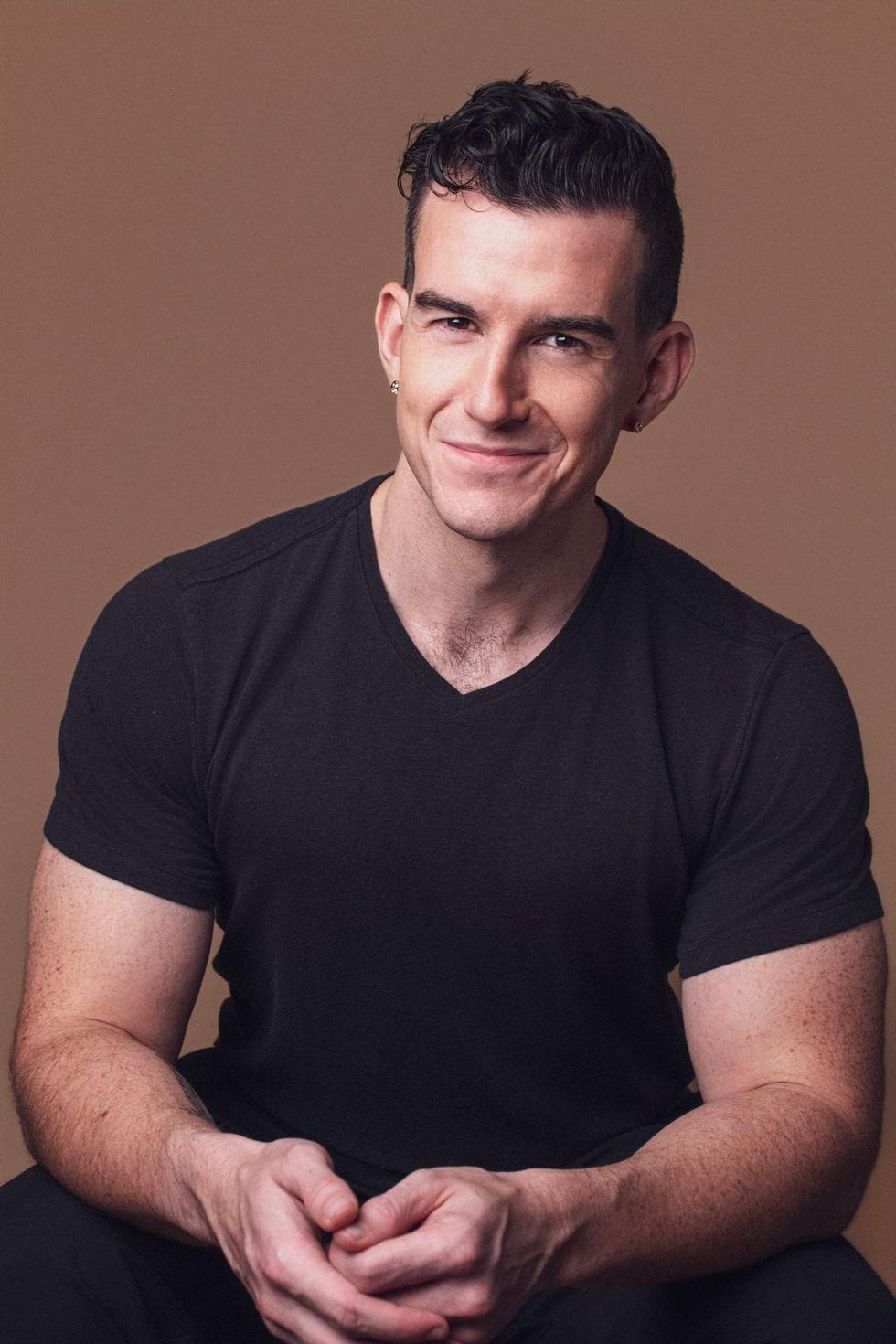

Nick Wolny

Cameron Thrower (@camthrow)

I’ve heard you say that you’re less interested in wealth than you are in stability, which is an outlook that I really like and resonate with. How do you explain that rationale to people?

It’s that I don’t care so much about like, “Wow, I’m so fucking wealthy.” That just doesn’t appeal to me. It’s more so that desire for stability. I live in a one bedroom apartment by myself in Long Beach, and I feel like so luxurious.

On a related note, you’ve been critical of this “extreme money culture” that exists online. How do you diagnose that issue, and turns you off about it?

I don’t think personal finance is this dramatic “get rich quick” thing. Or, you know, stuff that gets amplified so much nowadays on social. There’s lots of grift, and there’s lots of MLM energy… That is Multi-Level Marketing, not the Men Loving Men genre! [Laughs.]

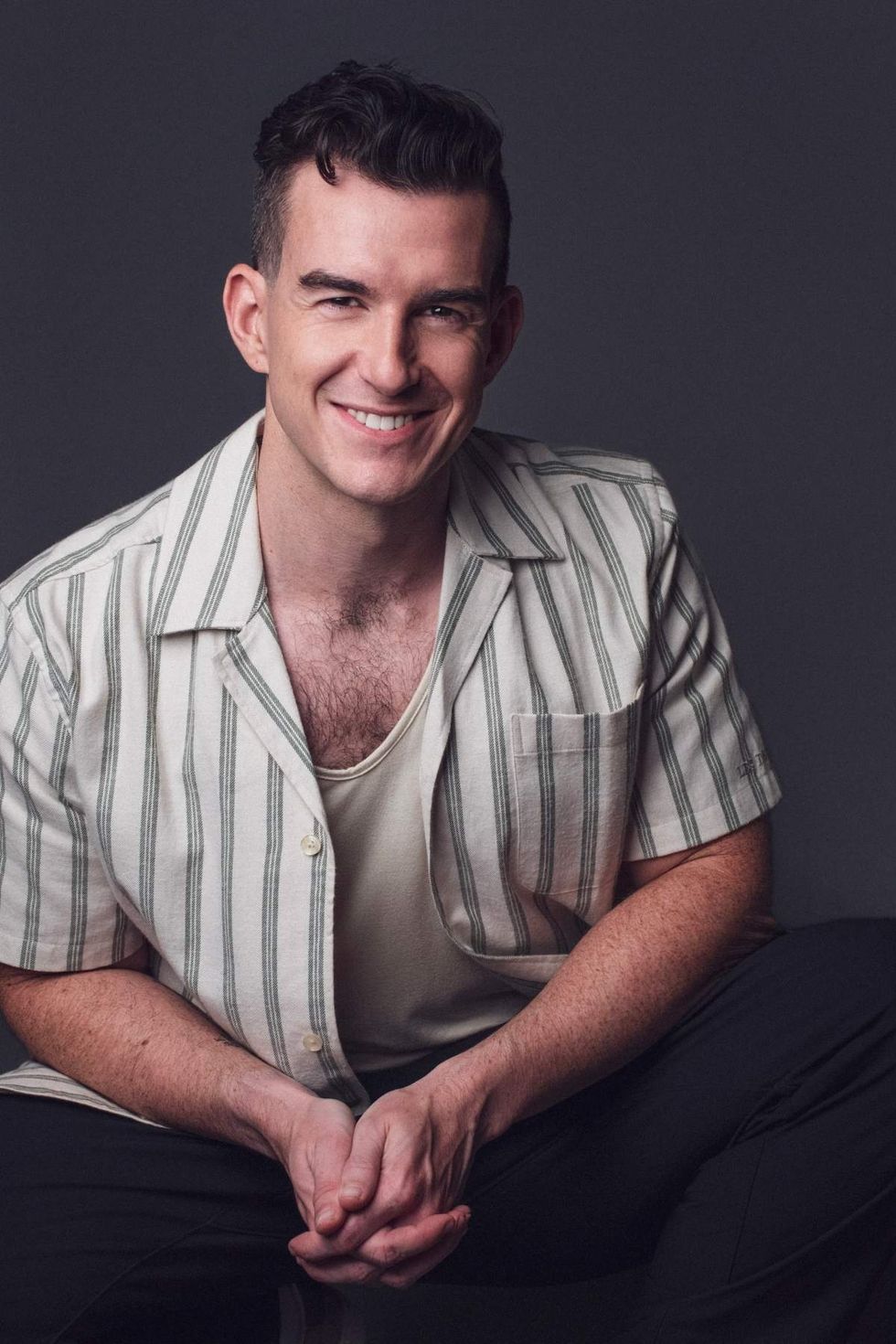

Nick Wolny

Cameron Thrower (@camthrow)

A big theme in your book is consumerism and pressure, especially in queer culture.

Yeah. Queer culture, in particular, there’s always this unspoken pressure. It’s kind of a version of Keeping Up with the Joneses. There’s that pressure in consumerism to spend money you don’t have, which is quite normalized in order to keep up. And then we have queer people with a lot of credit card debt; with a lot of Buy Now, Pay Later.

We also have a lot of data that I showcase in the book that queer people just have more debt, and less in savings, in general.

Of course subjects like finance and money are common causes of stress, but I still found it so interesting for you to start this book, Money Proud, straight-up just talking about stress in the first chapter. It’s just not the typical move for a book like this.

Yeah, the whole first chapter of this book is about chronic stress, which is weird for a money book. But I’m just like, “It is actually the first thing we have to address.” If that is out of control, then you’re never going to look at your bank account. And I know that, and you know that, so it’s a problem.

Nick Wolny

Cameron Thrower (@camthrow)

I’ve had a few personal experiences related to money that felt specifically tied to being queer, but I was already over 18 at those points in time. I do think, though, that most queer people are sort of pushed to think or to worry about money at a younger age than the average child. We all know stories of kids who got kicked out of their homes for being queer — but they’re still just children. Are you able to observe that relationship through your work?

For a lot of queer people, there is fear about the financial impact of the coming out process. And, yes, that is statistically true. That kind of creates a survival instinct for us. And then you find your people, and you feel like you should try to keep up with them now — you want to drink all that up. It sort of just keeps going.

Something that annoys me deeply — particularly for Millennials and younger generations — is this constant retirement advice that we all need millions of dollars to retire. Even though I understand what that means, it’s hard for the average person to look around and have even one friend who has reached the million-dollar mark. I really enjoy talking through things with other people, but it’s frustrating when the conversation has nowhere to go. The only advice is this timeline with dollar amounts that just feel impossible to keep up with. What is that about?

I think a part of this is that we’re really bad at visualizing compound interest. The idea of a million dollars sounds insane, but there’s a saying in personal finance that goes, “30 percent is halfway there.”

After 15 years, you’re only at $300,000, which is weird. But the rest of the money starts to compound faster and faster after that.

Nick Wolny

Cameron Thrower (@camthrow)

You often emphasize “consistency” over “perfection.” Why do you think that is such an important message to share with your audience?

Instead of being freaked out about the big number at the end, it’s easier to focus on one foot in front of the other. Can you swing 100 bucks out of your paycheck twice a month? Then, I’d say, just start there.

One last question (just for fun): Is there a pop star or pop culture figure who you think is secretly a personal finance genius?

Rihanna not releasing songs is actually one of the first ones that come to mind. She does what she wants to do, and she doesn’t care what anyone thinks. And she’s taking care of her family.

There’s this thing called sunk-cost fallacy, which is that people keep doing something because of how much time and effort they’ve already put into it. The fact that she just decided, like, ‘Nah…’ I think that’s actually something we could all go off of.

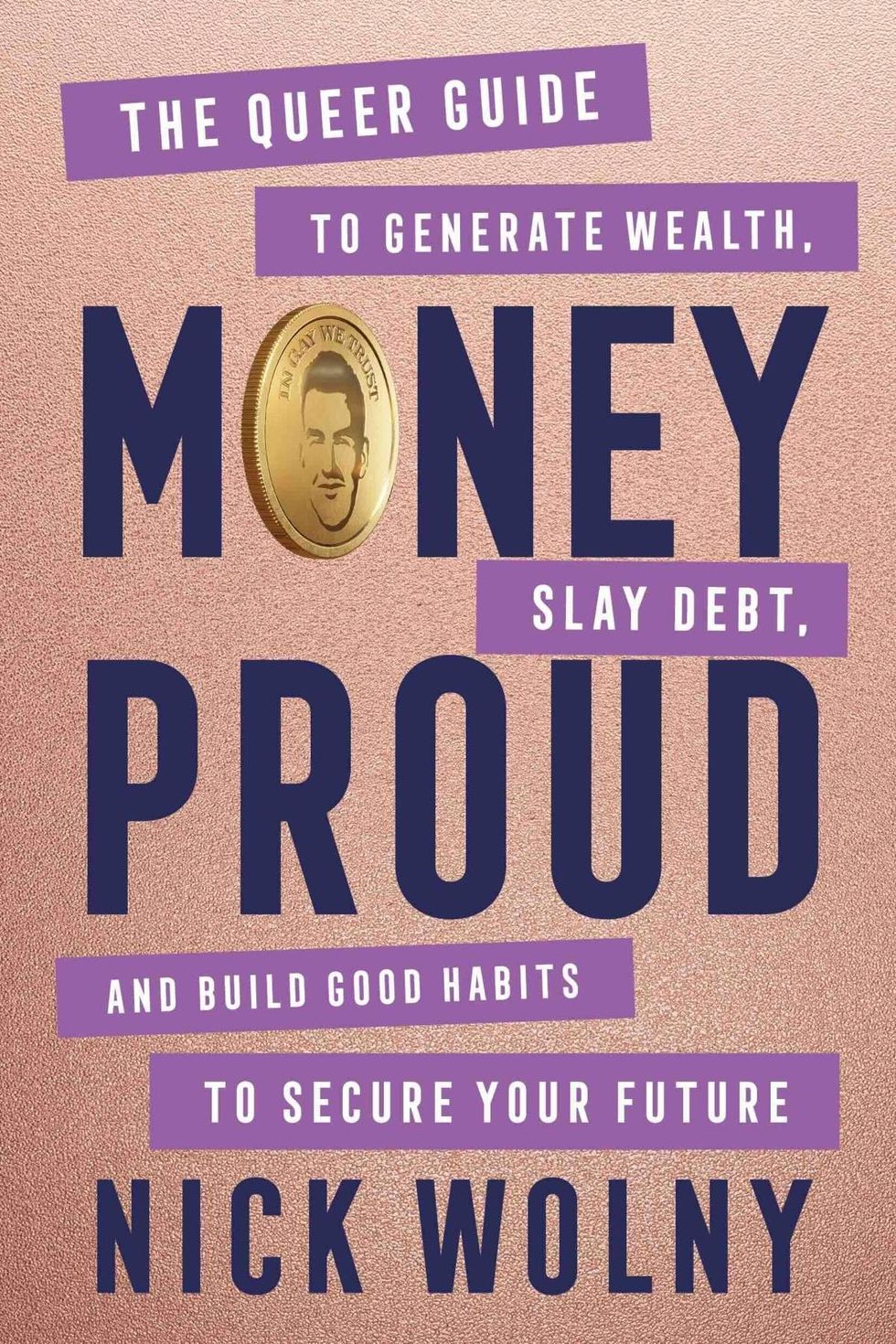

Nick Wolny’s debut book, Money Proud, is now available everywhere books are sold.

The official cover art for Nick Wolny’s book Money Proud: The Queer Guide to Generate Wealth, Slay Debt, and Build Good Habits to Secure Your Future, first released on December 30, 2025.

William Morrow

You can subscribe to Nick Wolny’s newsletter, Financialicious, on NickWolny.com. Otherwise, the author can be followed on his official social media pages on Instagram and TikTok, among others.