Reports of the week:

-

Alinea Analytics: 2025 Year in Review (PC & Console)

-

Skala: Age ratings and the impact of Game Content on them

-

BCG: Gaming Market in 2025 & Forecast up to 2030

-

Niko Partners: Gaming markets in Asia and MENA will reach $88.97 billion in 2025

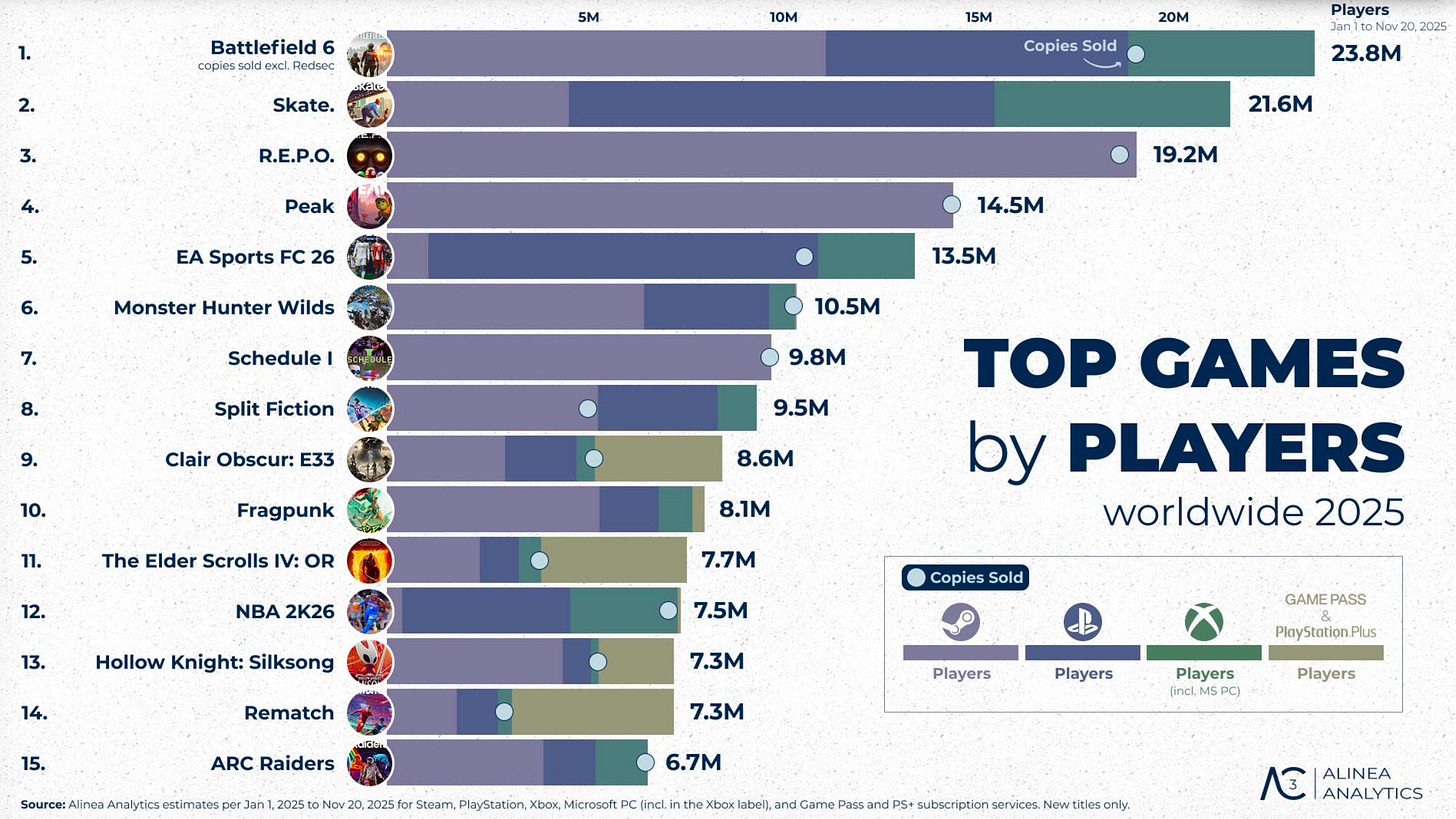

The data covers the period from January 1 to November 20, 2025. The analysis includes Steam, PlayStation, Xbox, Microsoft PC, as well as Xbox Game Pass and PS Plus subscribers. The rankings include only new games released during the 2025 calendar year.

-

Battlefield 6 was the most successful release by player count (excluding the free-to-play Redsec). 23.8 million players across all platforms purchased the game.

-

Skate ranked second with 21.6 million players. However, it is a free-to-play title, hard to compare it with BF6’s success.

-

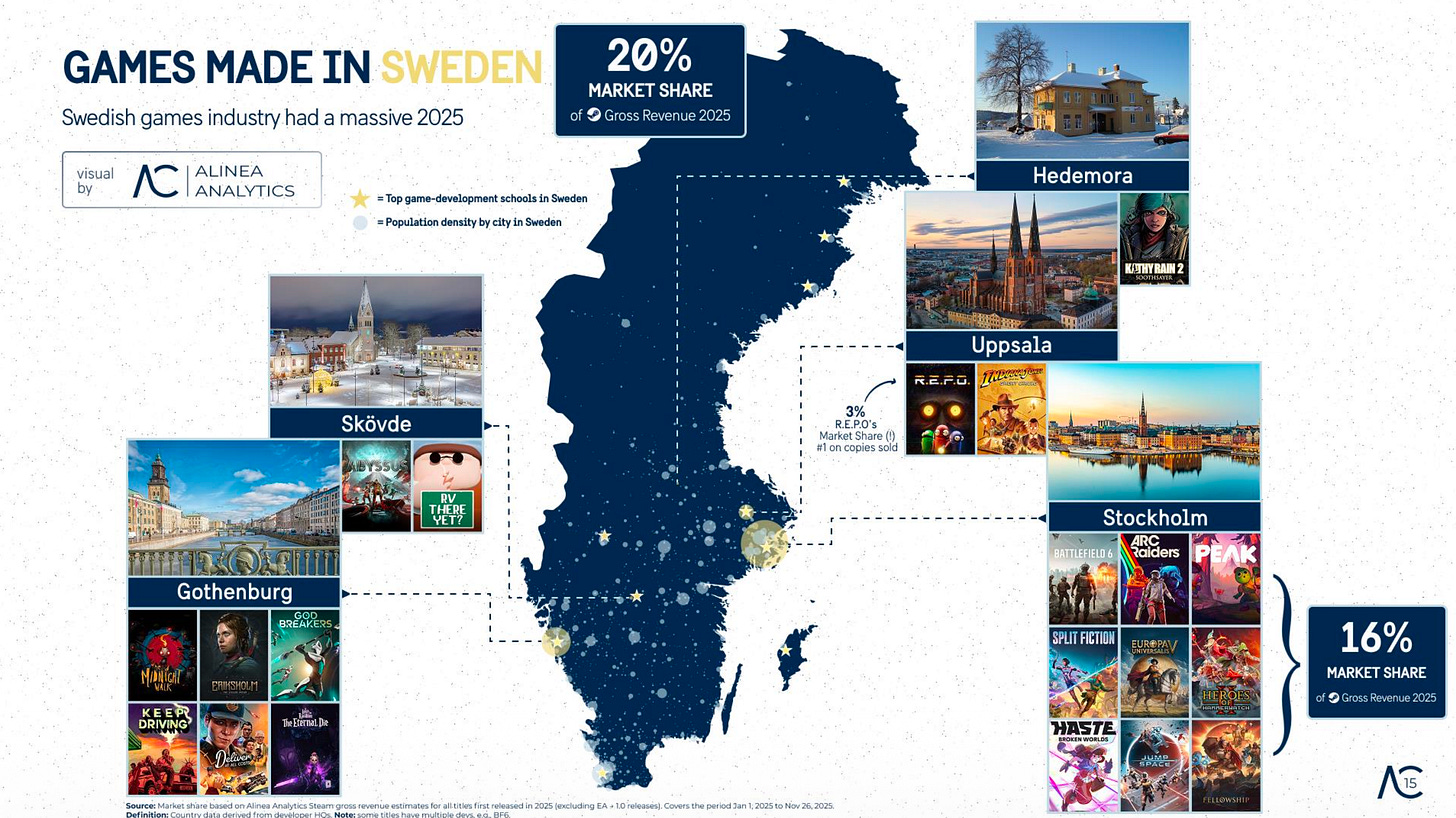

Third and fourth place by player count went to two indie hits: R.E.P.O. with 19.2 million players and Peak with 14.5 million.

-

Around 20,000 projects are expected to be released on Steam in 2025. Just over 300 of them will generate more than $1 million in gross revenue.

-

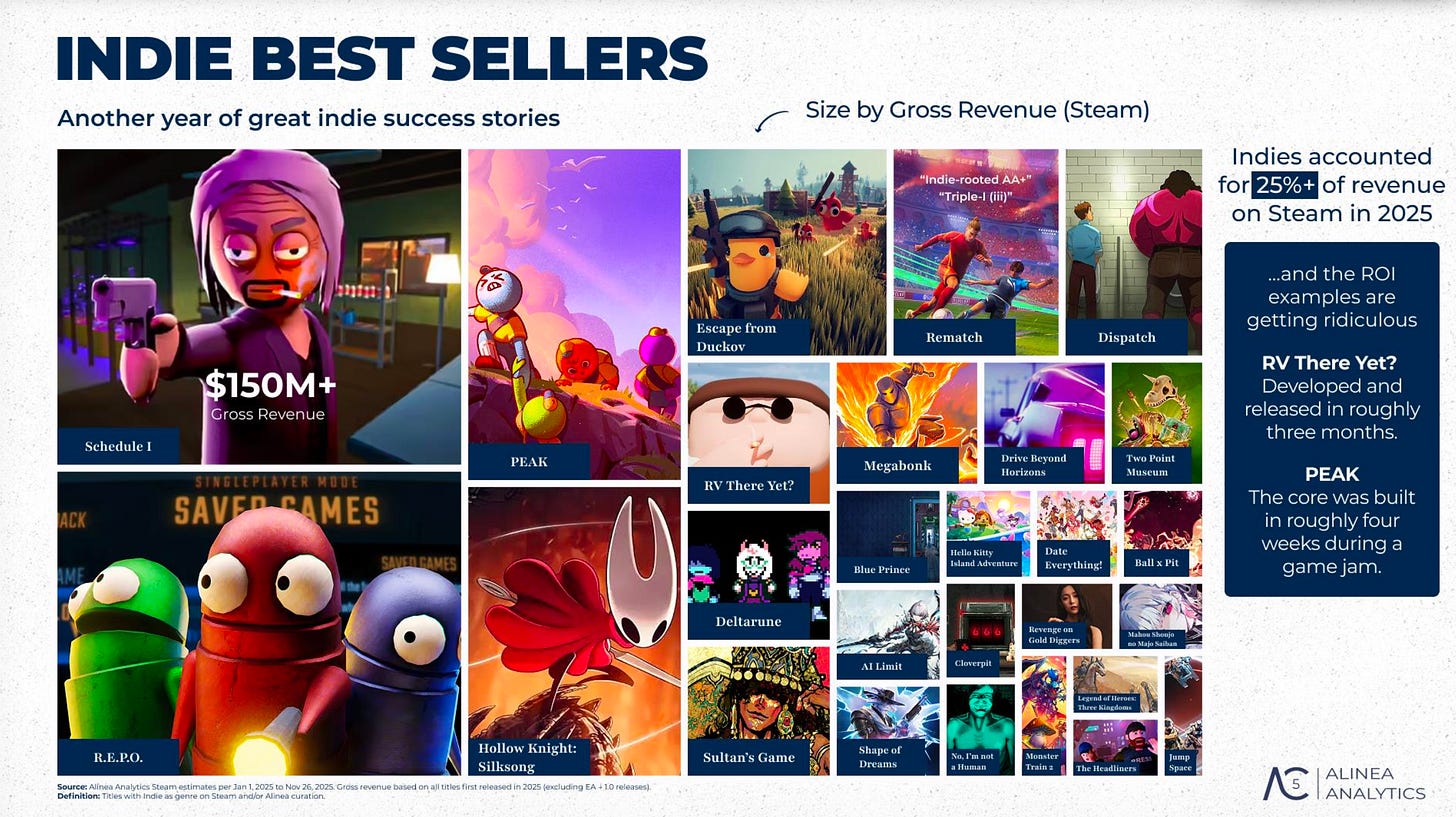

Indie games will account for 25%+ of total Steam revenue by the end of 2025.

-

Alinea Analytics highlights examples of games with extremely high ROI. For instance, RV There Yet? was developed in roughly three months. PEAK took slightly longer, and the project itself originated from a four-week game jam (the slide contains a minor inaccuracy, as development lasted longer than four weeks).

-

Alinea Analytics emphasizes the importance of the Chinese audience for PC and console success. According to the service, China is the largest market on Steam and the fifth-largest for PlayStation.

-

Escape From Duckov (64% of its audience from China), Split Fiction (44%), and Monster Hunter: Wilds (26%) are the biggest Steam hits in China. On PlayStation, the leaders are Split Fiction (26% of the audience from China), Monster Hunter Wilds (17%), and Death Stranding 2: On The Beach (24%).

-

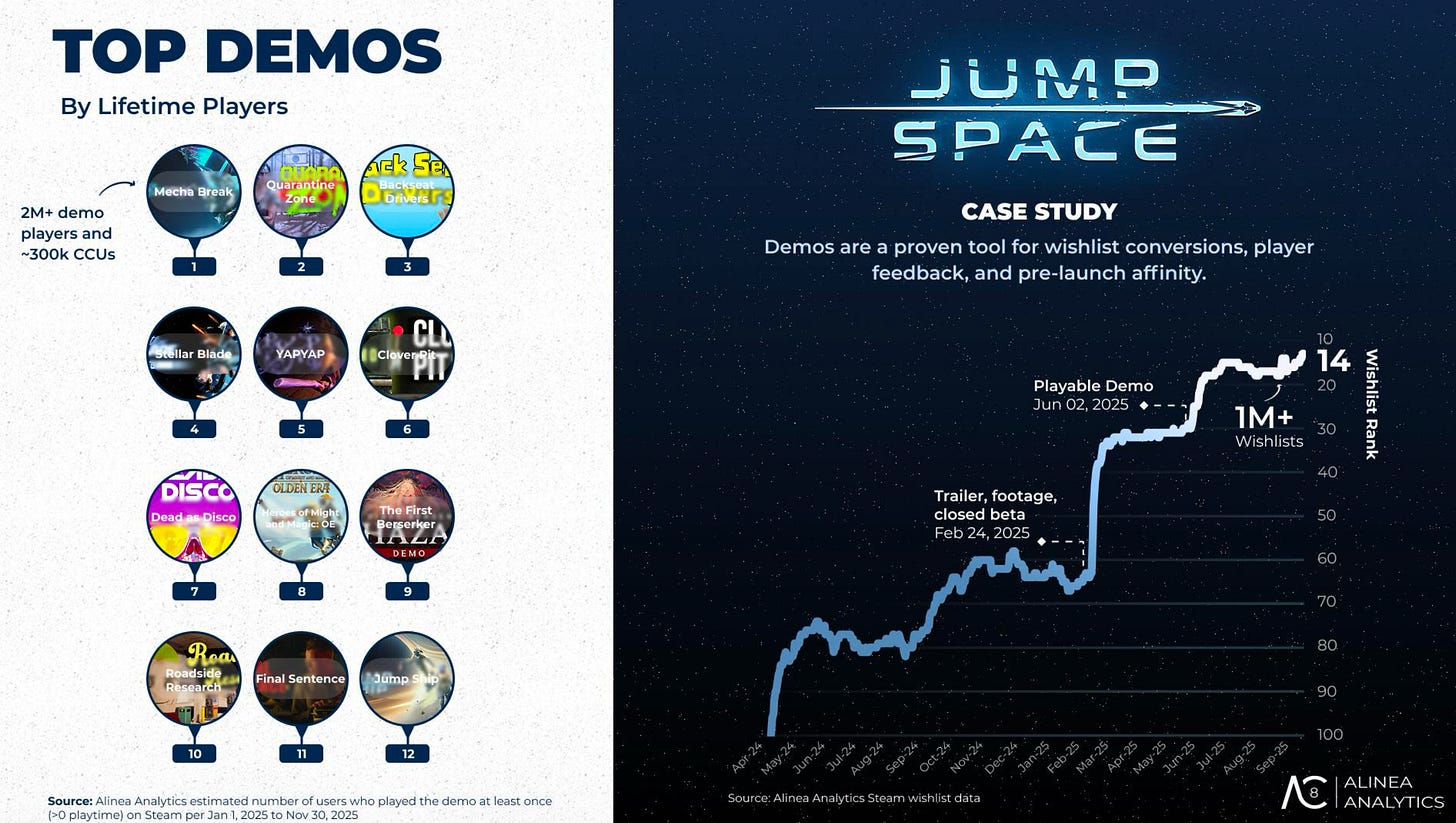

Mecha Break was the most popular demo of 2025. More than 2 million players tried it, and peak CCU exceeded 300,000.

A word from our sponsor

Launch a fully branded web shop for your game in just one day with Xsolla’s Storefront – powered by AI for lightning-fast, 5-second site generation and simple drag-and-drop customization. Create native, game-like player experiences at any scale, localize instantly into 26 languages, adapt pricing for every region, and apply geo-restriction controls.

Effortlessly A/B test offers and layouts, go live with one click, and track results with built-in analytics for maximum player engagement and revenue growth.

Webshops are fast with Xsolla – join now!

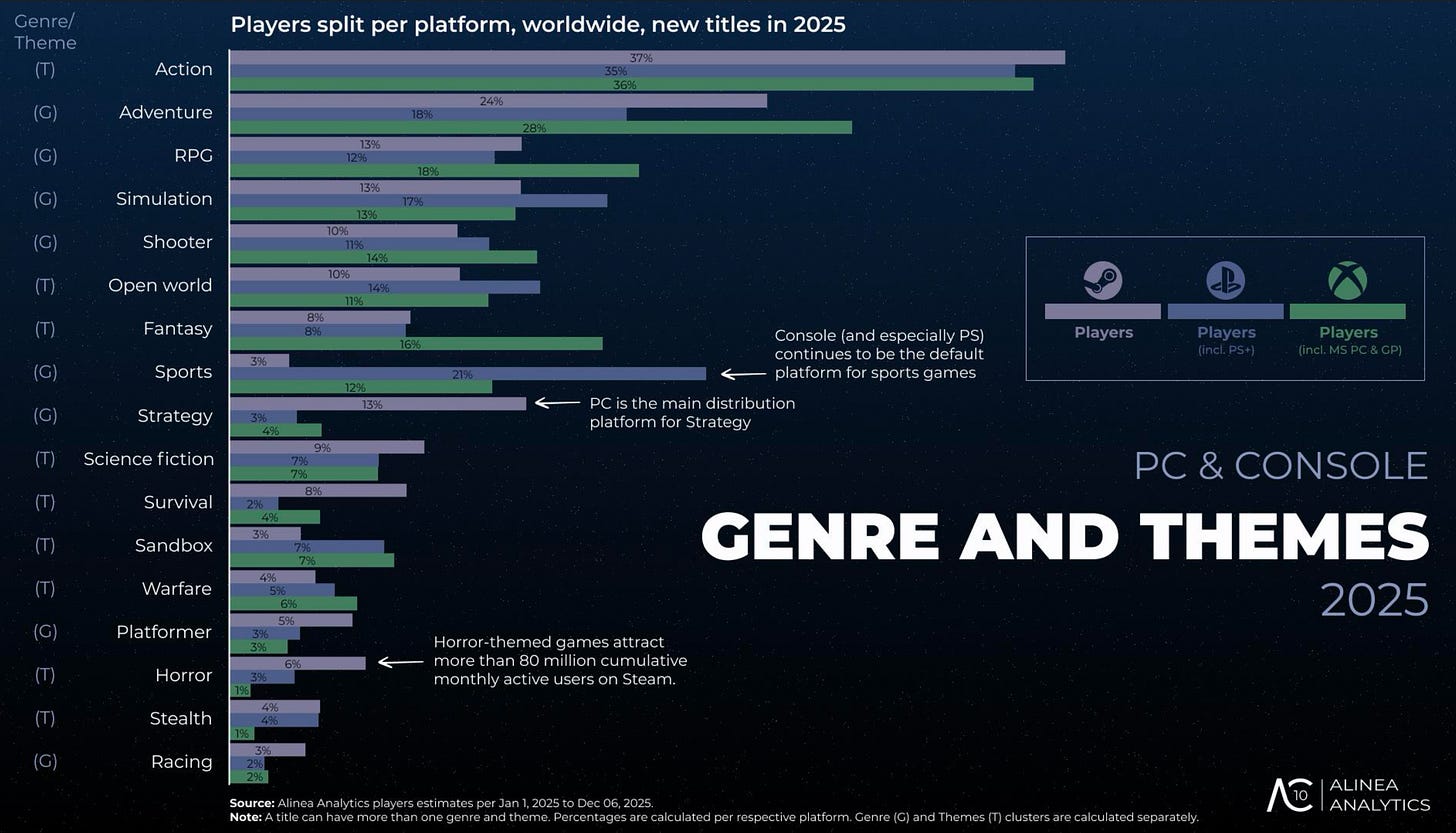

The data covers the period from January 1, 2025, to December 6, 2025.

-

Action, adventure, and RPG are the top three genres by total player count among new releases. There are exceptions: sports games rank second in popularity on consoles, while strategy games perform better on Steam.

-

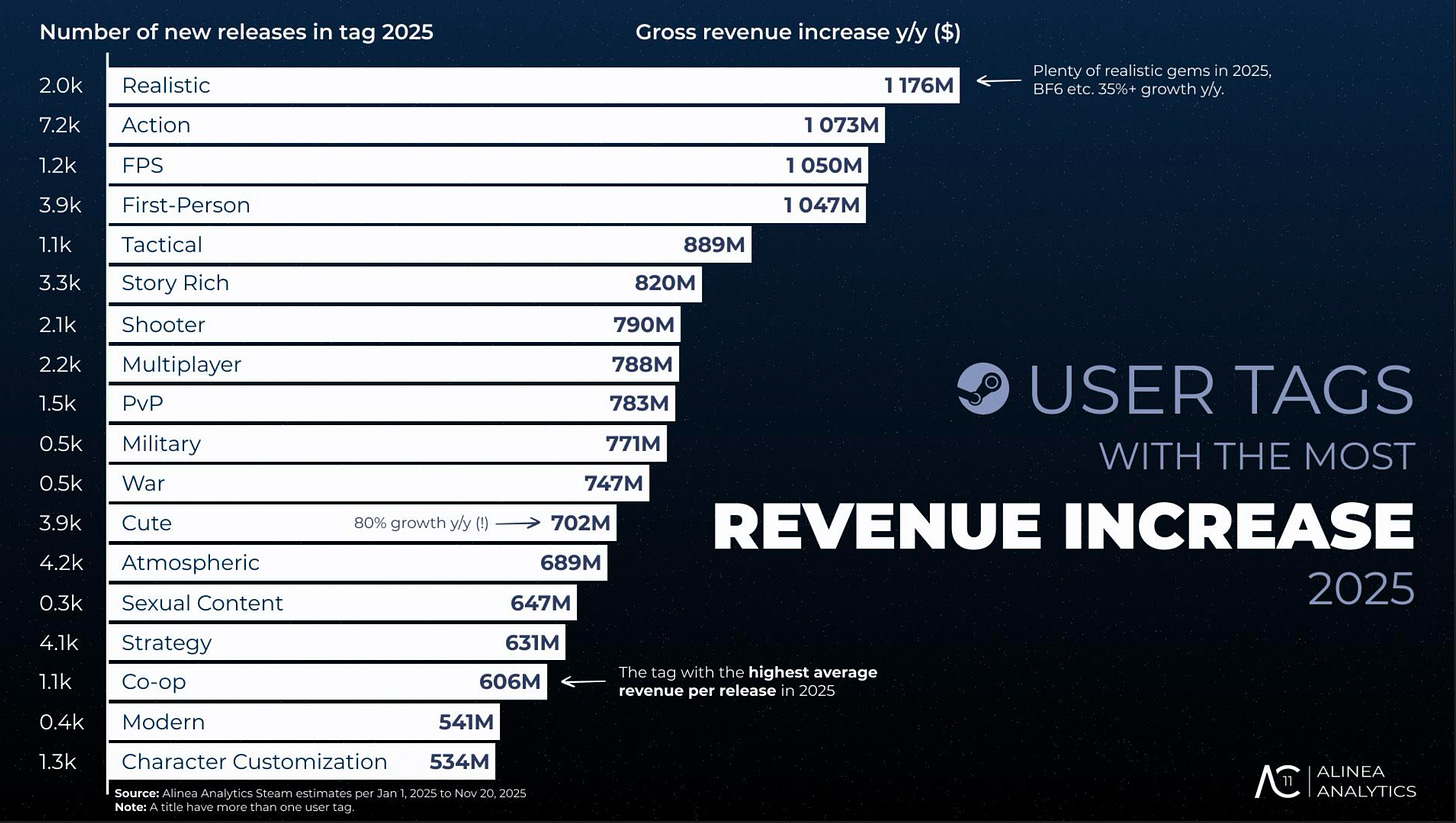

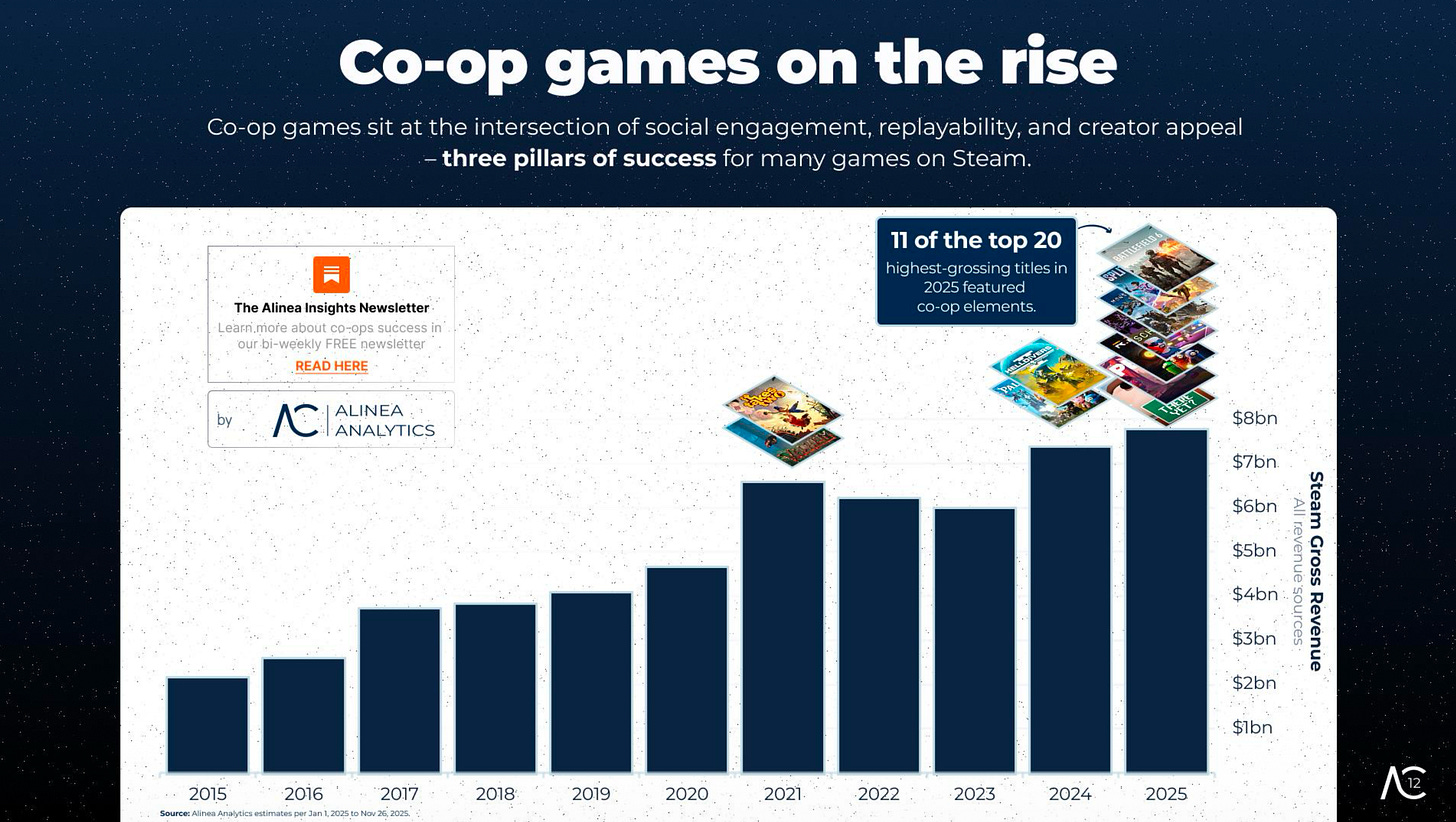

Looking at Steam tags, realistic games showed the strongest revenue growth (with a major contribution from Battlefield 6), followed by action and FPS. Cooperative games (with the relevant tag) showed the highest average revenue in 2025.

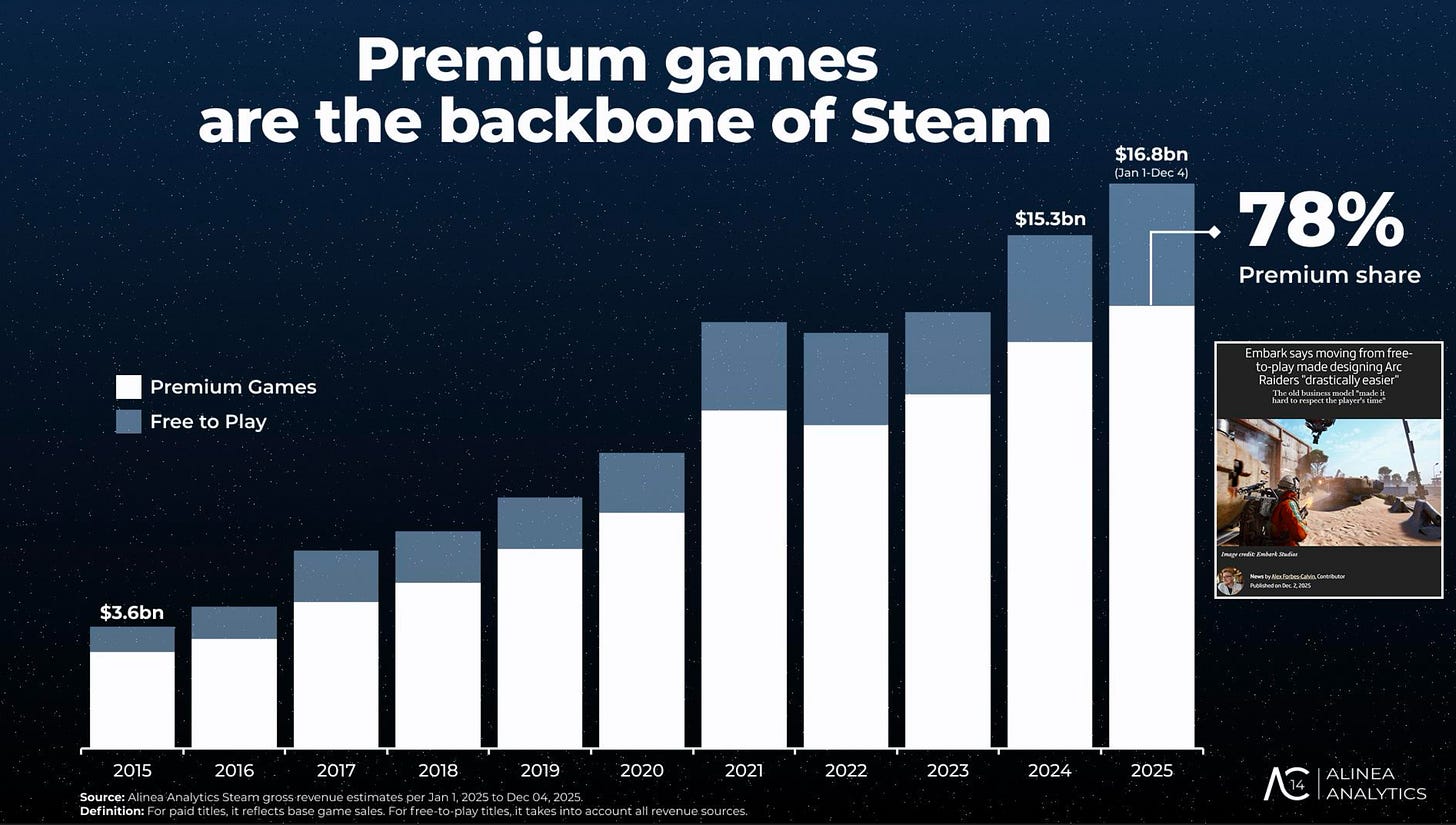

I’m not sure how accurate Alinea Analytics’ estimate of F2P revenue is. The service is definitely missing some of the most successful F2P hits of the last few years, like Fortnite, Genshin Impact, and so on.

-

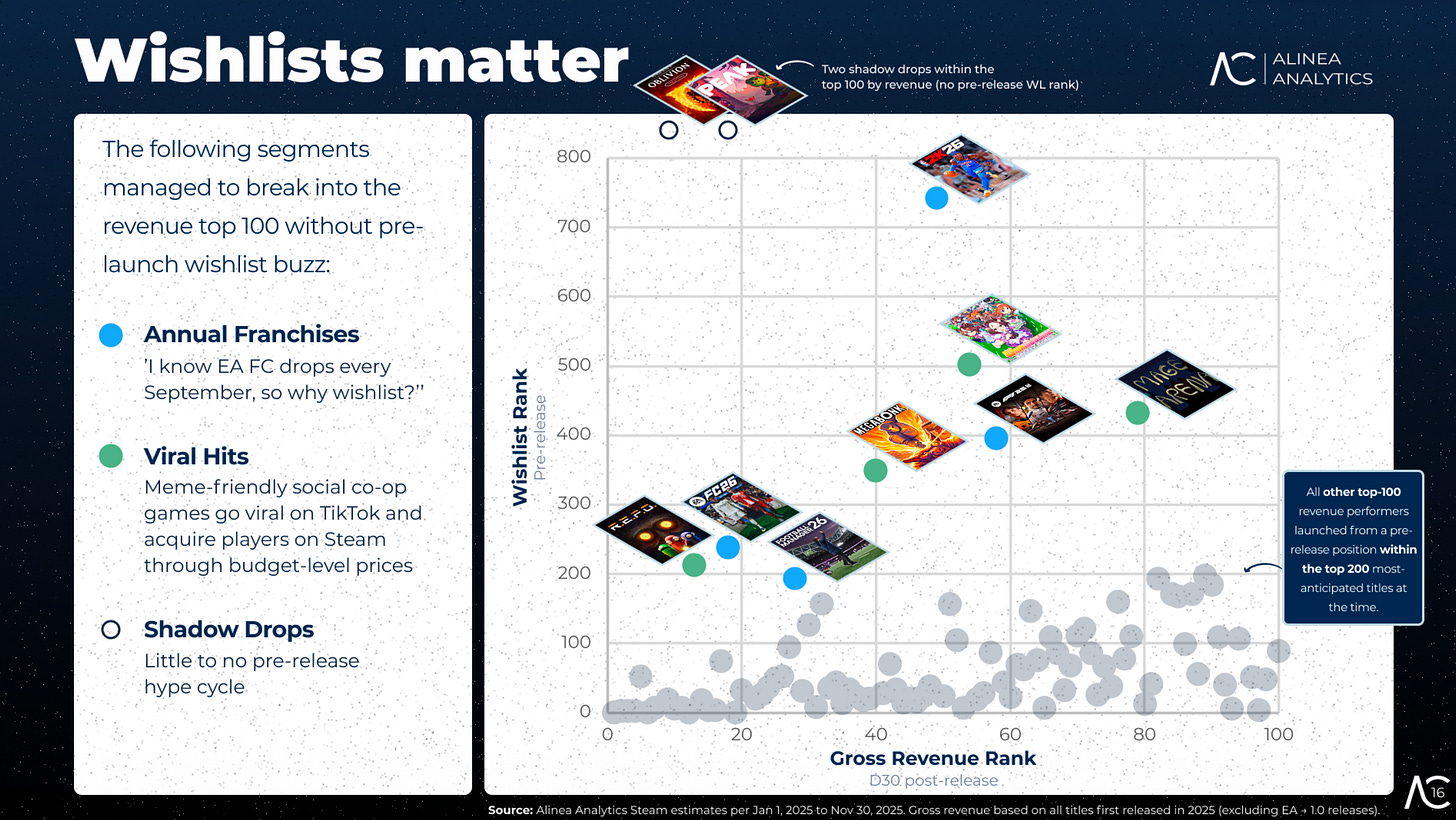

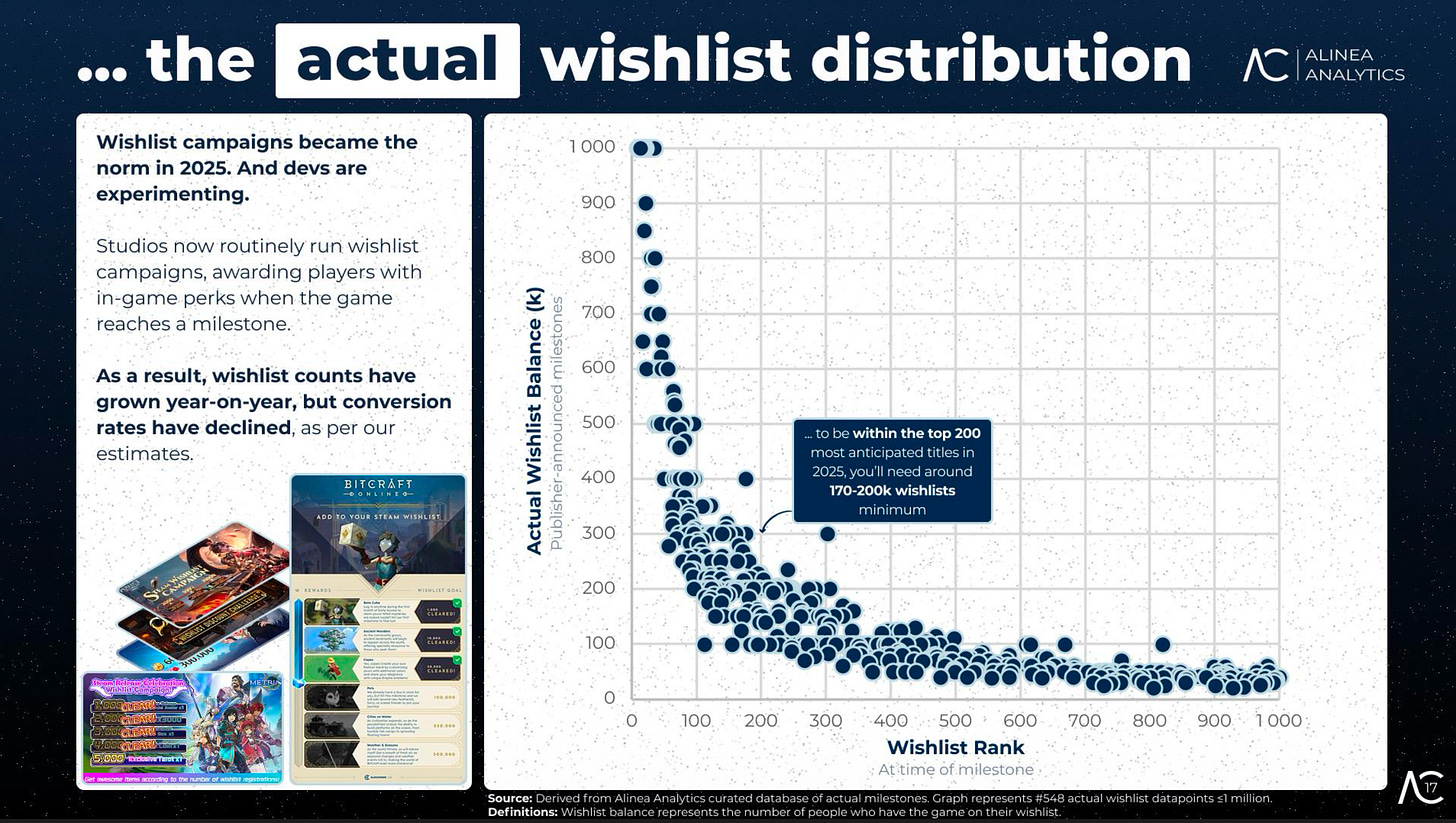

There are three types of projects that managed to enter the top 100 by revenue without a large number of wishlists: annual franchises like EA FC, viral hits such as R.E.P.O., and “shadow launches” where a game releases on the same day it is announced (Peak, The Elder Scrolls IV: Oblivion).

-

All other projects that made it into the top 100 by revenue in 2025 were at least in the top 200 most-wishlisted games.

-

In 2025, entering the top 200 most anticipated projects required at least 170k to 200k wishlists. In addition, Alinea Analytics estimates that wishlist-to-sales conversion is declining.

-

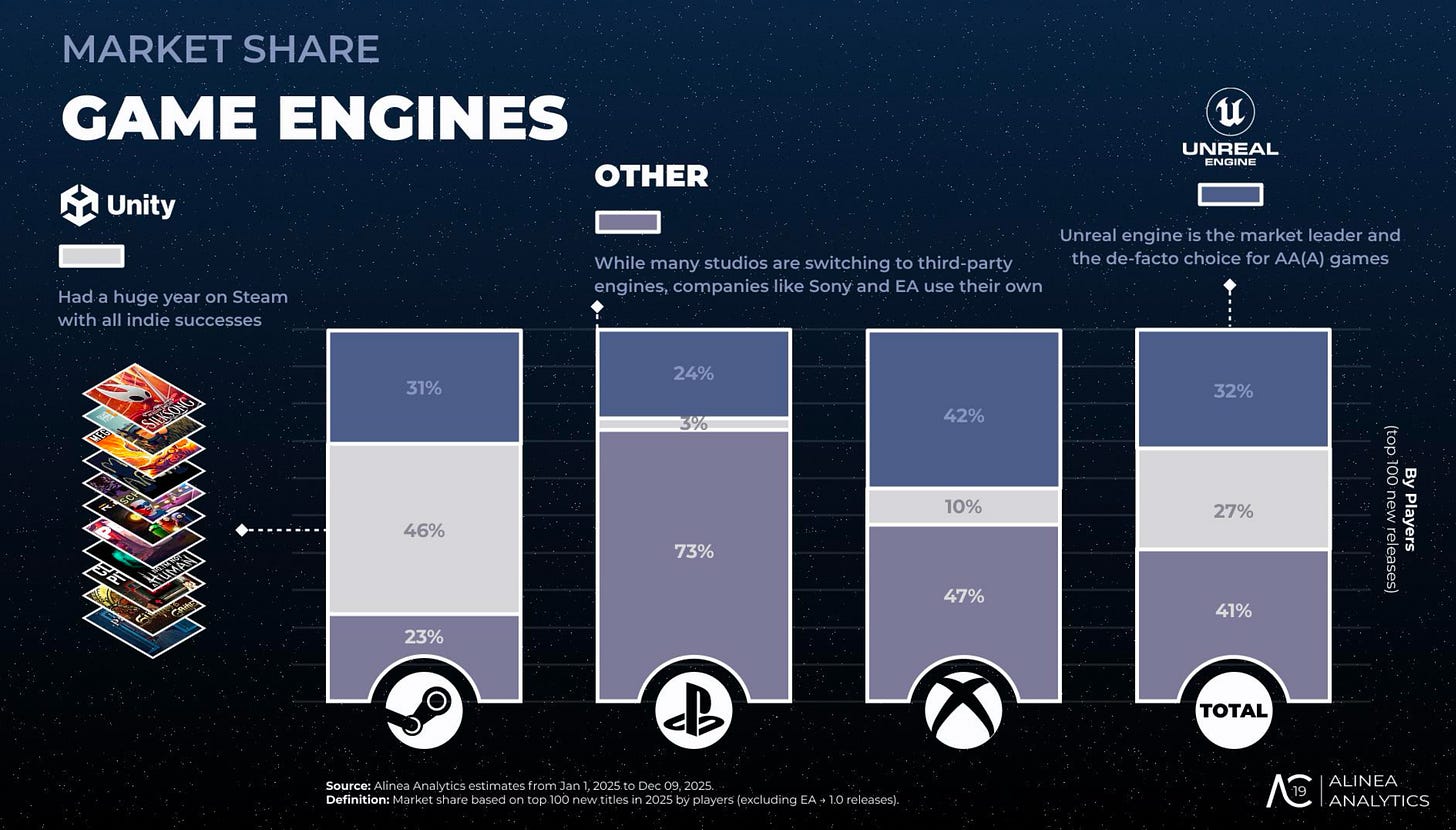

Interestingly, 41% of games in the top 100 were not made using Unity or Unreal Engine. On PlayStation, for example, 73% of the top 100 projects were built on other engines. On Steam, Unity performs particularly well, largely due to its popularity among indie developers.

-

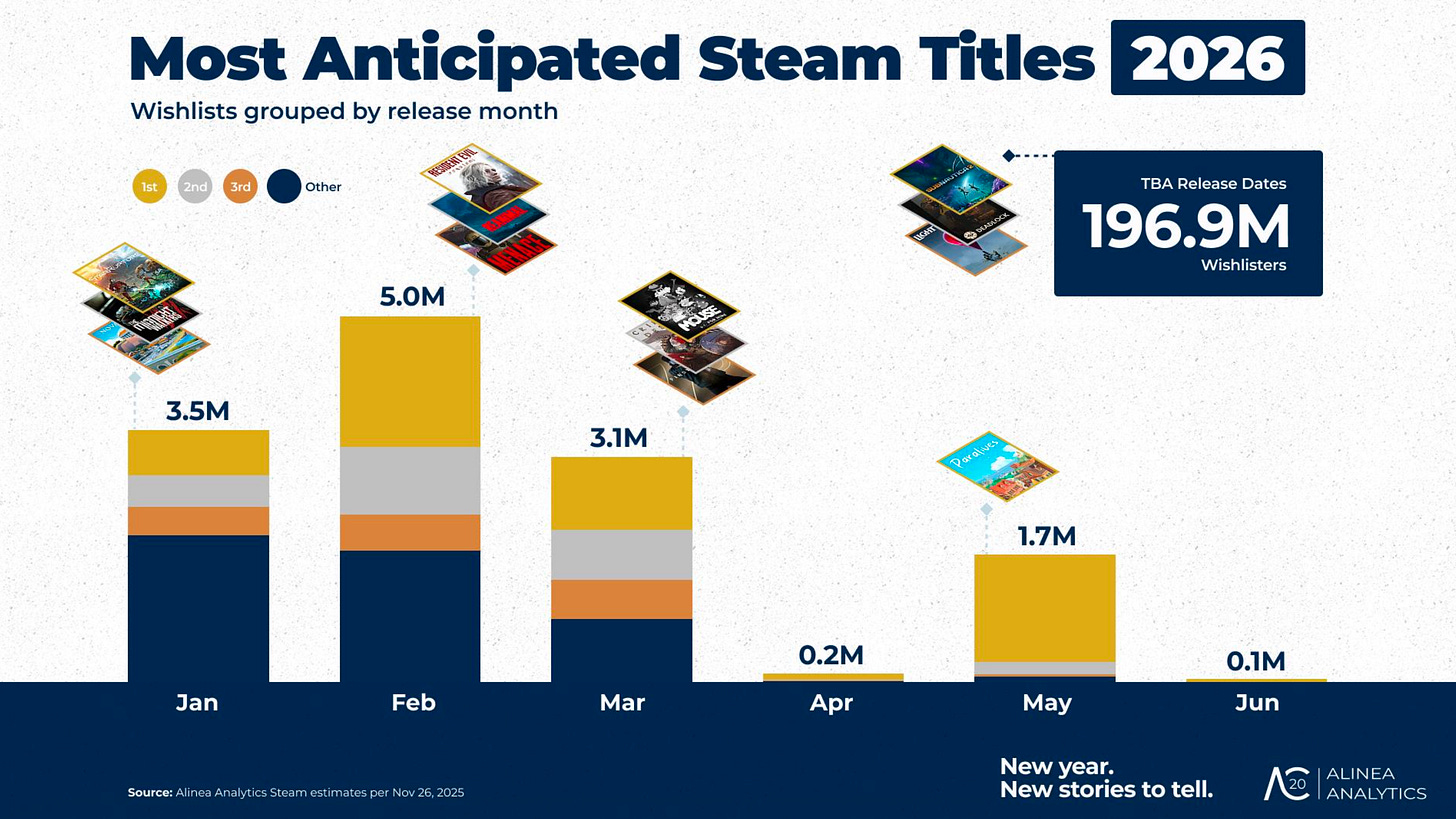

The most wishlisted titles with releases in 2026 are StarRupture (January), Resident Evil: Requiem (February), and Mouse (March). Among May releases, Paralives leads.

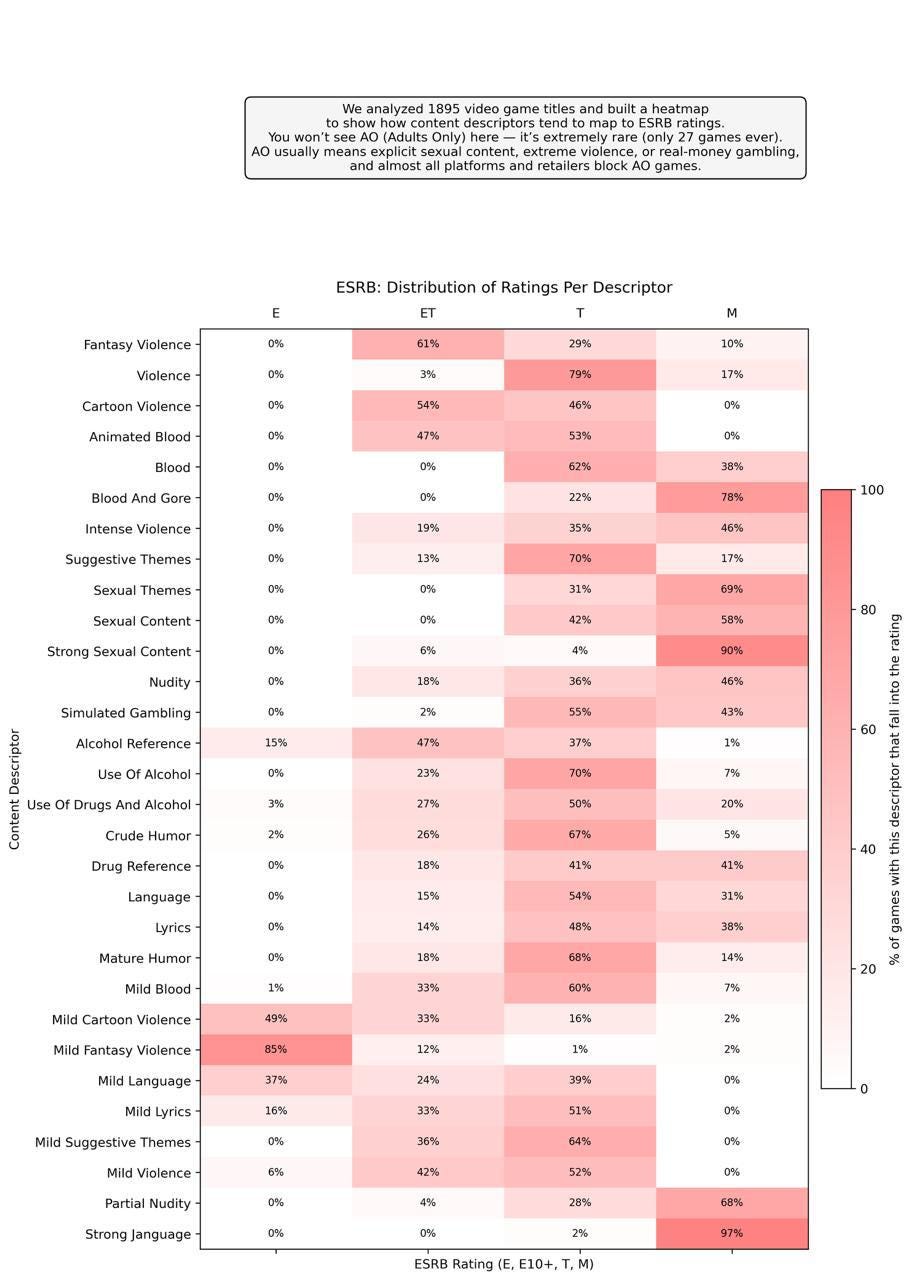

A friend of mine put together a heatmap showing which content categories lead to specific age ratings. I hadn’t come across this kind of breakdown before, so I’m happy to share this exclusive material. The study analyzed 1,895 games.

-

The pattern is clear: the less realistic the violence, the lower the age rating. There is a direct correlation.

-

Obscene language turns out to have a much stronger impact on the likelihood of receiving an M rating than violence or sexual themes. Only 2% of games with this type of content ended up in the T (Teen) category.

-

Violence, especially when stylized, very rarely ends up in the M (Mature) category. In most cases, it is classified as T (Teen).

-

There is a special category, AO (Adults Only). Only 27 projects from the sample fell into it. These are games with explicit pornography, real-money gambling games, and projects that are effectively banned from distribution, as partners refuse to work with them. The recent scandal around Horses (EGS flagged the game as AO, while the developers claim they received an M rating) is partly related to this issue.

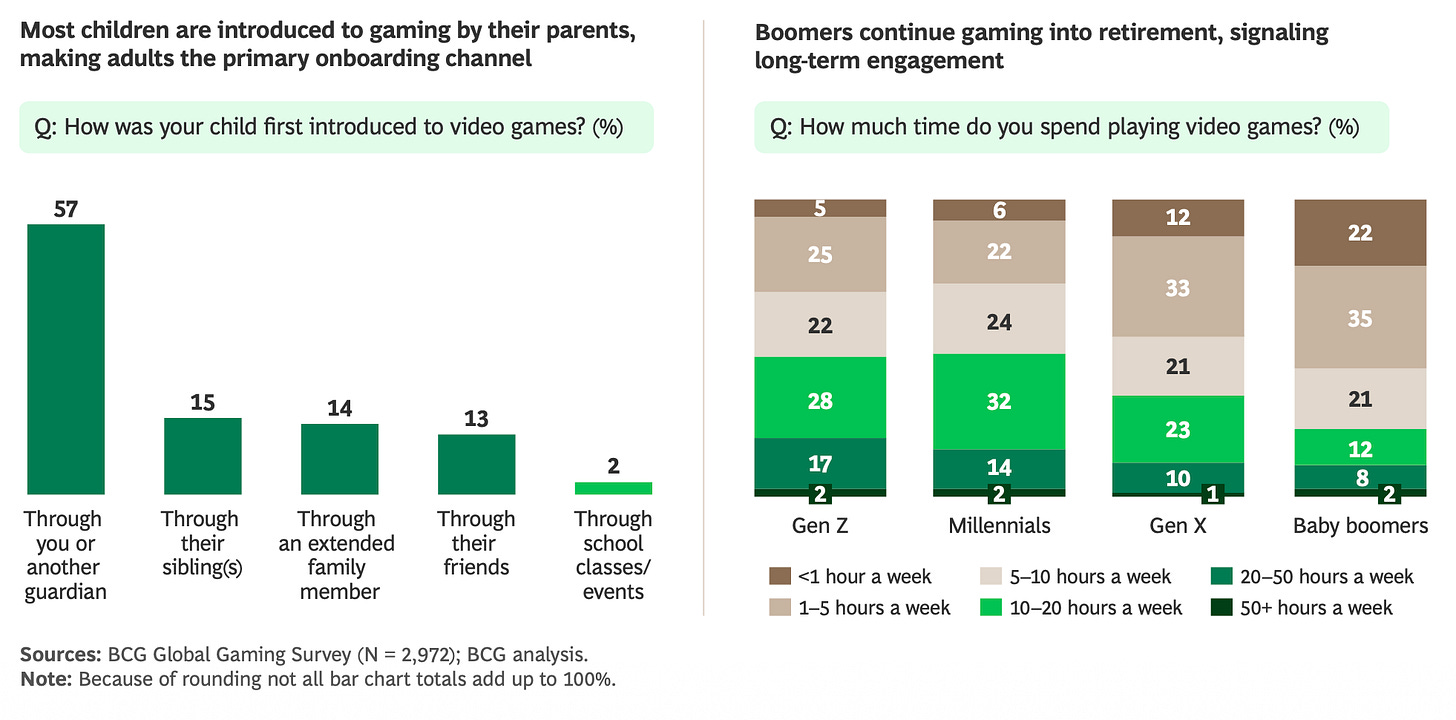

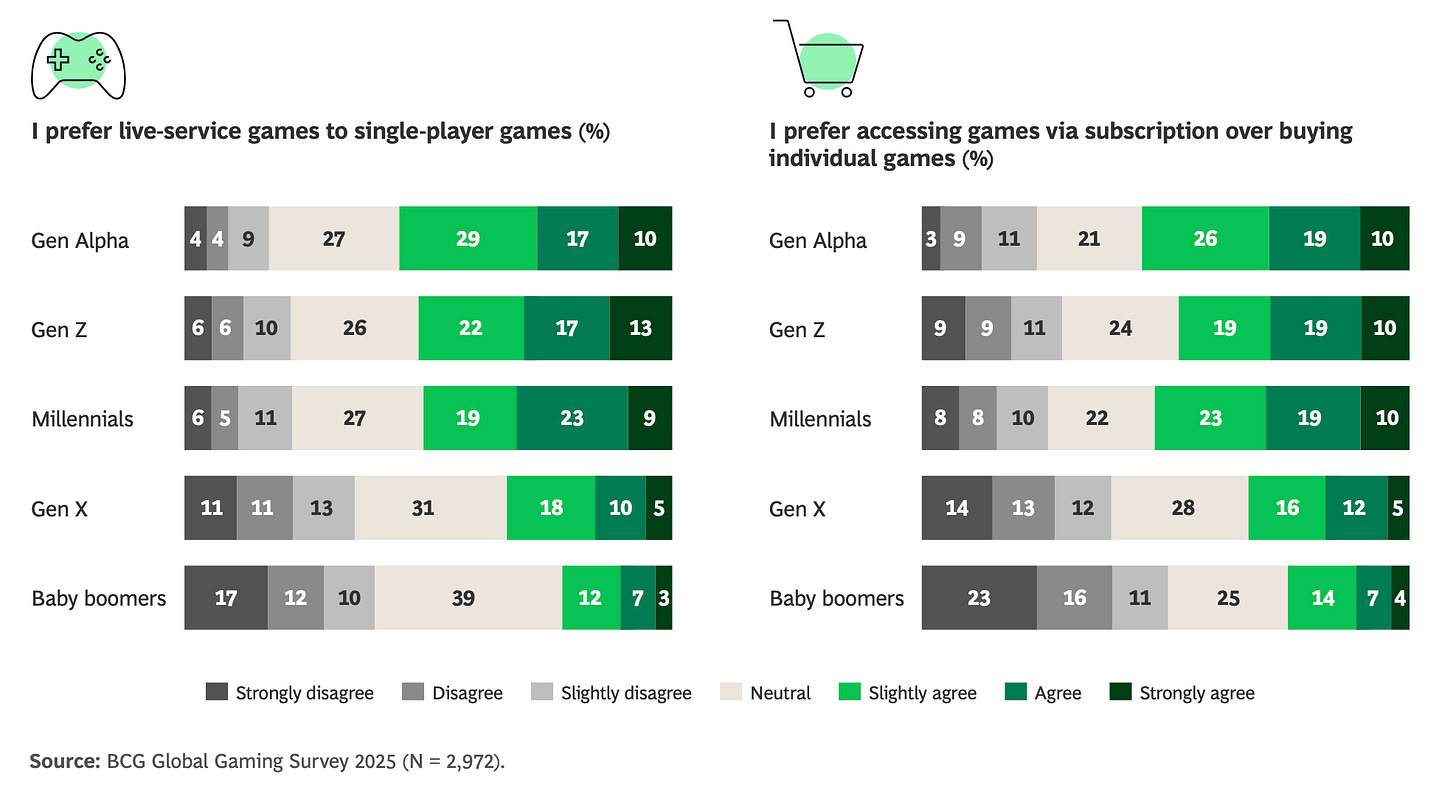

The report is based on a survey of 2,972 respondents conducted in July 2025. The US accounts for 22% of the total sample, followed by China, Germany, Japan, and South Korea.

-

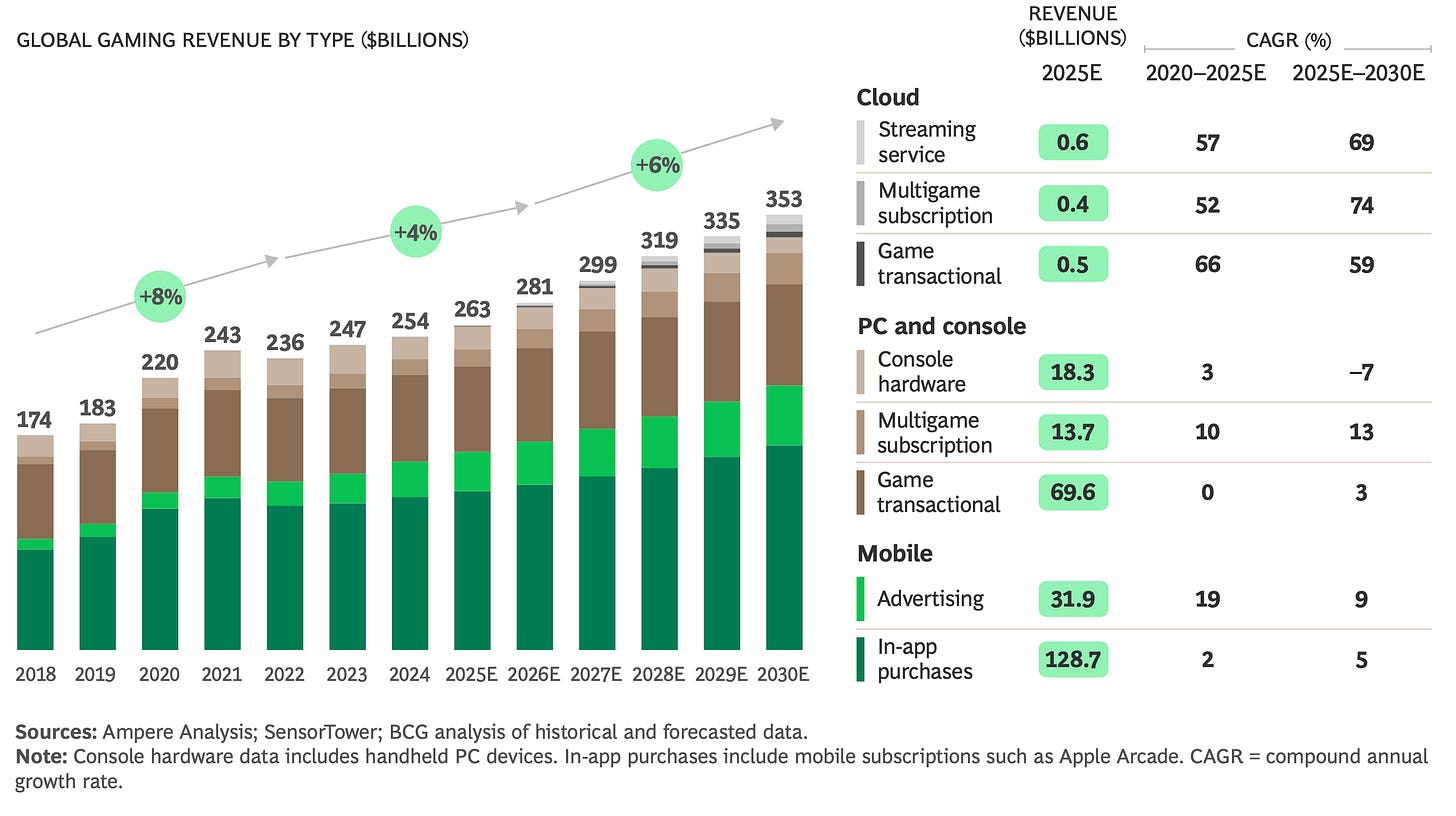

According to BCG, the global games market has emerged from post-pandemic stagnation. By the end of 2025, its size will reach $263 billion.

-

Market growth from 2026 to 2030 is expected to be faster than in 2022–2026: +6% CAGR versus +4% CAGR.

-

By 2030, the market will reach $353 billion. Mobile IAP revenue will remain the largest segment. The share of subscriptions, cloud services, and streaming platforms will grow, while console hardware sales are expected to stop growing.

-

Around 55% of players said they increased the amount of time they spend playing games over the past six months.

The difference in market size compared with, for example, Newzoo is due to methodology. BCG includes hardware sales and advertising.

-

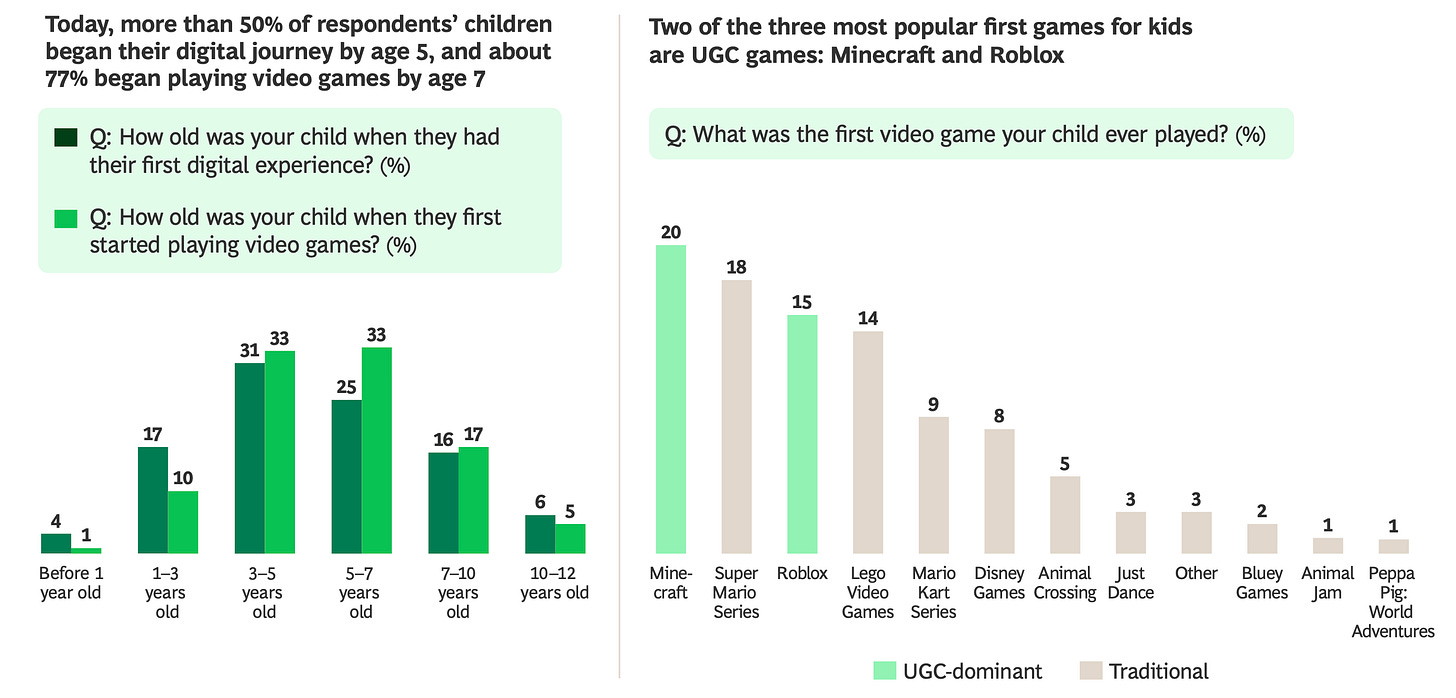

44% of children start playing games before the age of five (survey asked parents who play games themselves). Minecraft, the Super Mario series, and Roblox are the three most common first games for children.

-

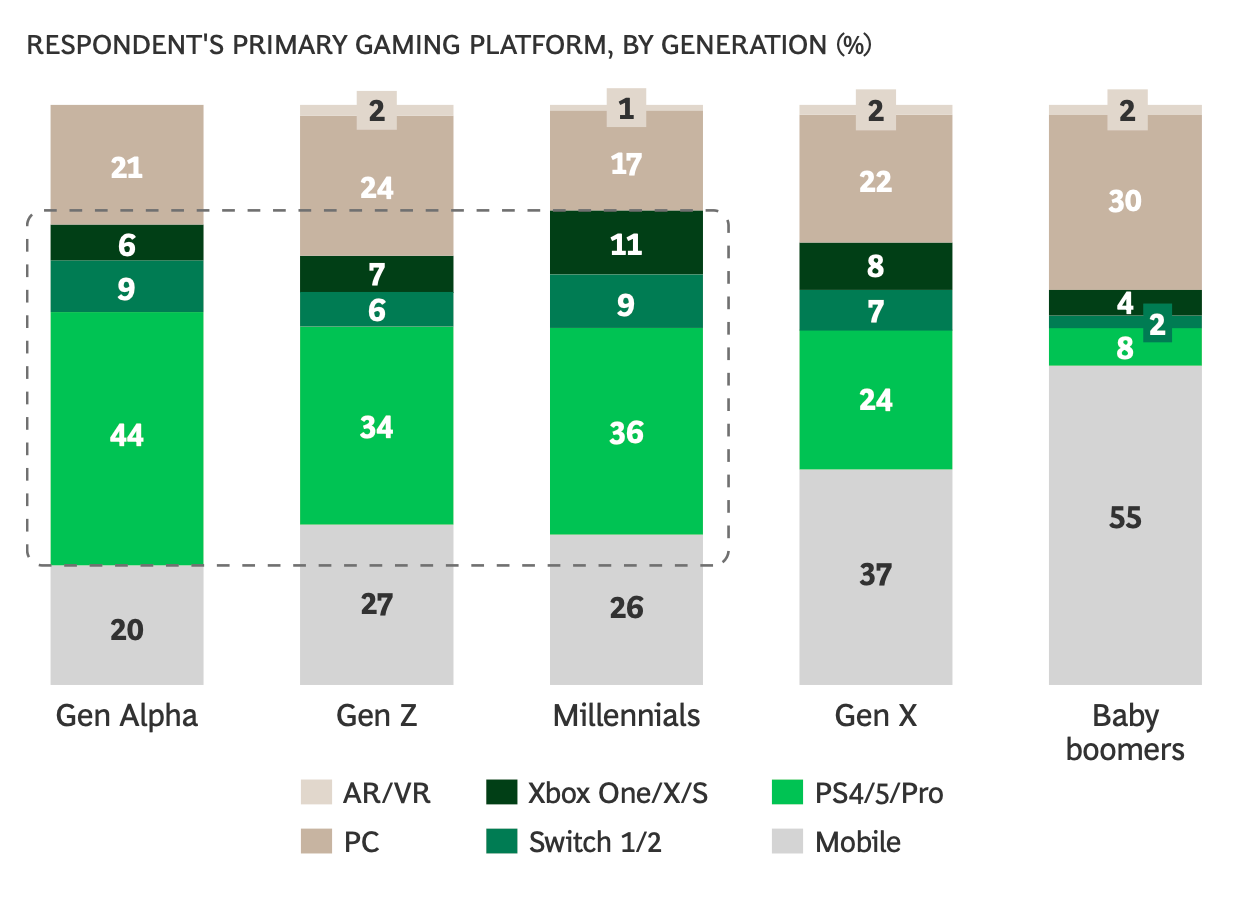

Consoles are the primary platform (where users spend the most time) for more than 50% of Gen Alpha, Gen Z, and millennials.

-

PC popularity varies across age groups. PCs are popular among Gen Z as well as Gen X, and baby boomers. The average age of the PC audience is higher, at least based on the sample.

The survey was conducted mostly in developed countries, which partly explains the strong position of consoles.

A word from our sponsor

Manage thousands of SKUs easily with Xsolla’s Catalog Management – import via JSON or API, apply bulk edits and filters, and set intelligent regional prices and restrictions that match local purchasing power. This flexible pricing boosts sales by up to 13%, ensures consistency across platforms like App Store and Google Play, and cuts your operational costs by up to 50%, maximizing your global revenue.

Make your webshop efficient – with Xsolla!

-

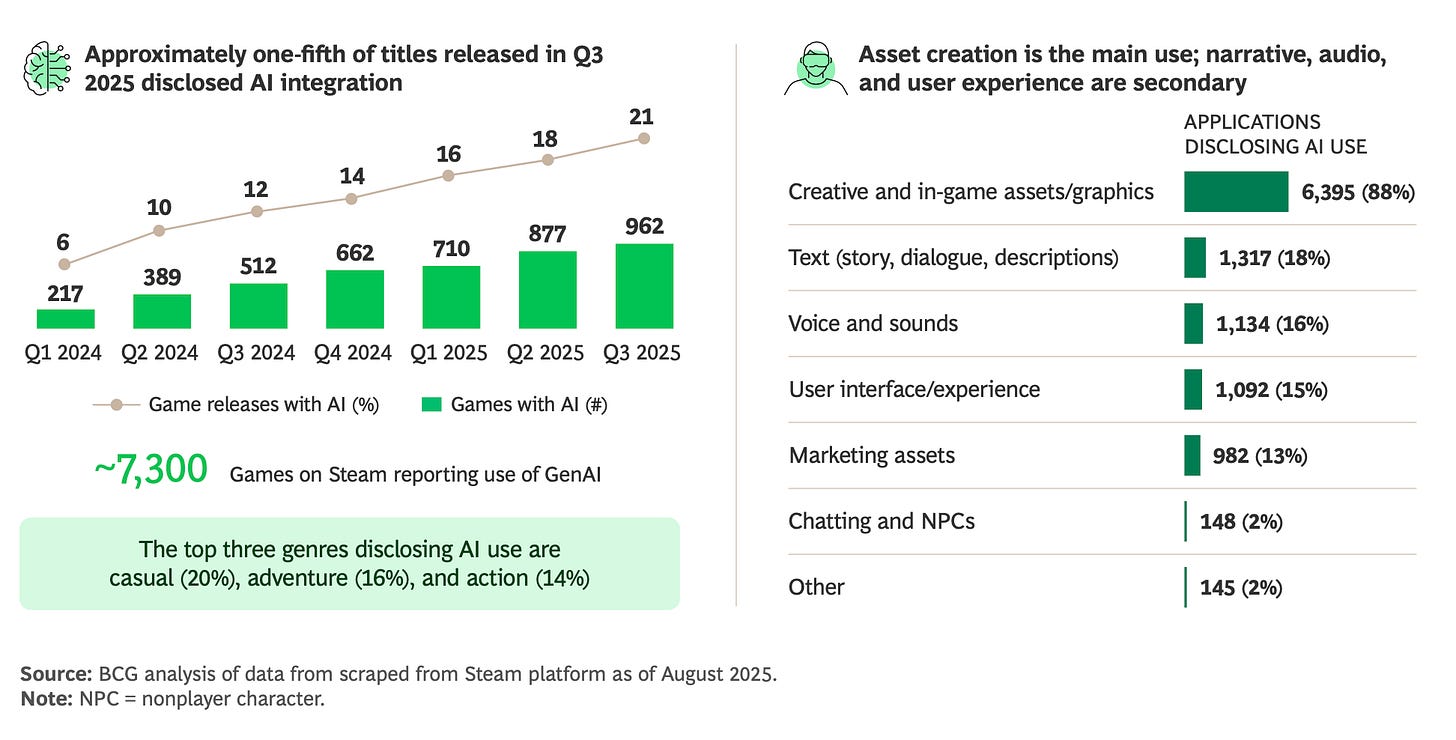

Around 7,300 games on Steam mentioned the use of AI as of August 2025. The chart shows that the share of such projects is growing and has reached 21% in Q3 2025.

-

AI is most often used for creating assets and visual materials (88%), text creation (18%), audio and voice (16%), UI/UX (15%), and marketing assets (13%).

-

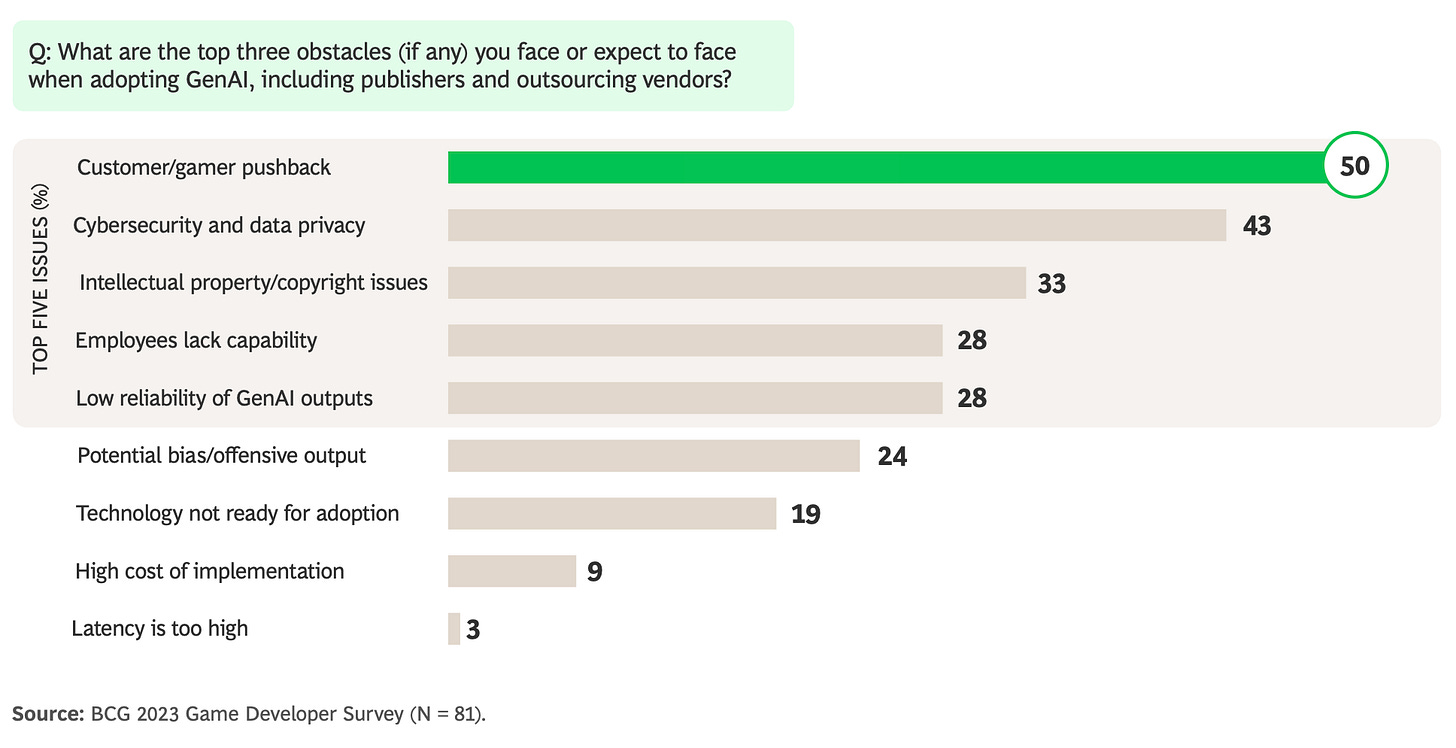

Developers’ main concerns around AI are potential negative audience reactions (50%), cybersecurity issues (43%), and legal risks (33%).

-

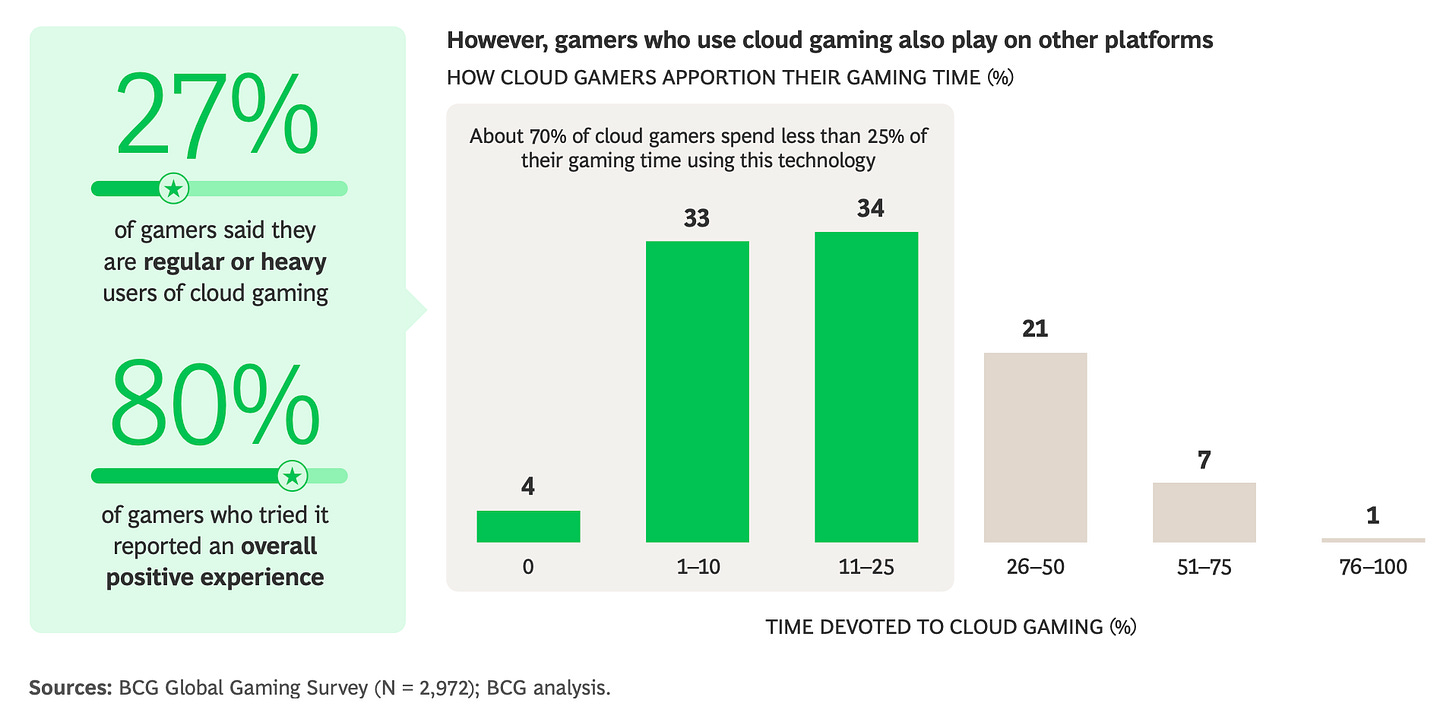

27% of surveyed players regularly use cloud gaming.

-

80% of those who have tried cloud gaming were satisfied, but only 8% play primarily via cloud (more than 50% of their total playtime).

-

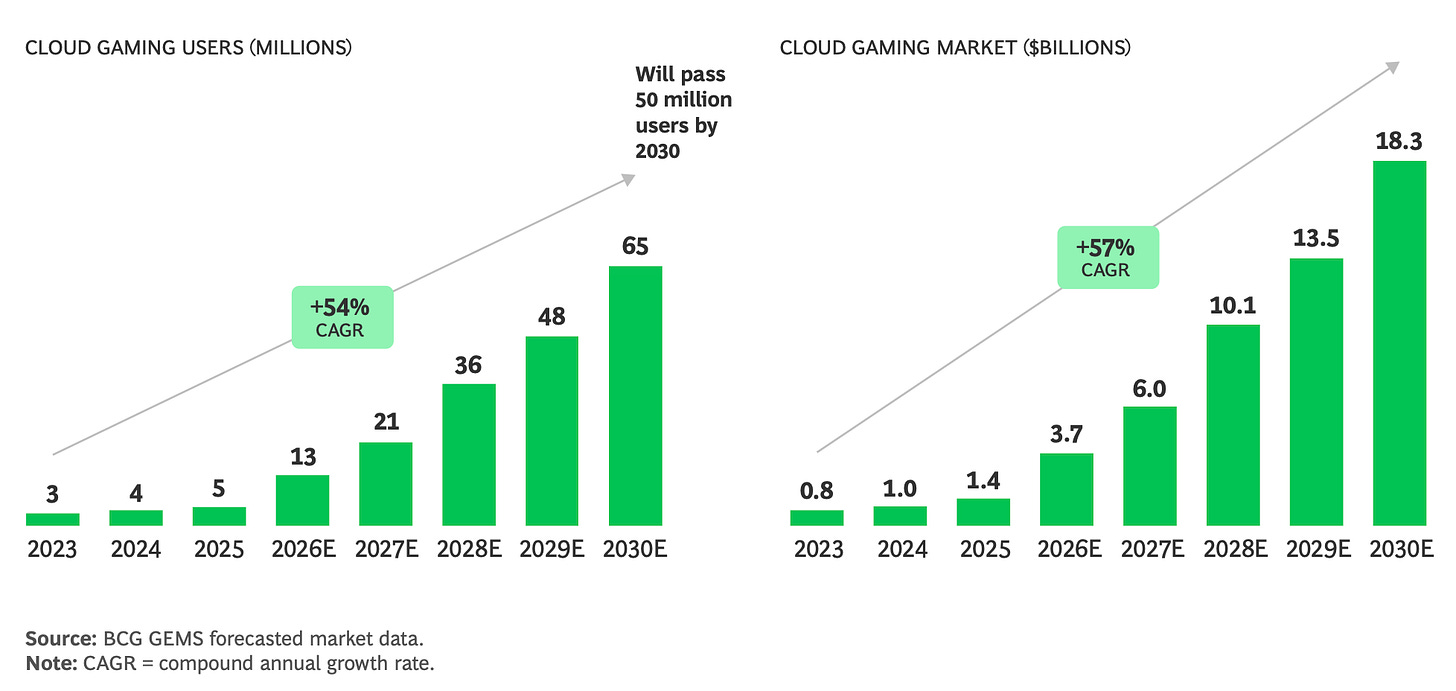

BCG projects significant growth in cloud gaming. Analysts estimate the number of users will grow from 5 million in 2025 to 65 million in 2030 (+54% CAGR), while market size will increase from $1.4 billion to $18.3 billion.

I’m skeptical about forecasts like these. Similar growth figures were promised in reports back in 2018, and they never materialized.

-

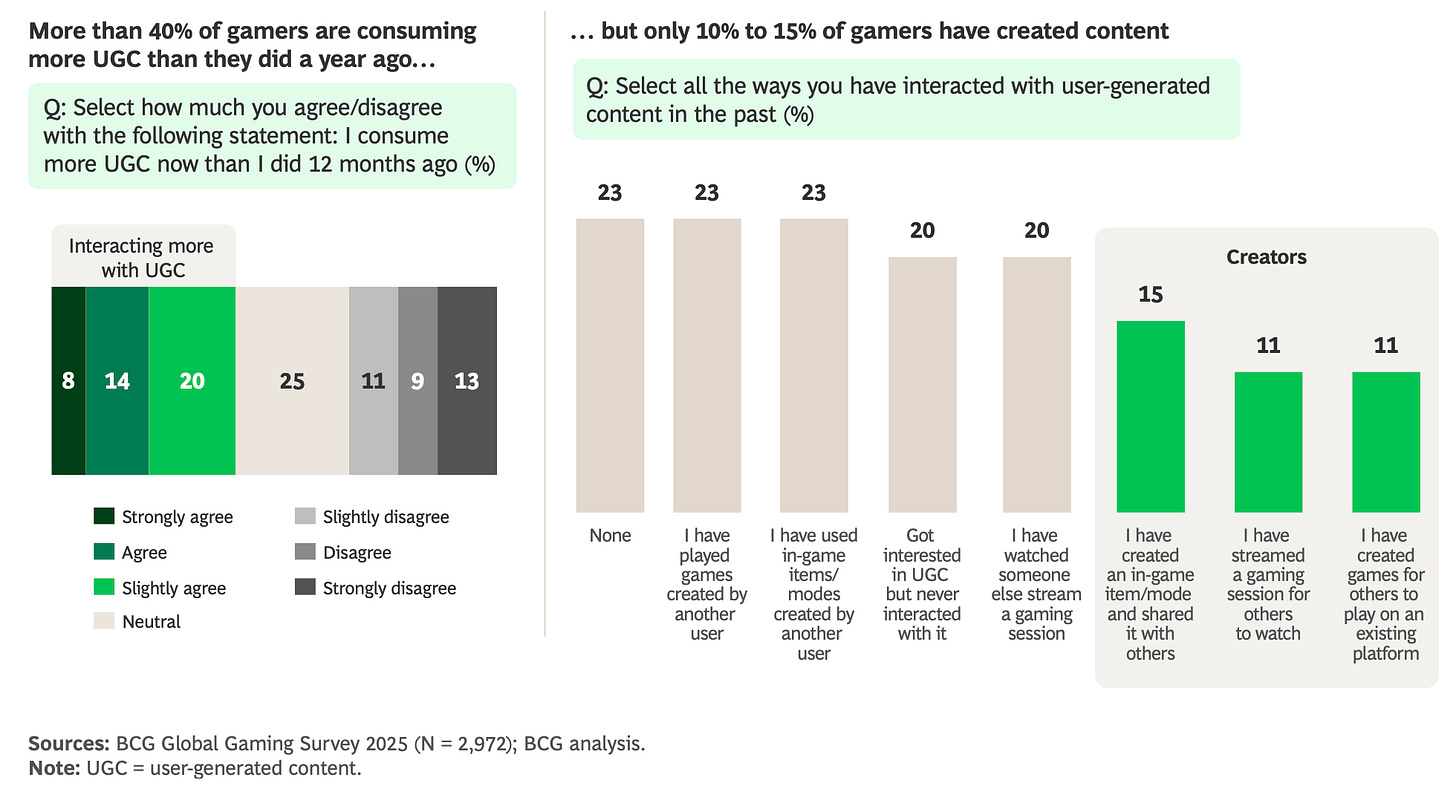

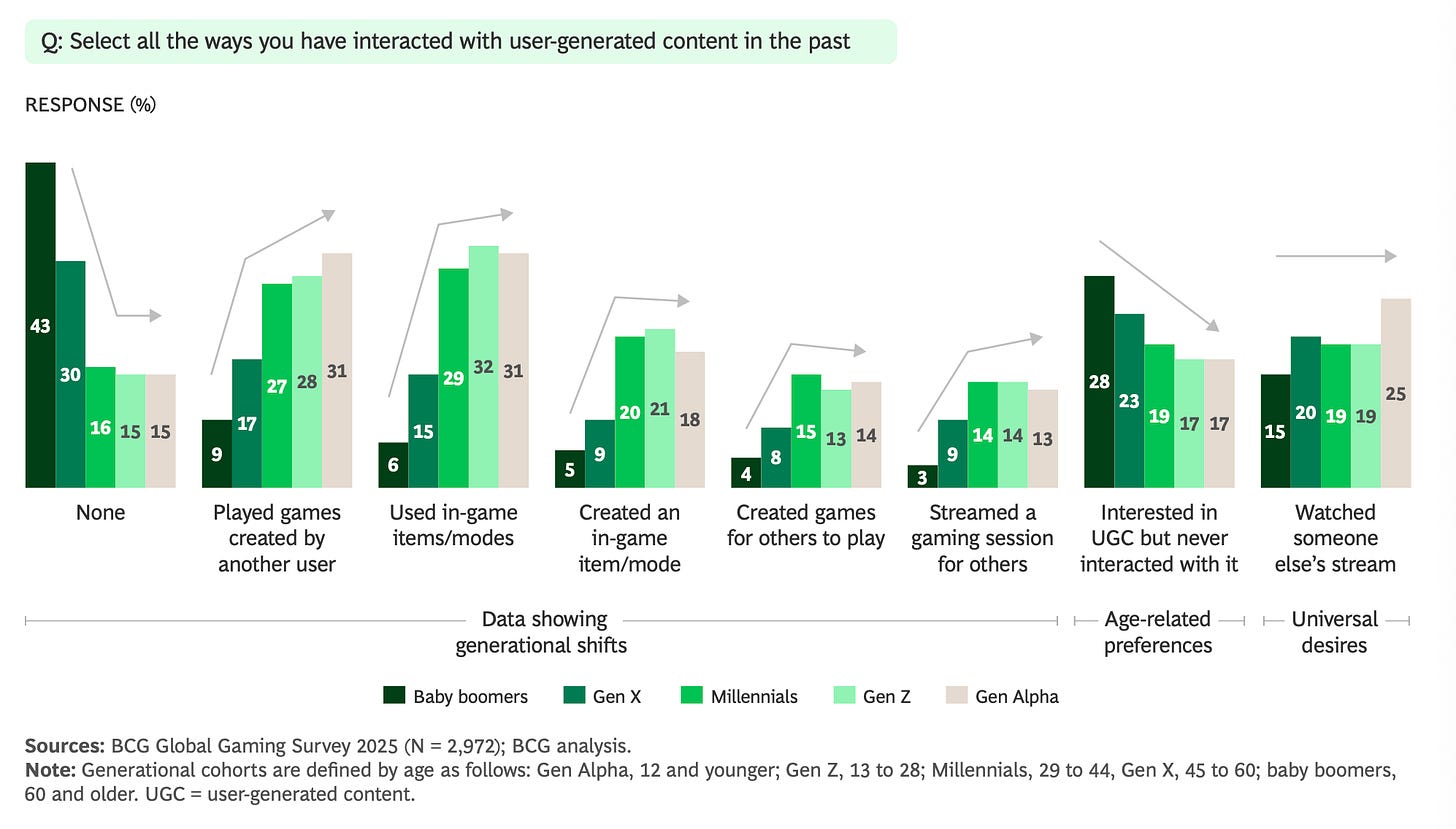

More than 40% of players said they interacted more with UGC over the past year. That said, 33% (almost as many) reported interacting with UGC less.

-

Only 10–15% of players are actively involved in content creation. The rest are consumers.

-

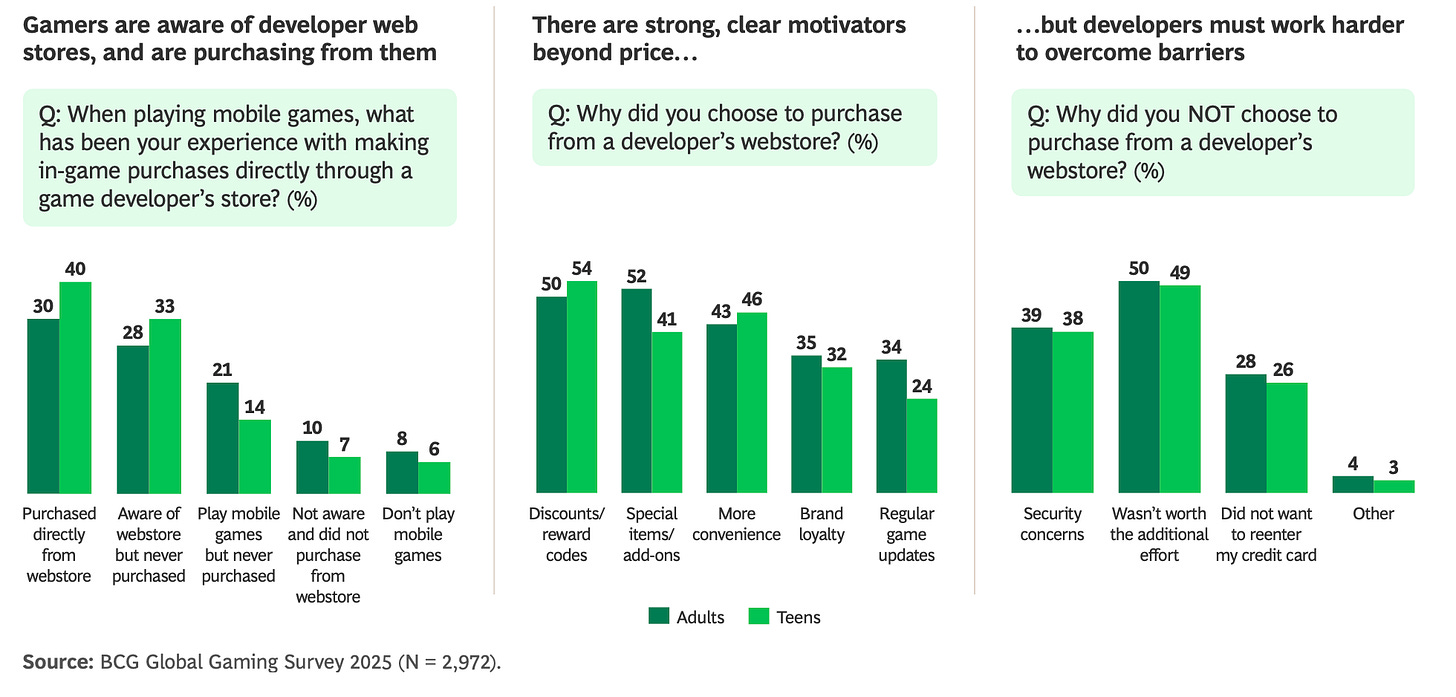

33% of adults and 40% of teenagers have already purchased games directly via developers’ web stores. The main motivations are discounts, bonuses, and exclusive items, as well as a desire to show brand loyalty. However, users are concerned about additional steps (such as re-entering card details) and security risks.

-

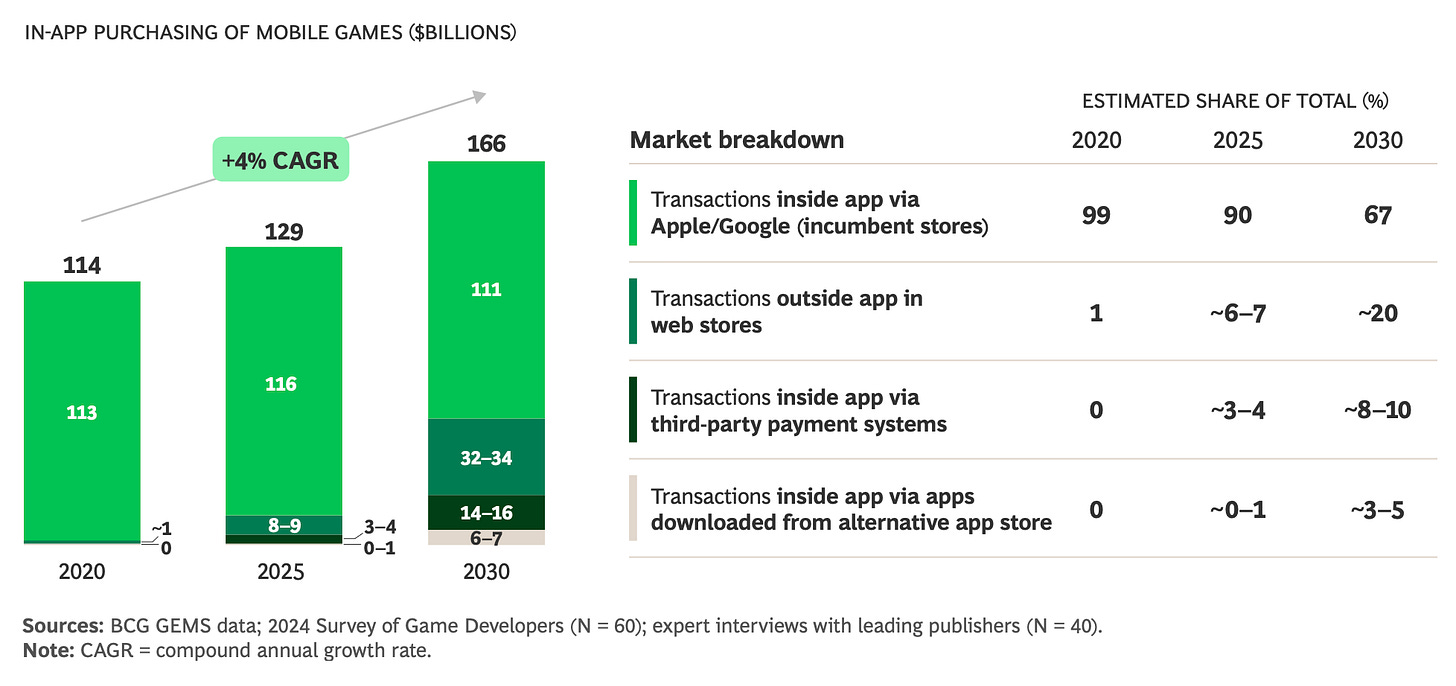

According to BCG, 8–9% of transactions currently go through alternative payment methods (web shops or third-party payments inside apps). By 2030, the share of payments via Google and Apple is expected to drop to 67% (from 90% in 2025).

-

The average commission is expected to fall from 30% to 5%.

-

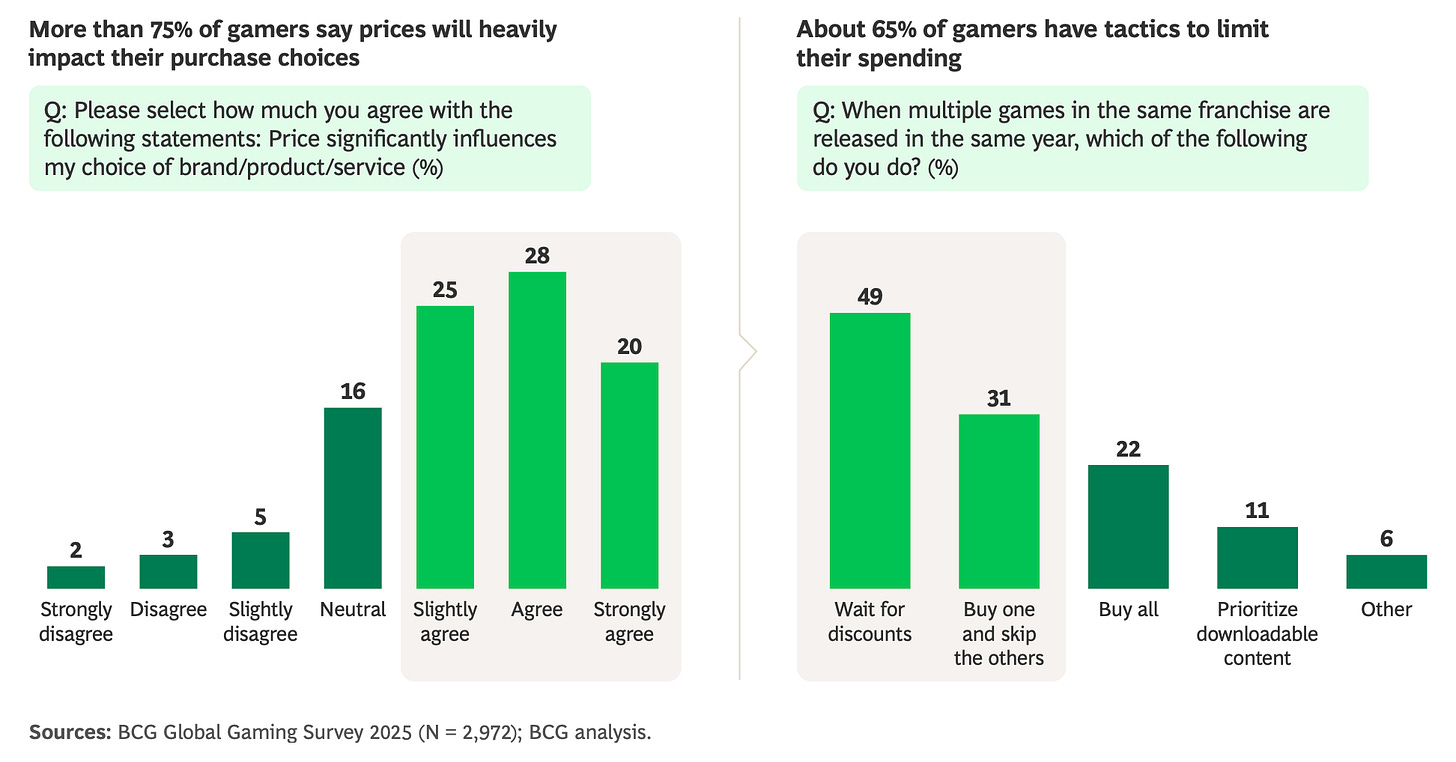

75% of players say price strongly influences their purchase decisions.

-

Around 65% of the audience actively manages spending: either waiting for discounts (49%) or focusing spending on a single product (31%).

-

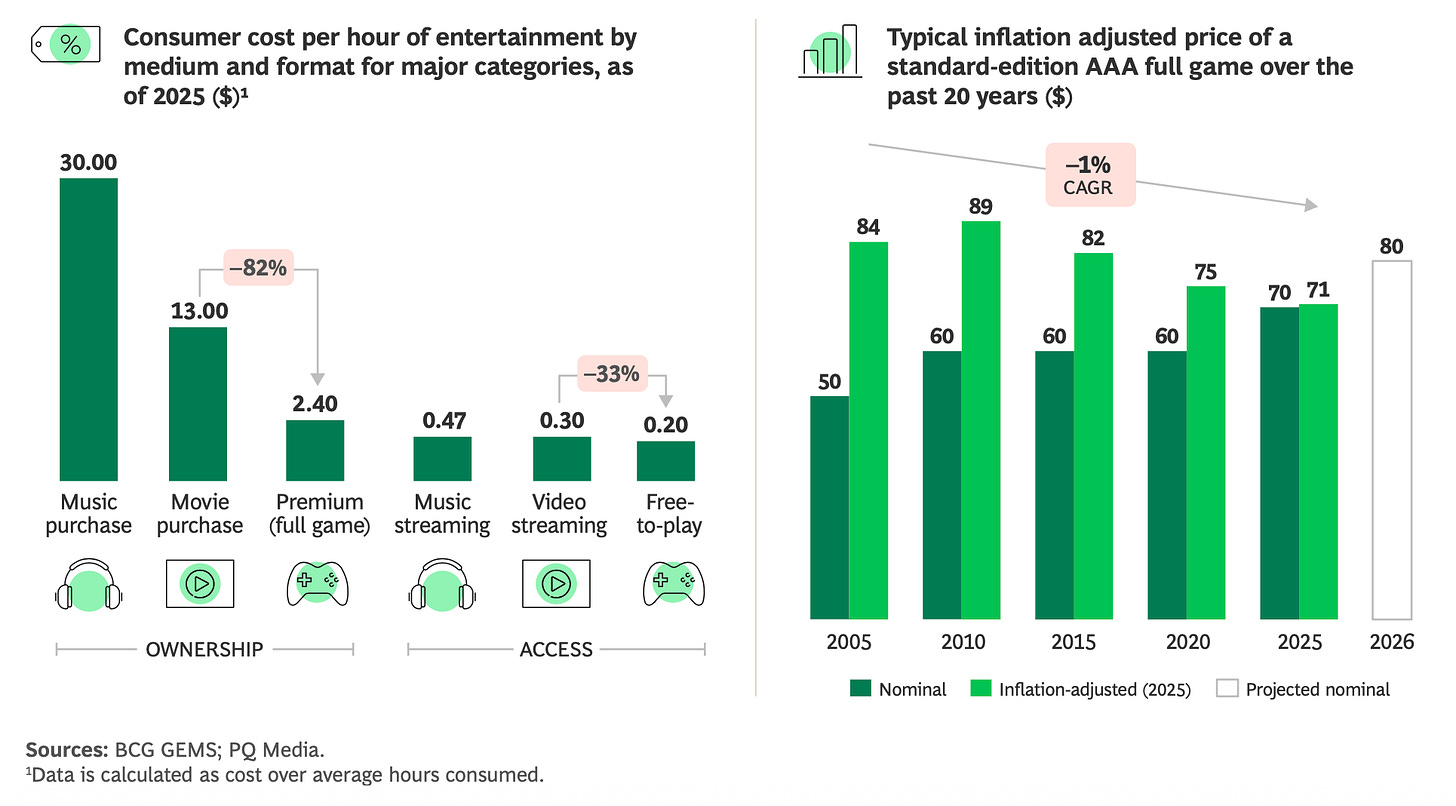

According to BCG, F2P games remain the most cost-effective form of entertainment when measured by cost per hour. It’s odd that vertical video services (TikTok being the clearest example), which are completely free, are not included here.

-

BCG notes that despite rising nominal game prices, inflation-adjusted prices are actually declining. Game prices peaked in 2010.

-

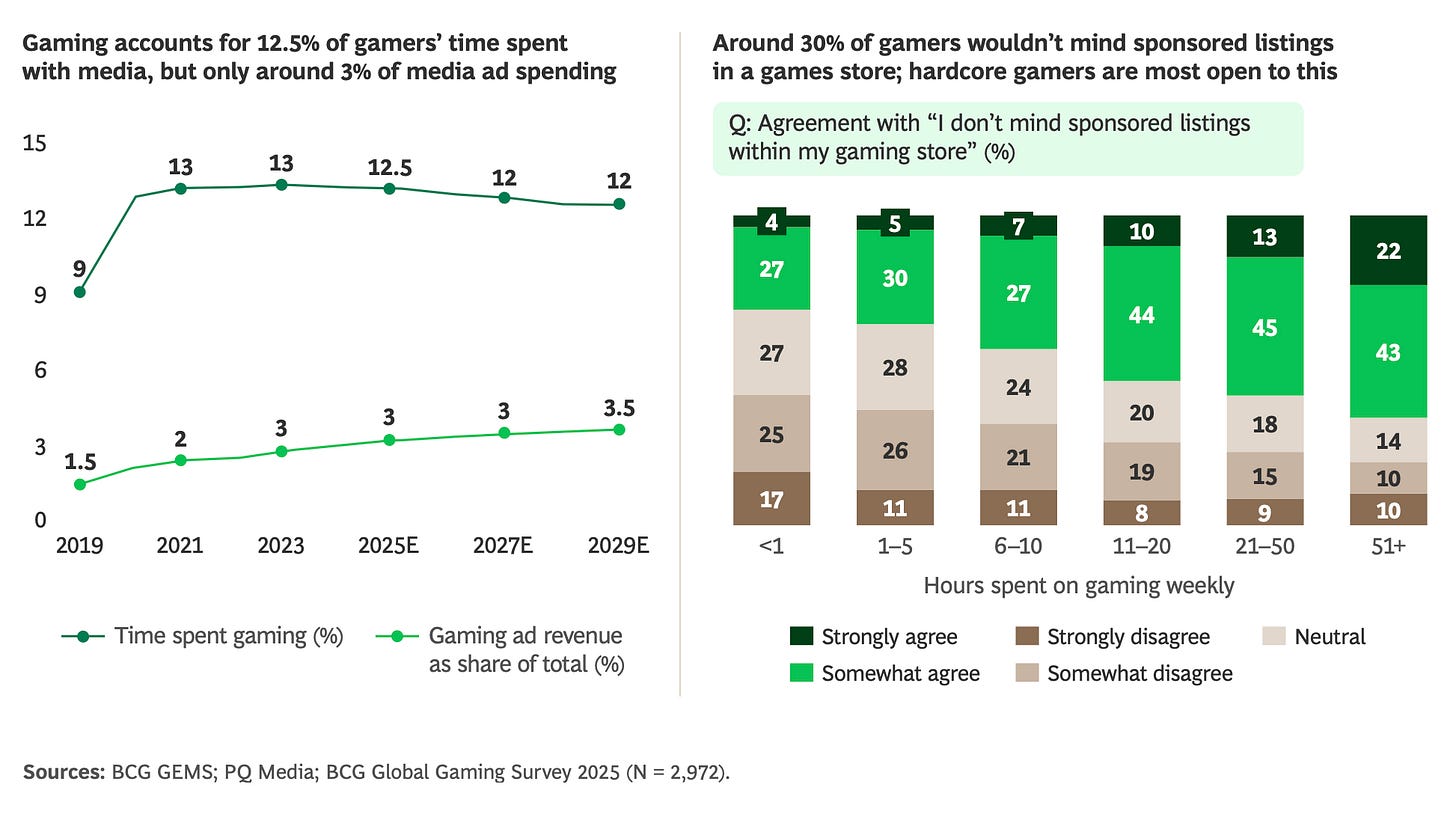

Although games account for 12.5% of total media spent by gamers, advertising spend in games represents only 3% of total media ad spending.

-

BCG expects this share to grow slightly to 3.5% by 2029.

-

Around 30% of players are comfortable with various forms of in-store advertising.

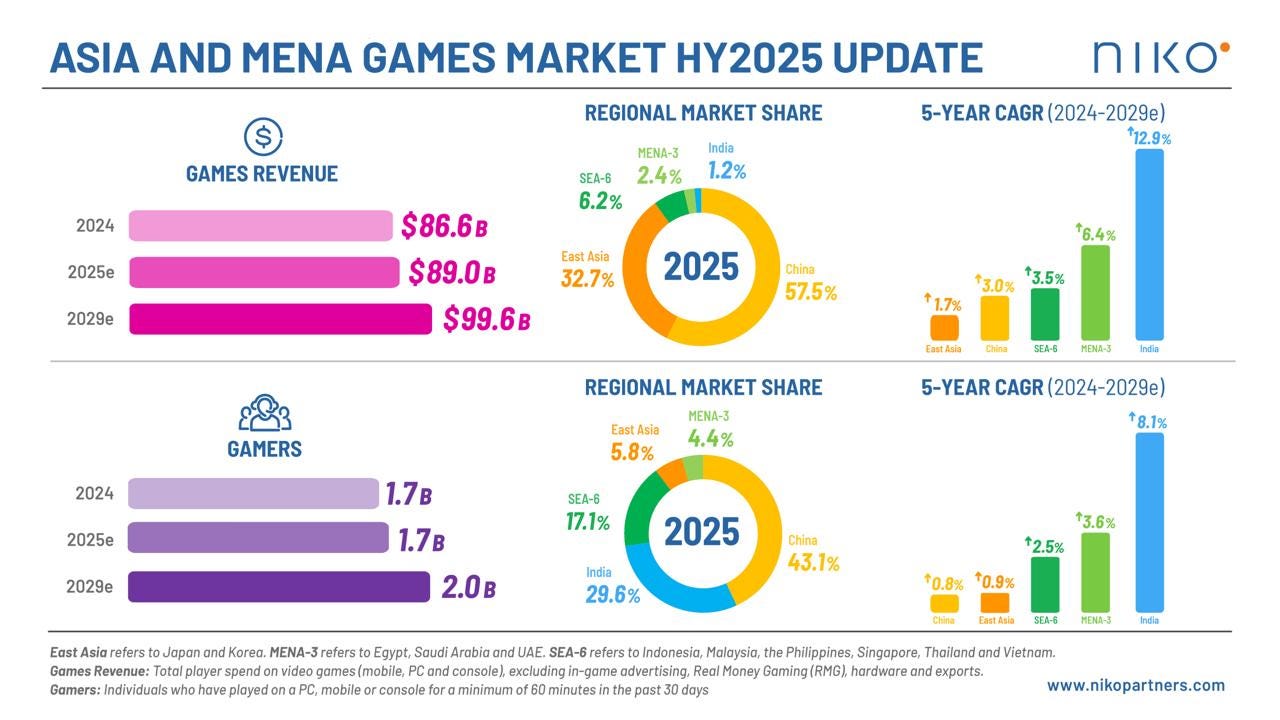

Niko Partners has updated its outlook for the gaming markets in Asia and the MENA region following the results of H1 2025. The report covers consumer spending on video games (excluding RMG and gambling).

-

In 2025, the combined size of the Asia and MENA gaming markets is expected to reach $88.97 billion (+2.7% YoY).

-

The number of players across these regions will reach 1.7 billion in 2025 (+2.7% YoY).

-

Forecasts were revised upward due to several factors. Regulatory conditions improved in several markets (China increased the number of licenses issued, RMG was banned in India), and games across all platforms performed above initial expectations. Niko Partners expects the combined Asia and MENA market to reach $100 billion by 2029.

-

India, MENA, and Southeast Asia are projected to be the fastest-growing regions through 2029 in terms of both revenue and player growth. At the same time, India, MENA, and China are expected to lead in ARPU growth.

-

By the end of 2025, China’s gaming market is expected to reach $51.2 billion (+4.1% YoY). By 2029, this figure is projected to grow to $57.1 billion (5-year CAGR of +3%, up from Niko Partners’ previous forecast of 2.2%).

-

Over the first 10 months of 2025, China issued 1,441 game licenses, up 24% YoY.

-

India’s gaming market revenue is expected to grow from $1.1 billion in 2025 (+16.2% YoY) to $1.67 billion by the end of 2029 (5-year CAGR of +12.9%).

-

The number of players in India will exceed 500 million this year and reach 700 million by 2029. The ban on real-money gaming (RMG) is expected to positively impact revenue from traditional games.

-

Malaysia, Thailand, and Vietnam are the fastest-growing markets in Southeast Asia. At the same time, Niko Partners lowered its forecasts for Thailand and Indonesia. The total size of Southeast Asia’s gaming markets in 2025 will reach $5.5 billion (+2.1% YoY), growing to $6.4 billion by 2029 (+3.5% YoY).

A word from our sponsor

Transform your online store into an LTV powerhouse with Xsolla’s LiveOps tools – run dynamic, segmented campaigns to drive an 80% repeat purchase rate, and boost player retention by 15%+ using in-game synchronized offers and loyalty shops.

Time-limited promos, login bonuses, and referral programs can lift player engagement and help grow ARPPU by 20%+, all through an intuitive interface built for fast campaign launches, deep personalization, and maximum revenue impact.

-

China, Japan, and South Korea remain the foundational markets in Asia and MENA. By 2029, their combined market size will reach $88.8 billion, accounting for 89.1% of total revenue across the covered regions.

-

The combined gaming markets of Japan and South Korea are expected to total $29.1 billion in 2025 (-0.3% YoY). By 2029, they are projected to grow to $31.7 billion (CAGR of +1.7%).

-

Console gaming accounted for just 6.3% of total revenue in 2025. However, Niko Partners expects this segment to grow the fastest in Asia and MENA through 2029, driven by the launch of Nintendo Switch 2, the upcoming release of Grand Theft Auto VI, increasing console adoption in the region, and rising consumer spending on console games.

-

The MENA-3 markets (Egypt, Saudi Arabia, and the UAE) are estimated at $2.2 billion in 2025 (+8.5% YoY). By 2029, their combined size is expected to reach $2.8 billion (CAGR of +6.4%).

-

Niko Partners lowered its outlook for the region due to lower expectations for mobile gaming revenue in Saudi Arabia and the UAE.