Niko Partners has updated its outlook for the gaming markets in Asia and the MENA region following the results of H1 2025. The report covers consumer spending on video games (excluding RMG and gambling).

-

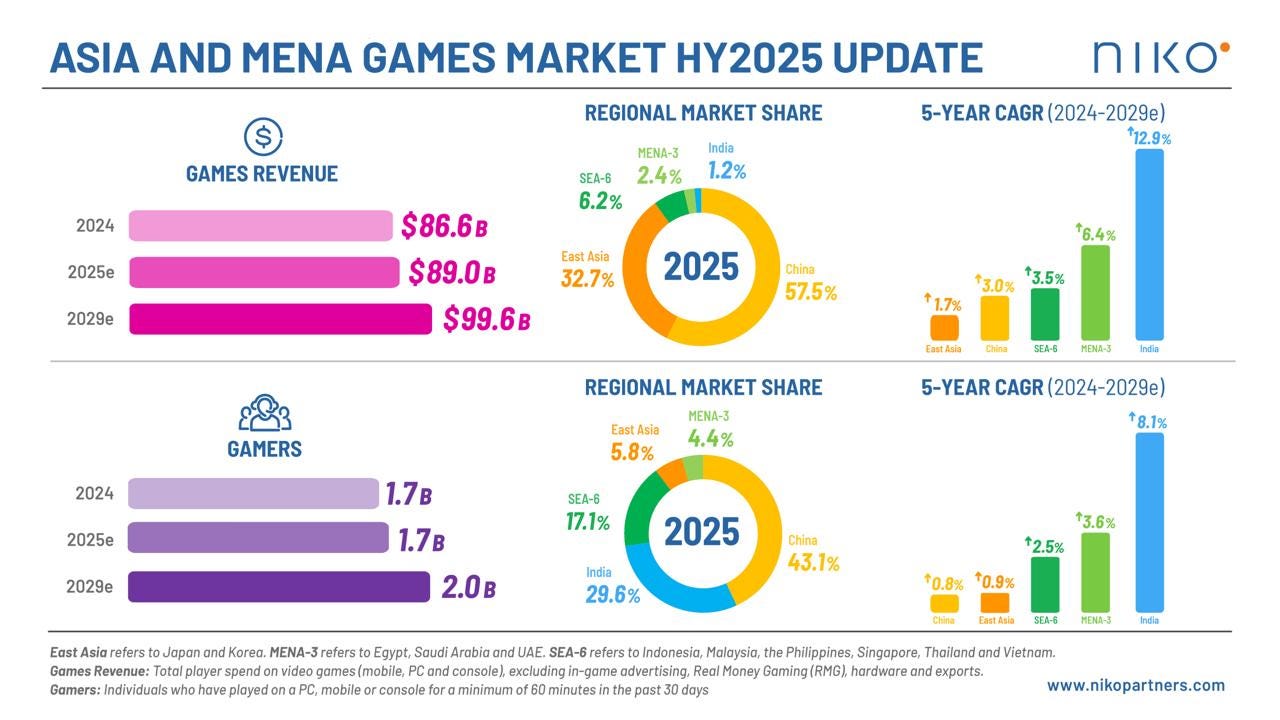

In 2025, the combined size of the Asia and MENA gaming markets is expected to reach $88.97 billion (+2.7% YoY).

-

The number of players across these regions will reach 1.7 billion in 2025 (+2.7% YoY).

-

Forecasts were revised upward due to several factors. Regulatory conditions improved in several markets (China increased the number of licenses issued, RMG was banned in India), and games across all platforms performed above initial expectations. Niko Partners expects the combined Asia and MENA market to reach $100 billion by 2029.

-

India, MENA, and Southeast Asia are projected to be the fastest-growing regions through 2029 in terms of both revenue and player growth. At the same time, India, MENA, and China are expected to lead in ARPU growth.

-

By the end of 2025, China’s gaming market is expected to reach $51.2 billion (+4.1% YoY). By 2029, this figure is projected to grow to $57.1 billion (5-year CAGR of +3%, up from Niko Partners’ previous forecast of 2.2%).

-

Over the first 10 months of 2025, China issued 1,441 game licenses, up 24% YoY.

-

India’s gaming market revenue is expected to grow from $1.1 billion in 2025 (+16.2% YoY) to $1.67 billion by the end of 2029 (5-year CAGR of +12.9%).

-

The number of players in India will exceed 500 million this year and reach 700 million by 2029. The ban on real-money gaming (RMG) is expected to positively impact revenue from traditional games.

-

Malaysia, Thailand, and Vietnam are the fastest-growing markets in Southeast Asia. At the same time, Niko Partners lowered its forecasts for Thailand and Indonesia. The total size of Southeast Asia’s gaming markets in 2025 will reach $5.5 billion (+2.1% YoY), growing to $6.4 billion by 2029 (+3.5% YoY).

A word from our sponsor

Transform your online store into an LTV powerhouse with Xsolla’s LiveOps tools – run dynamic, segmented campaigns to drive an 80% repeat purchase rate, and boost player retention by 15%+ using in-game synchronized offers and loyalty shops.

Time-limited promos, login bonuses, and referral programs can lift player engagement and help grow ARPPU by 20%+, all through an intuitive interface built for fast campaign launches, deep personalization, and maximum revenue impact.

-

China, Japan, and South Korea remain the foundational markets in Asia and MENA. By 2029, their combined market size will reach $88.8 billion, accounting for 89.1% of total revenue across the covered regions.

-

The combined gaming markets of Japan and South Korea are expected to total $29.1 billion in 2025 (-0.3% YoY). By 2029, they are projected to grow to $31.7 billion (CAGR of +1.7%).

-

Console gaming accounted for just 6.3% of total revenue in 2025. However, Niko Partners expects this segment to grow the fastest in Asia and MENA through 2029, driven by the launch of Nintendo Switch 2, the upcoming release of Grand Theft Auto VI, increasing console adoption in the region, and rising consumer spending on console games.

-

The MENA-3 markets (Egypt, Saudi Arabia, and the UAE) are estimated at $2.2 billion in 2025 (+8.5% YoY). By 2029, their combined size is expected to reach $2.8 billion (CAGR of +6.4%).

-

Niko Partners lowered its outlook for the region due to lower expectations for mobile gaming revenue in Saudi Arabia and the UAE.