Reports of the week:

-

GDC: The State of the Game Industry – 2026

-

GameDiscoverCo: Top Sellers on Steam and Consoles in January 2026

More than 2,300 people participated in the survey.

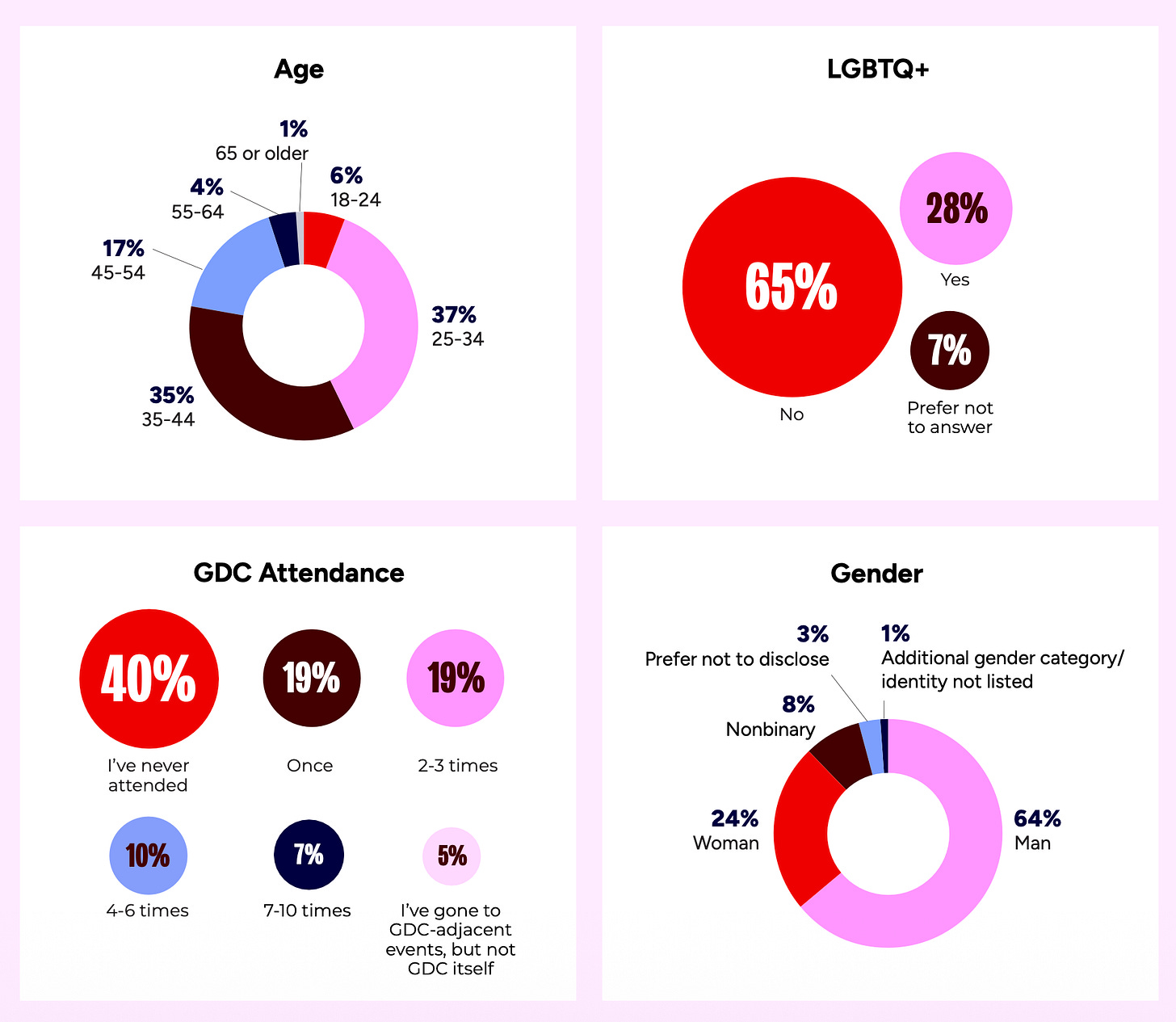

72% of respondents are aged between 25 and 34. 40% have never attended GDC before. 64% are men, 24% are women.

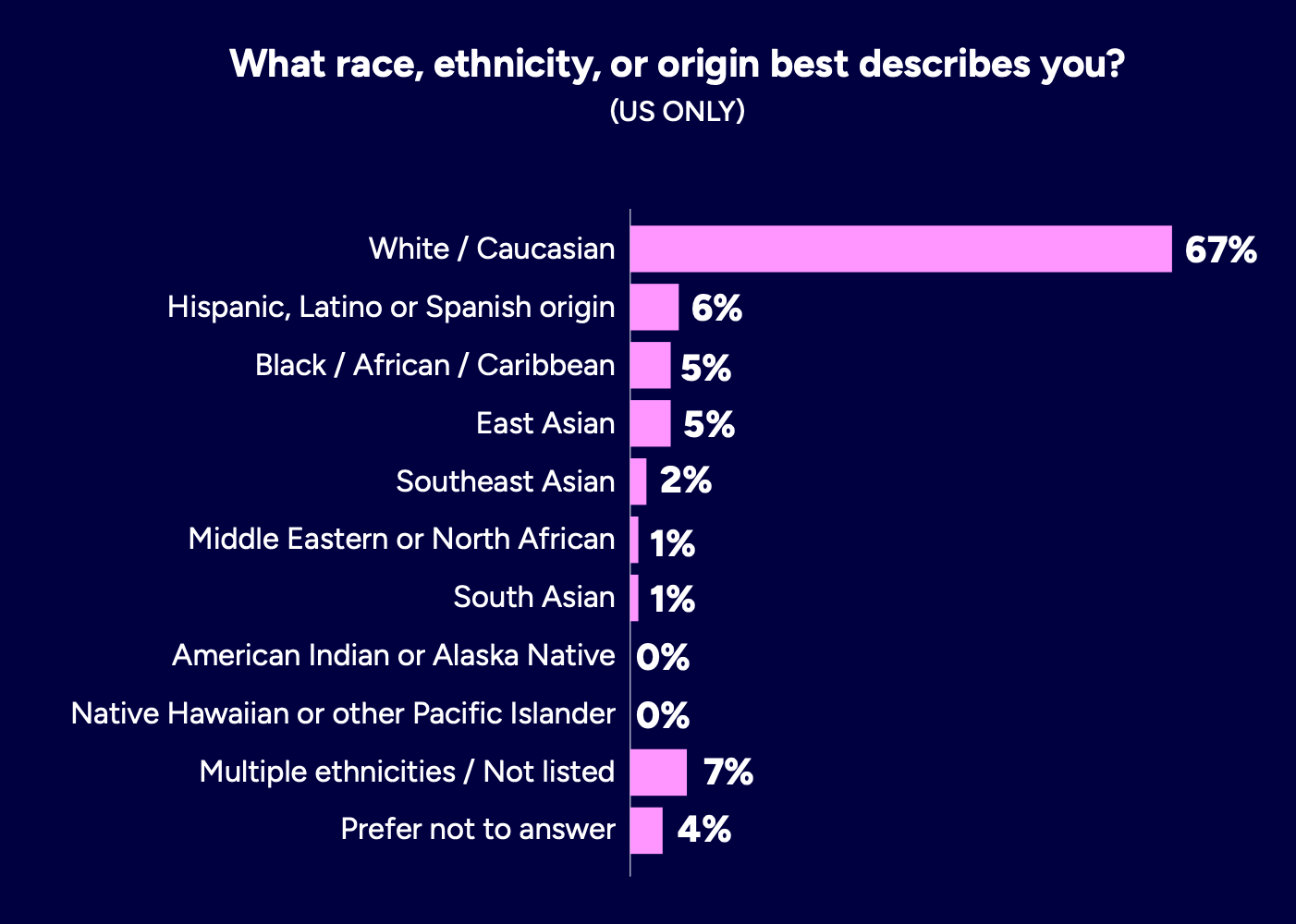

Among U.S. respondents, 67% identify as White/Caucasian, making it the dominant racial/ethnic/origin group.

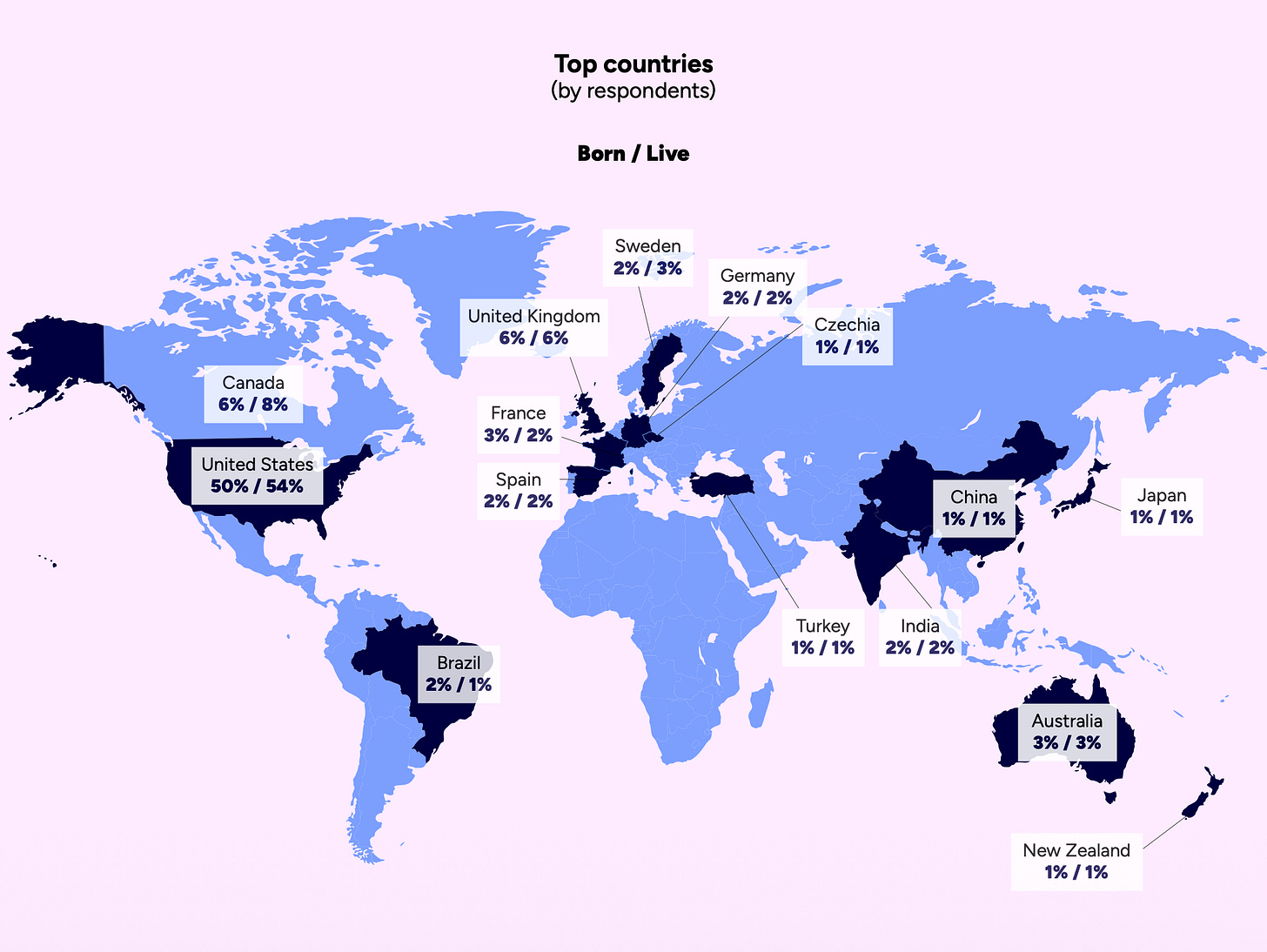

The majority of respondents are from the United States. 50% were born there, and 54% currently live there. More than 90% of respondents represent North America and Europe.

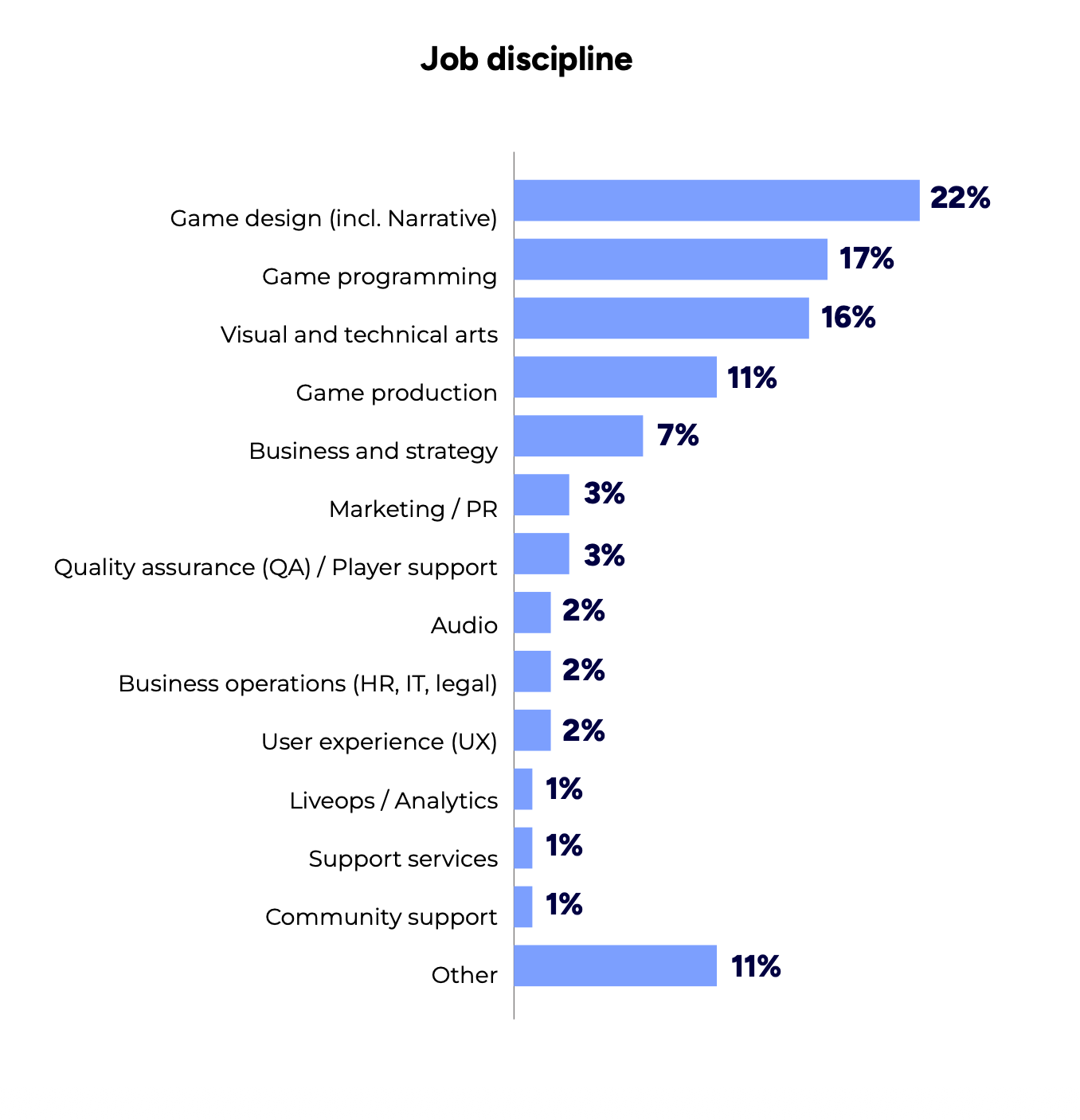

Most respondents work in game design, programming, or art roles.

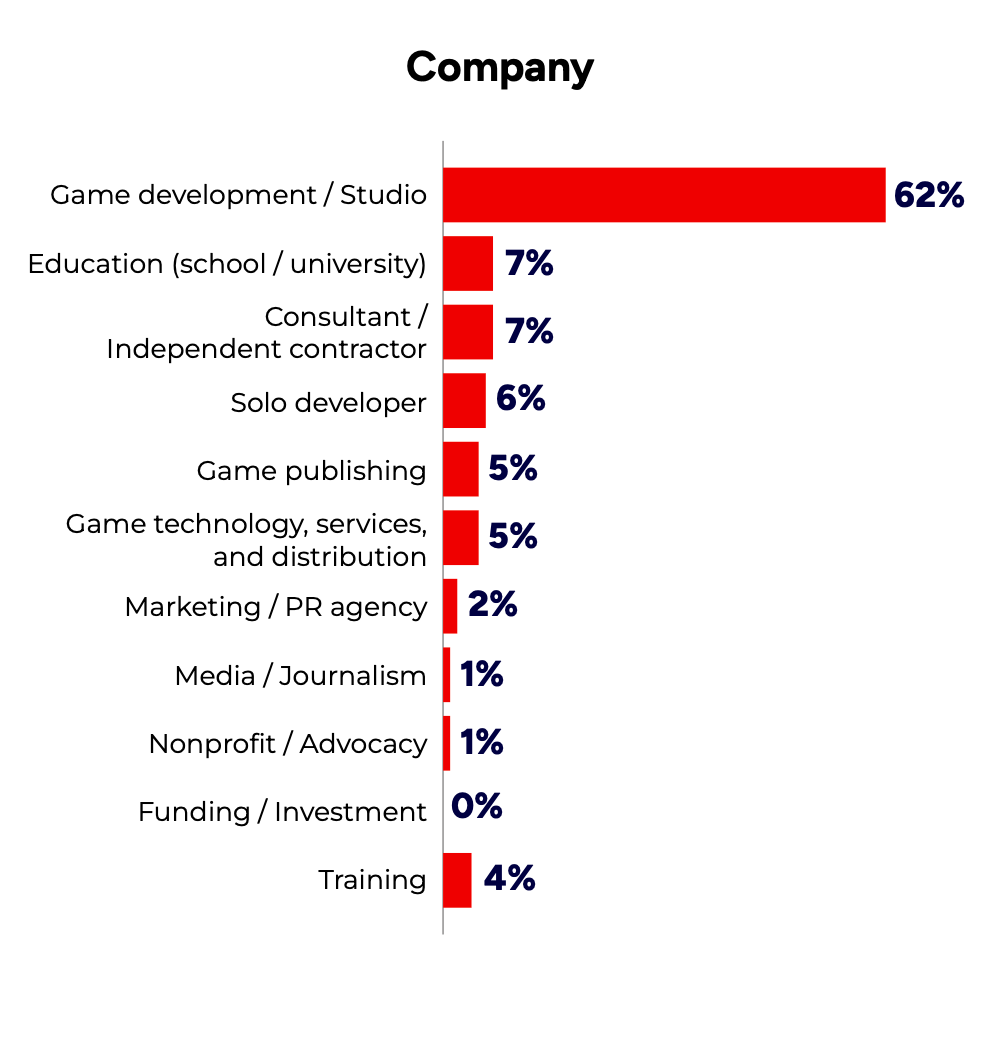

62% of respondents work at game studios.

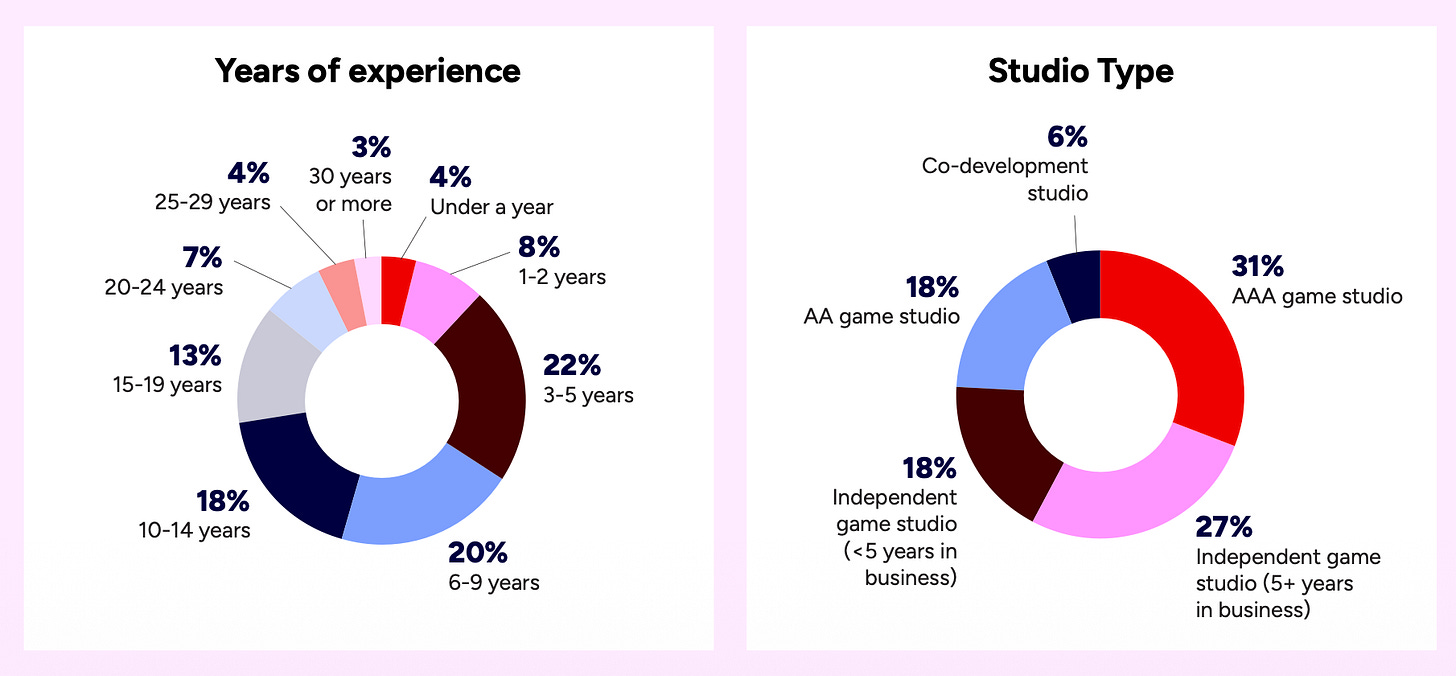

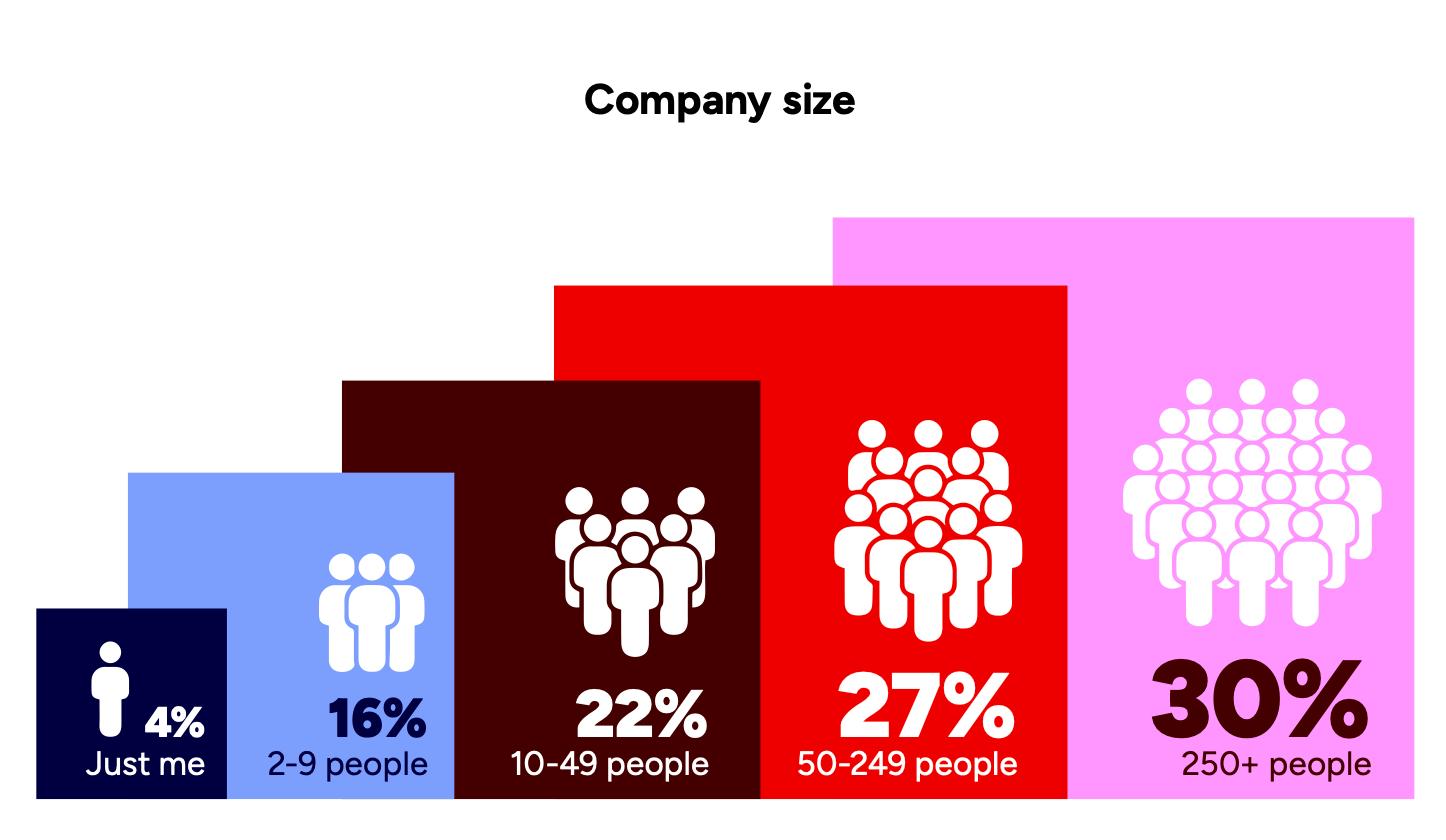

The authors of the survey aimed to maintain a balanced proportion between newcomers and industry veterans. Studios of different sizes are also well represented in the sample.

The authors separately note that this year’s sample differs significantly from previous years. As a result, there are fewer year-over-year comparisons than in past editions.

A word from our sponsor

Boost your game’s revenue with Xsolla’s Buy Button, enabling secure 1-tap purchases via Apple Pay, Google Pay, and saved cards. Leverage Apple’s 2025 update, allowing external purchase links in the U.S., to reduce platform fees and increase control over monetization. Sync offers in-game events via API, driving player retention with dynamic bonuses, discounts, and loyalty rewards – all in a seamless, familiar payment flow that maximizes conversions.

-

Game designers were the most affected profession, accounting for 20% of layoffs. Those working in service companies and business functions were the least affected at 8%.

-

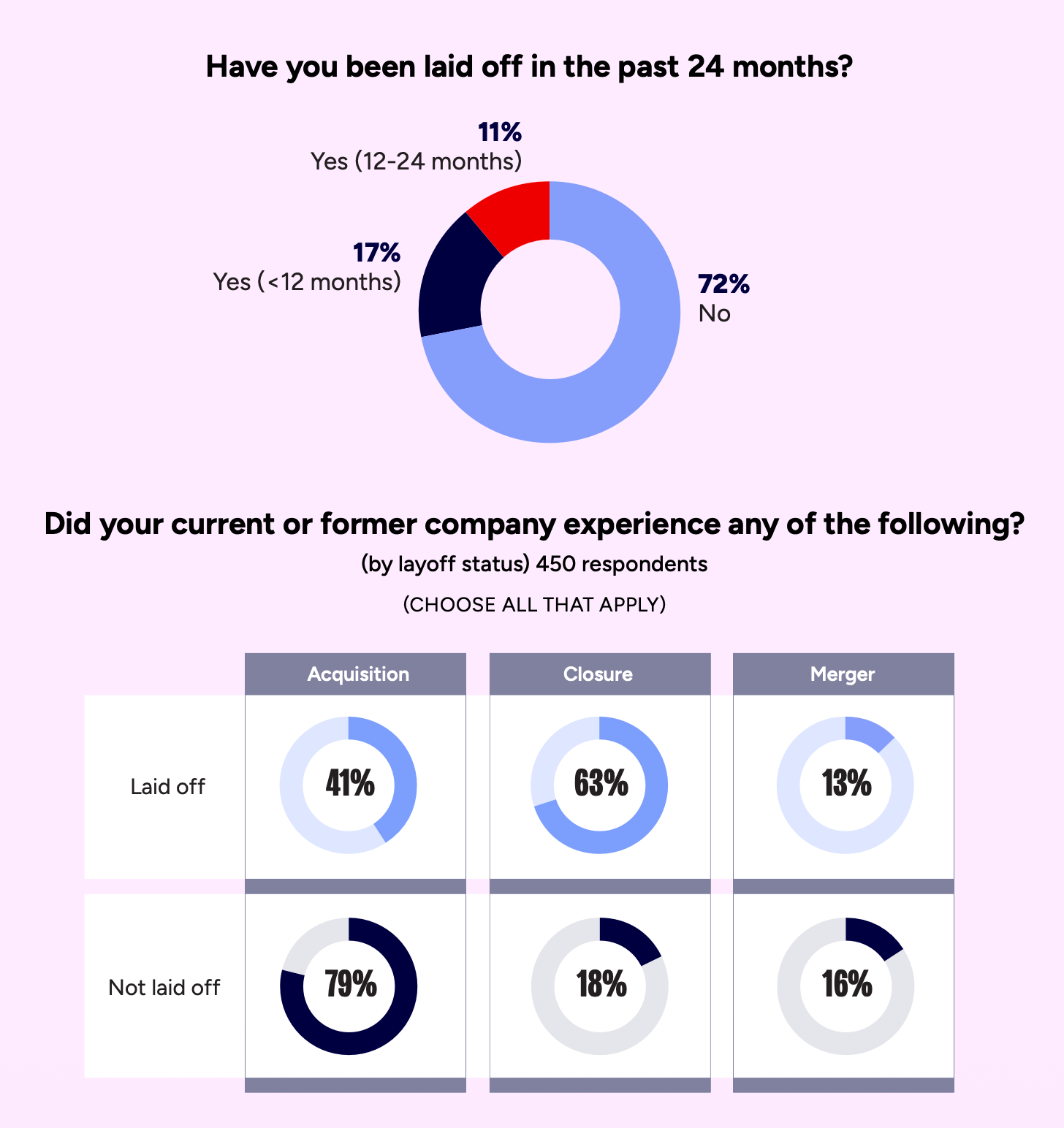

Among those who were laid off, 48% have not yet found a new job. Of that group, 36% were laid off one to two years ago.

-

58% of respondents reported that their companies conducted layoffs.

-

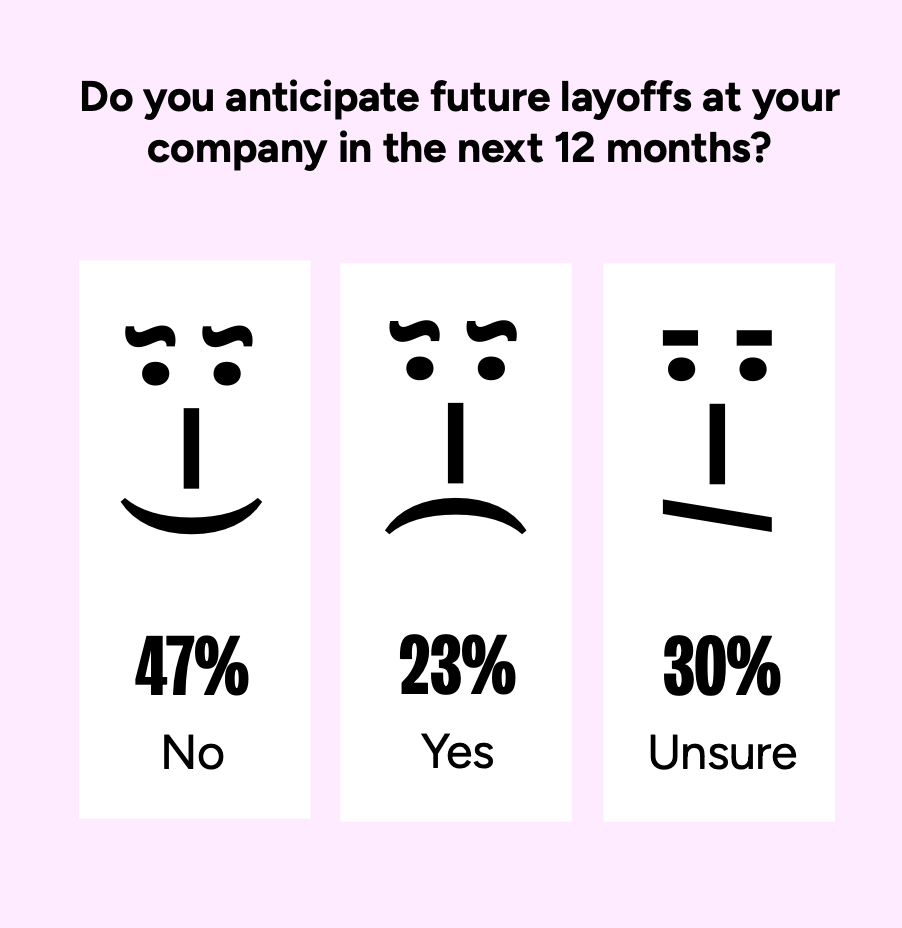

Despite the situation, 47% of respondents remain optimistic and believe there will be no further layoffs at their companies.

-

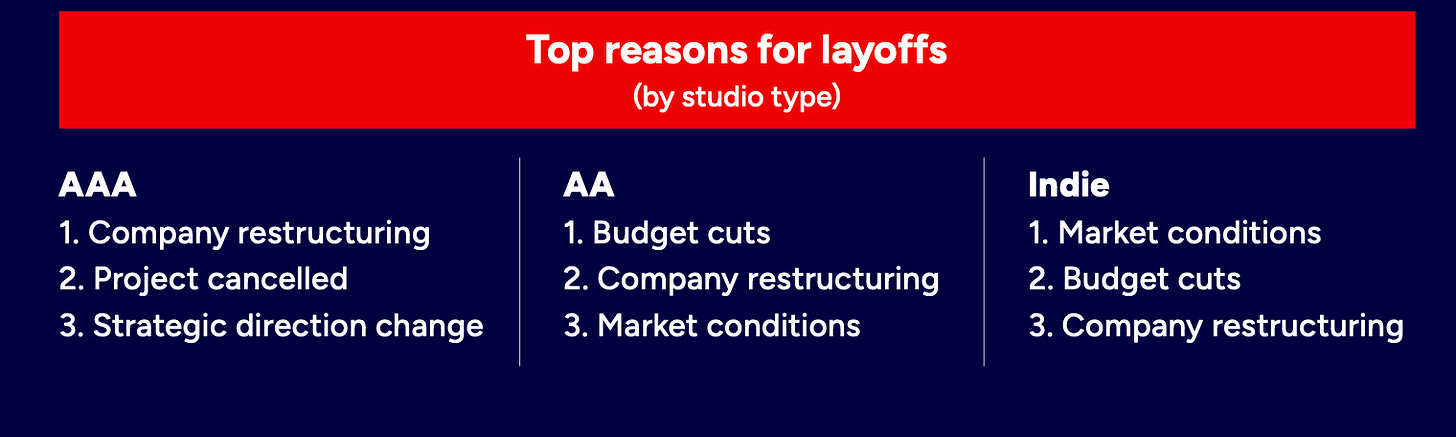

AAA studios appear to be under the greatest pressure. Two-thirds of employees at AAA companies reported either being laid off themselves or seeing colleagues laid off.

-

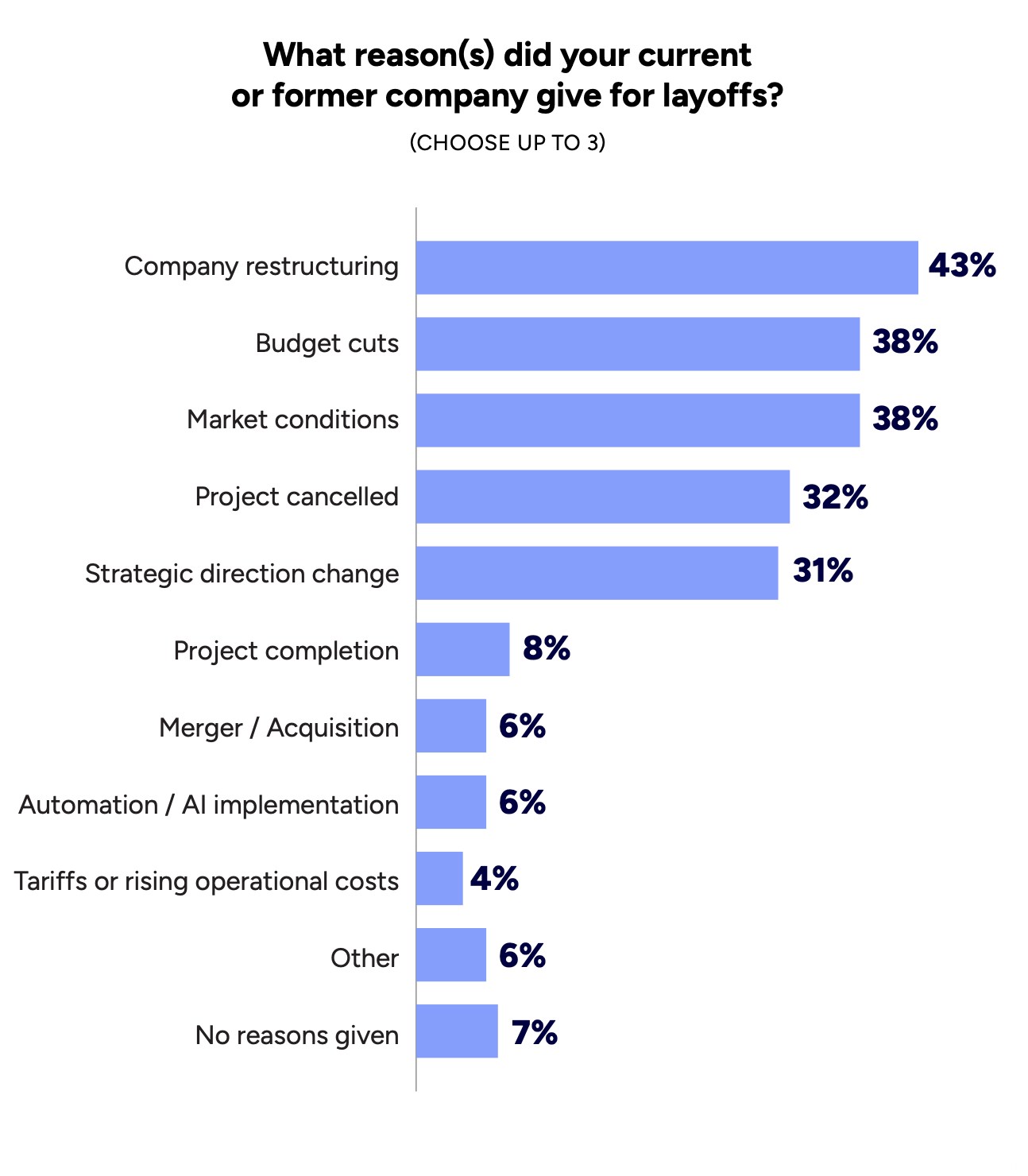

The most commonly cited reasons for layoffs are restructuring (43%), budget cuts (38%), market conditions (38%), project cancellations (32%), and strategic shifts (31%).

❗️I genuinely believe creative professionals should strive to better understand business realities, while business leaders should make a stronger effort to listen to product teams. That would likely reduce situations like this.

-

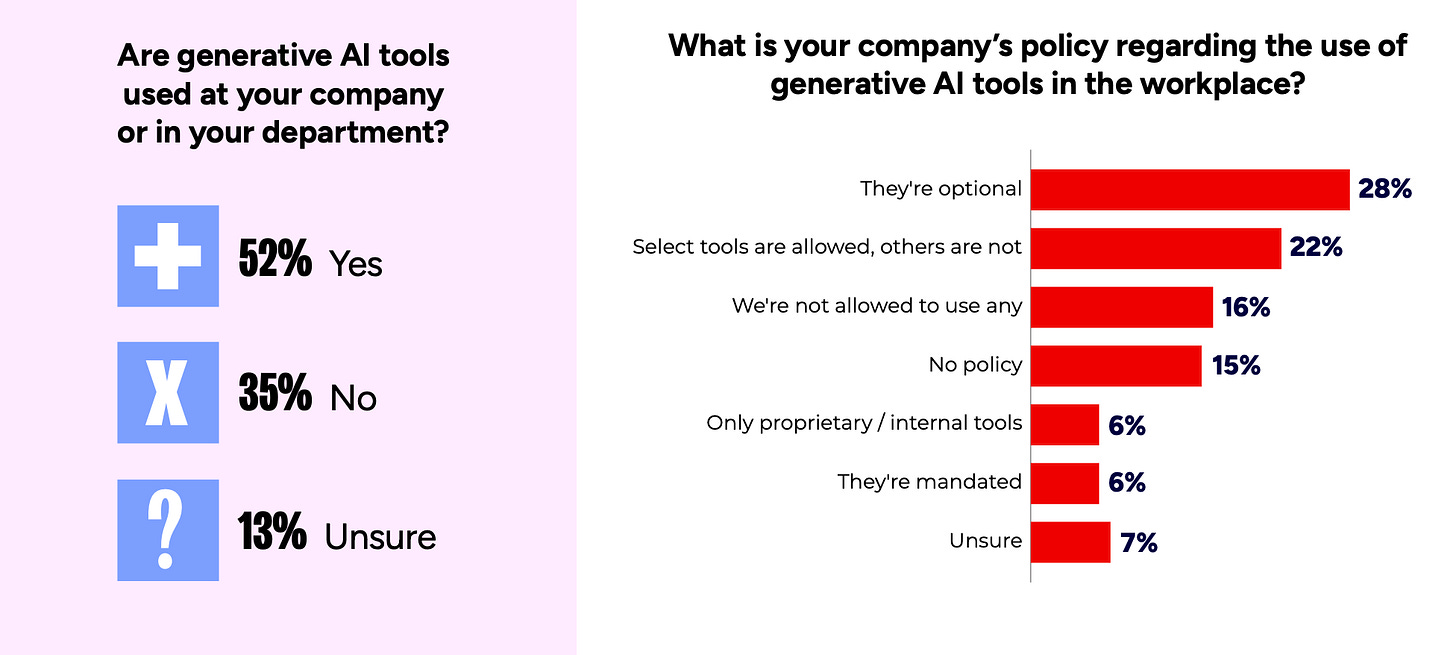

36% of respondents actively use AI in their work.

-

Men report using AI more often than women, at 41% versus 35%. Older professionals use AI more actively (46%) than younger colleagues (34%). The higher the education level, the higher the likelihood of AI adoption.

-

58% of business roles use AI. Managers also report high adoption at 47%.

-

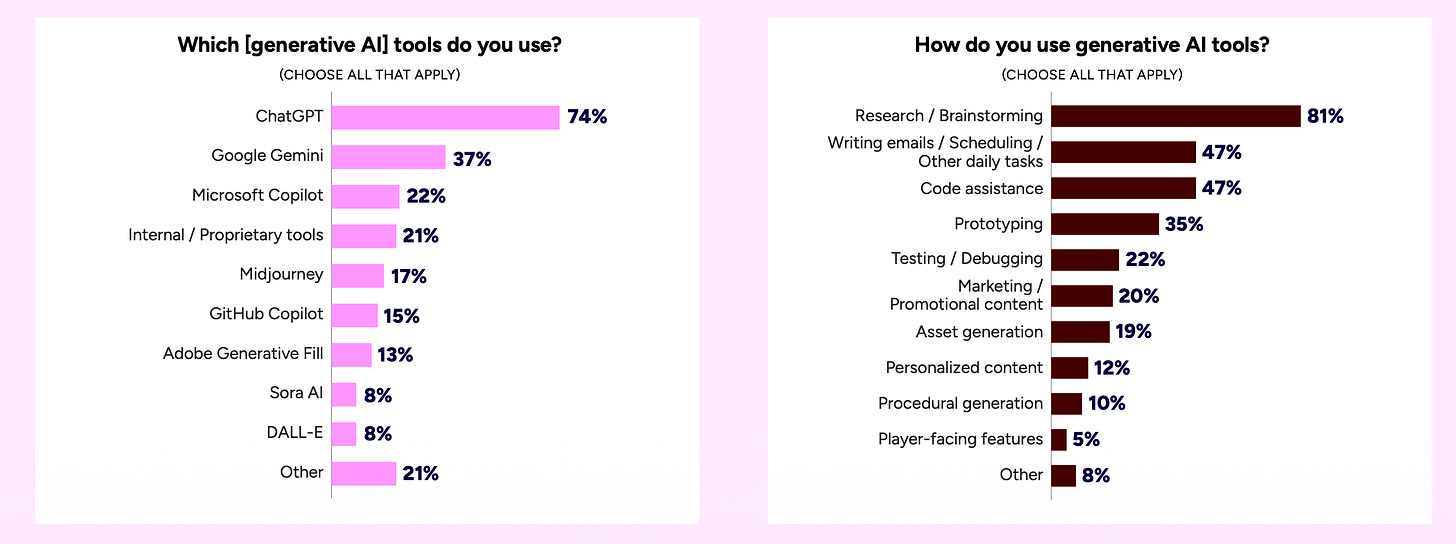

ChatGPT is the clear leader among AI tools.

-

The most common use cases are research and brainstorming (81%), writing emails and planning meetings (47%), coding (47%), and prototyping (35%).

-

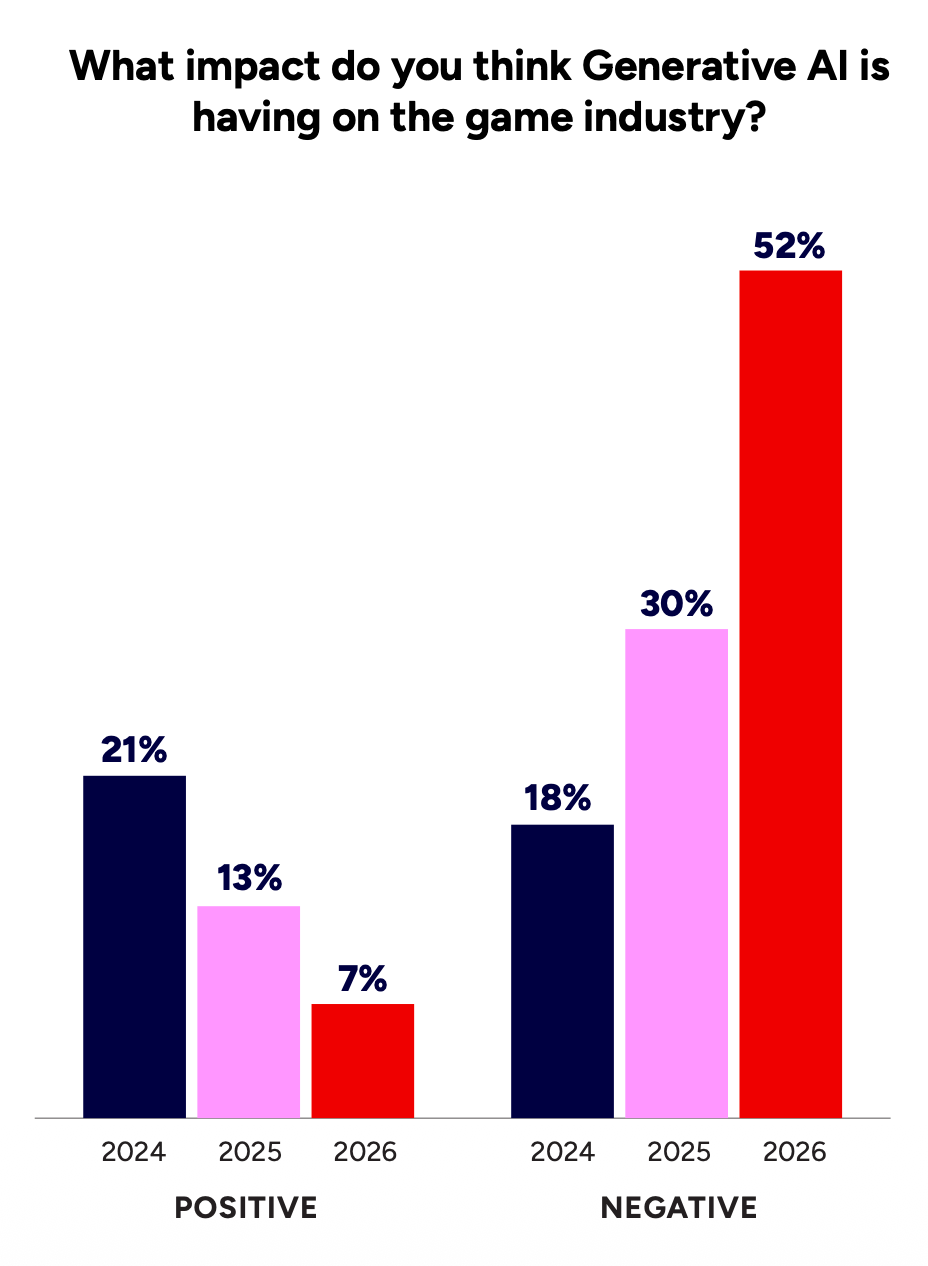

An increasing share of respondents believe AI harms the game industry. 52% this year reported a negative view of AI.

-

The industry is particularly skeptical about generative AI. Many respondents believe it reduces creativity and contributes to layoffs.

❗️For me, there is still no obvious causal link between AI development and layoffs. The excess capital during the COVID period likely had a much stronger impact.

-

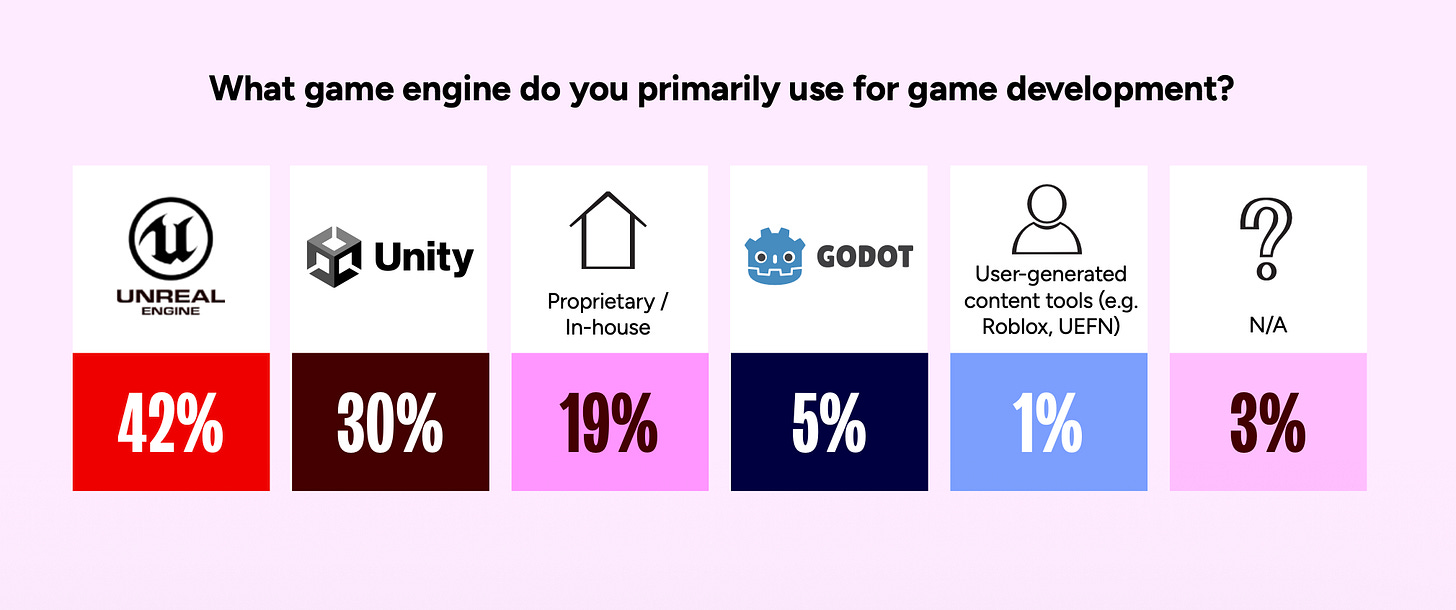

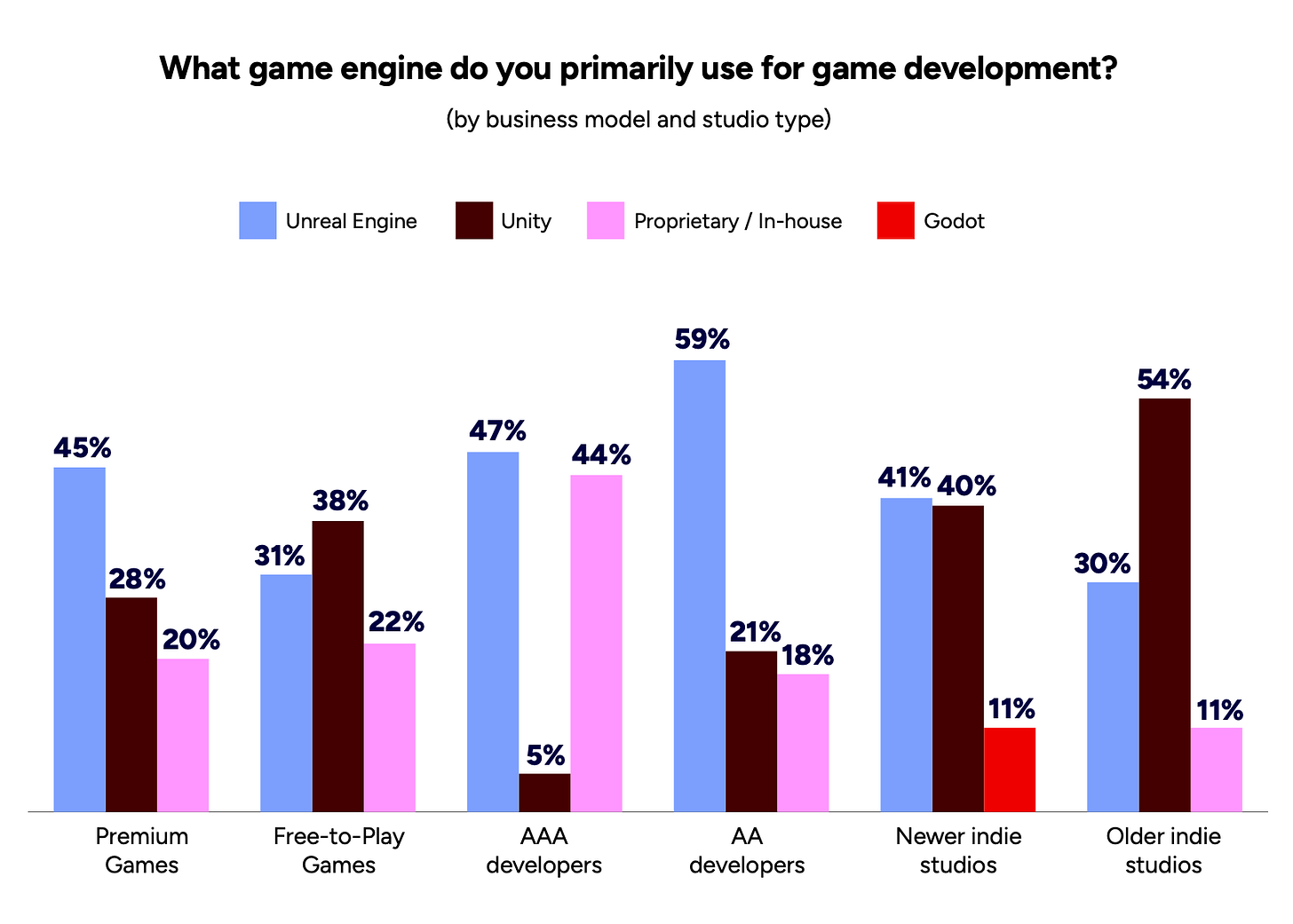

Unity is most popular among F2P projects and smaller teams. Unreal Engine is more common in B2P, AA, and AAA development.

-

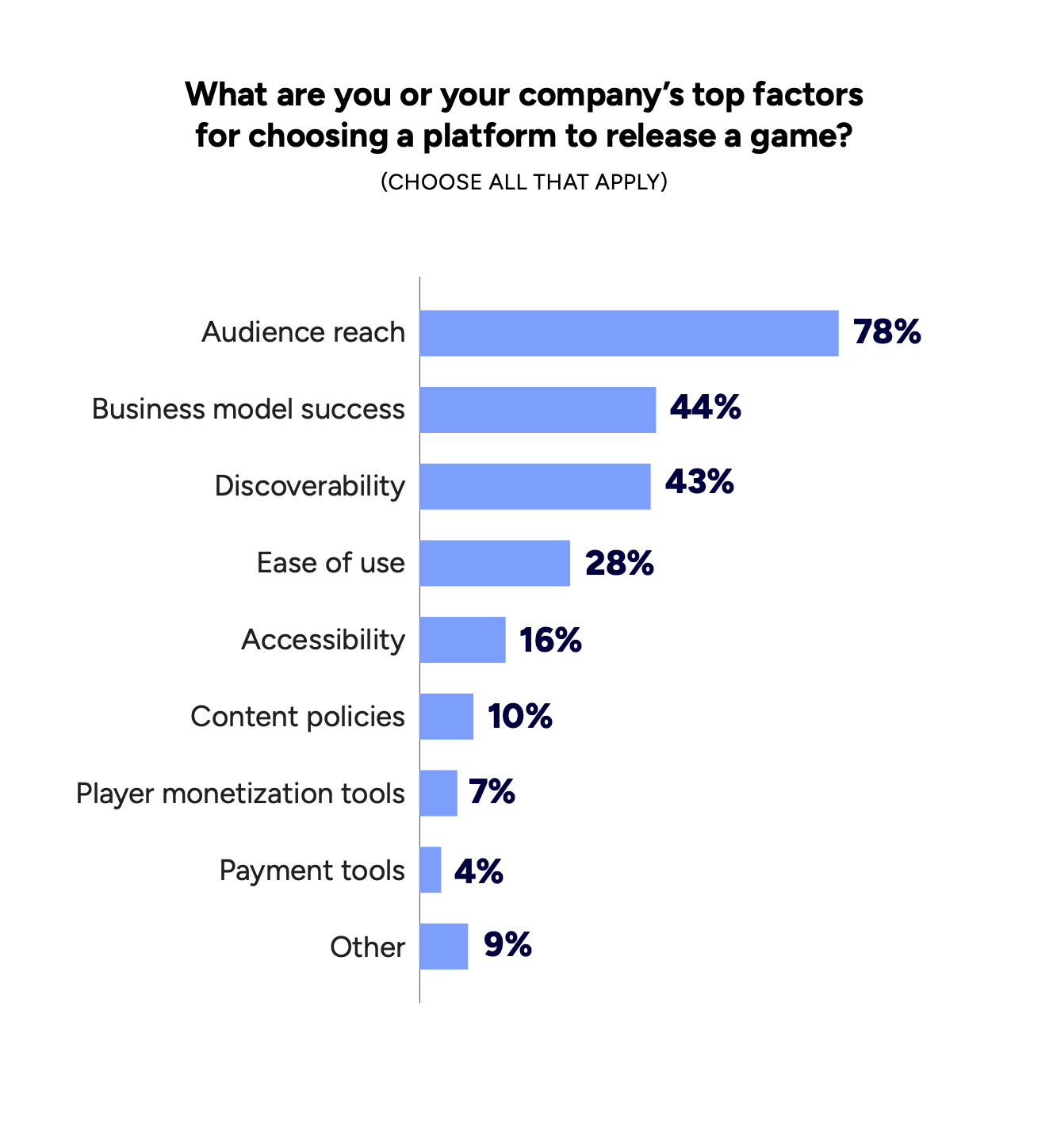

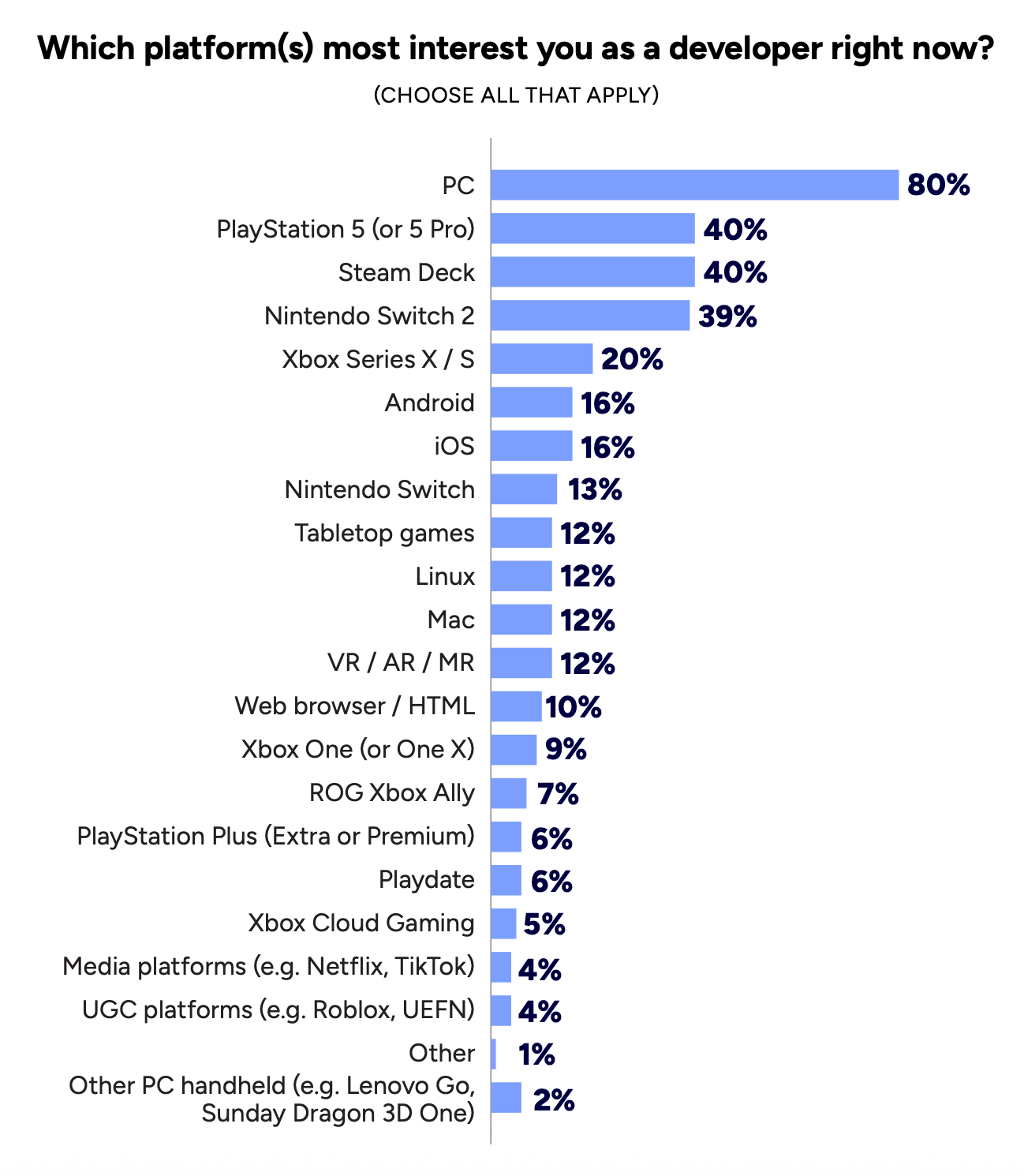

When choosing platforms, developers prioritize audience access (78%), business model success on the platform (44%), and discoverability (43%).

-

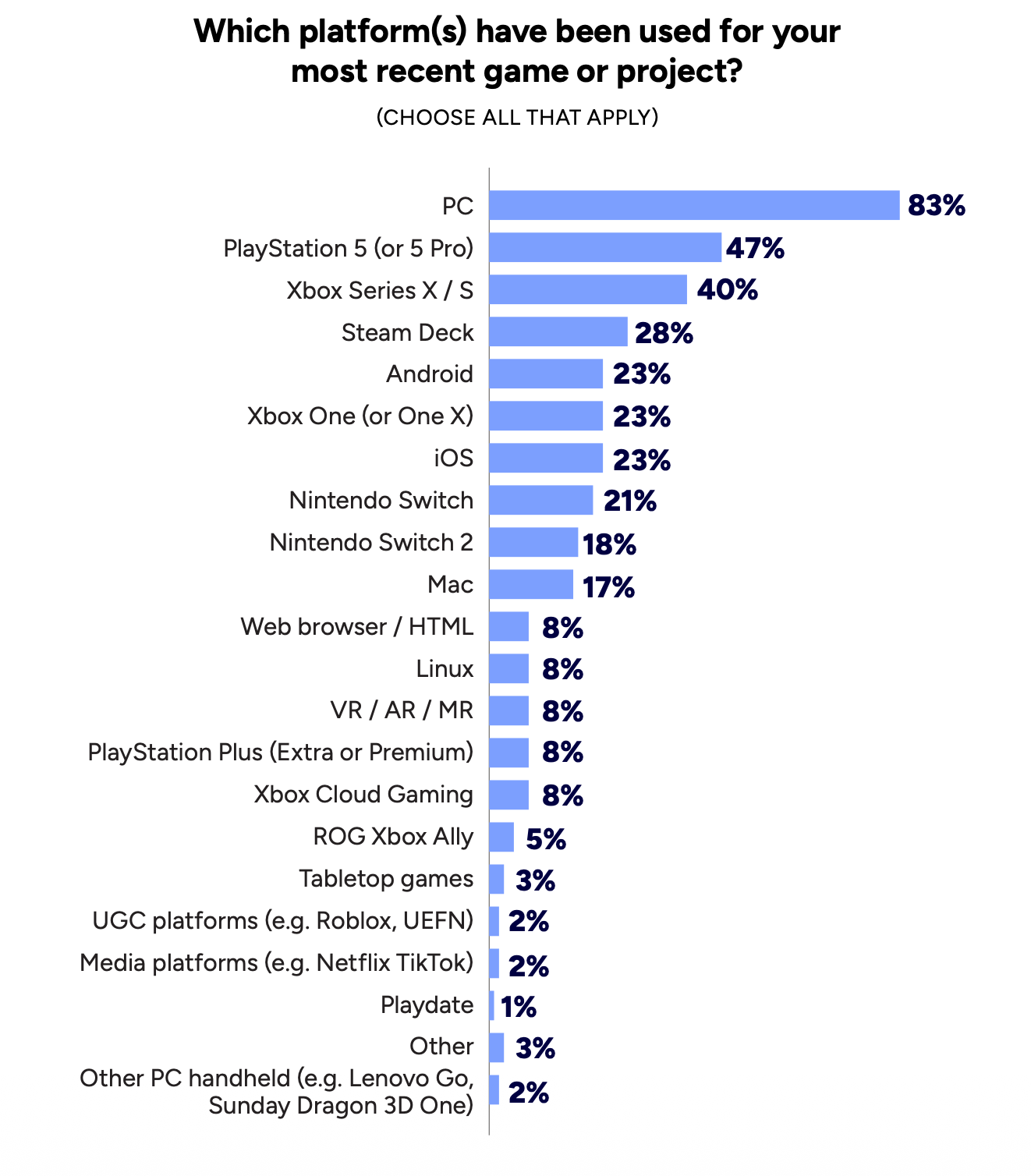

PC at 83%, PS5 at 47%, Xbox Series S|X at 40%, Steam Deck at 28%, Android or iOS at 23%, and Xbox One at 23% were the platforms used for respondents’ most recent projects.

-

8% of developers reported working with VR, AR, or MR. Meta dominates this segment, accounting for 82% of projects developed by the 94 respondents specializing in this area.

-

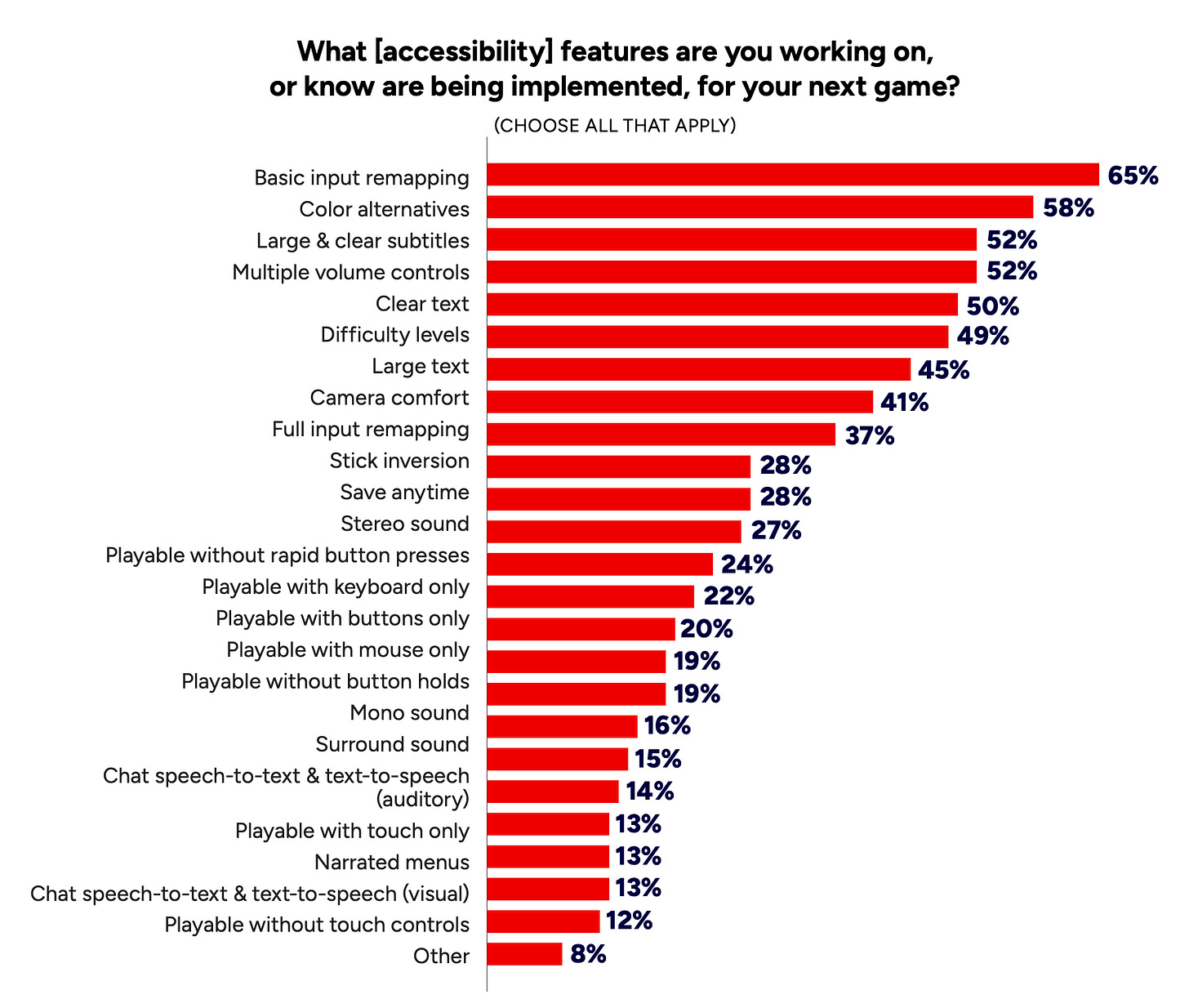

One third of developers add accessibility features to their games. The most common options are button remapping (65%), color settings (58%), larger subtitles (52%), and audio settings (50%).

-

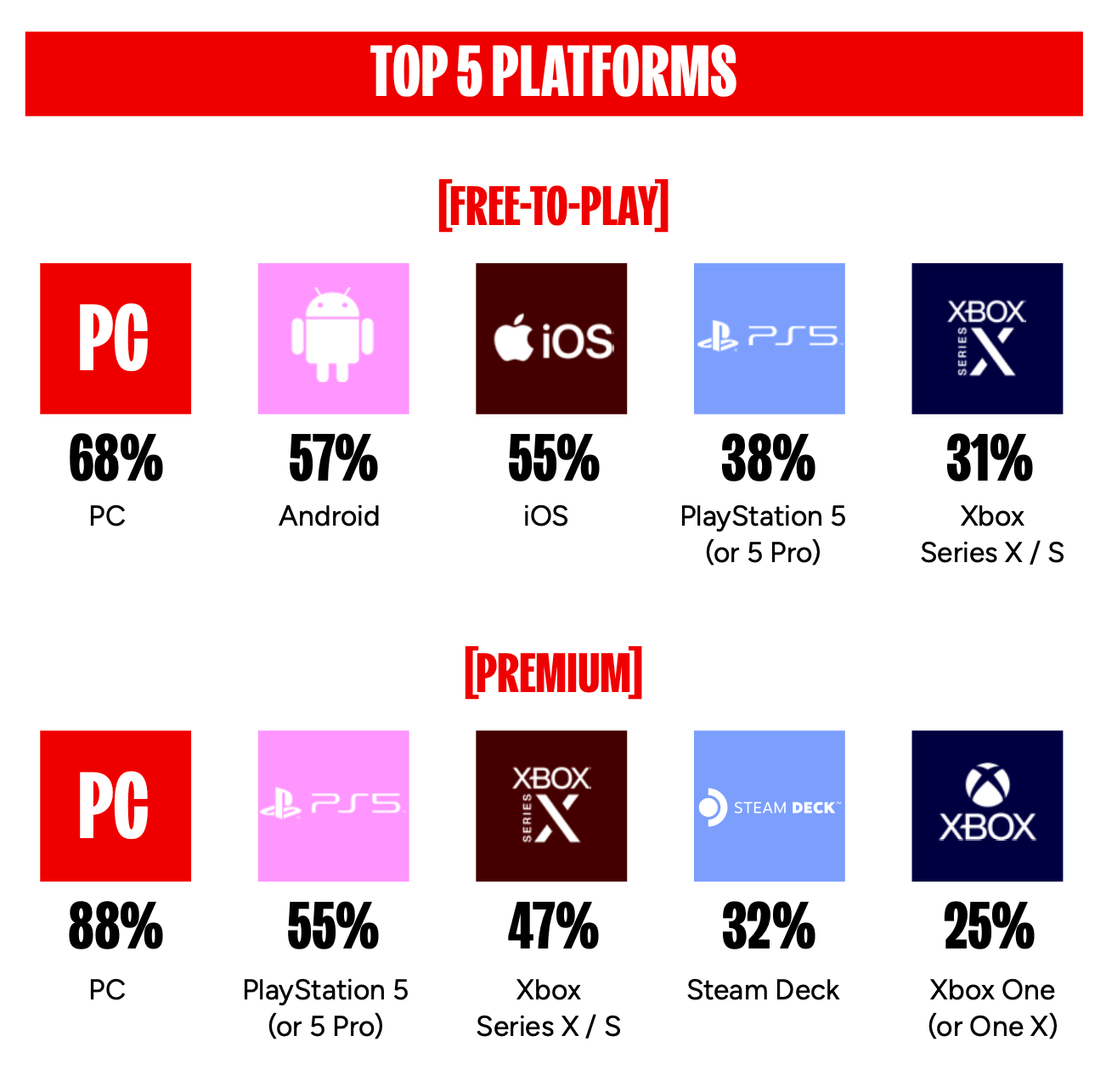

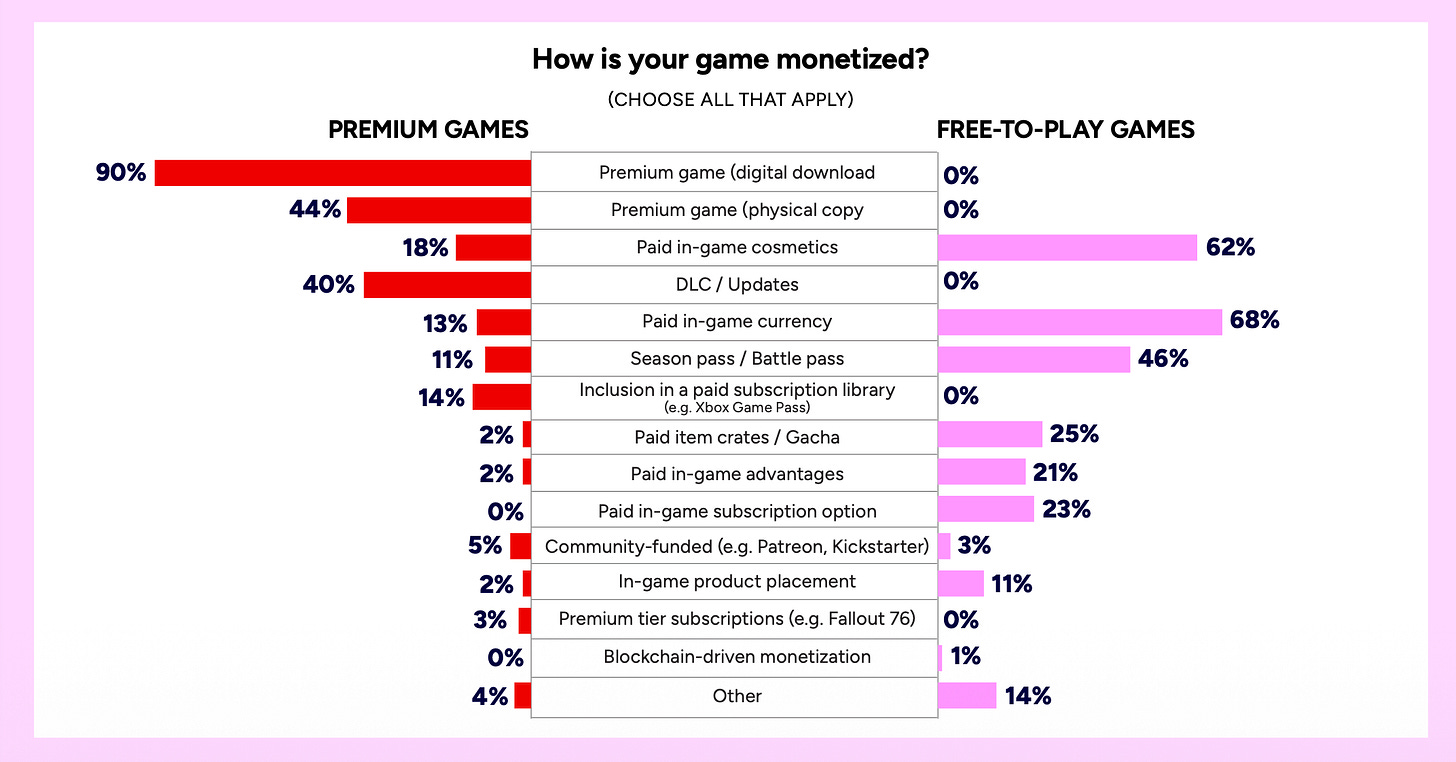

74% of respondents work on B2P games. The rest focus on F2P projects.

-

Among AAA studios, F2P is more common than in indie studios, at 33% versus 22%.

-

There are no major surprises in monetization trends. Blockchain monetization can effectively be considered over, with only 0.4% adoption.

-

Among 170 mobile F2P respondents, 37% are attempting to redirect users from App Store and Google Play to their own web shops.

-

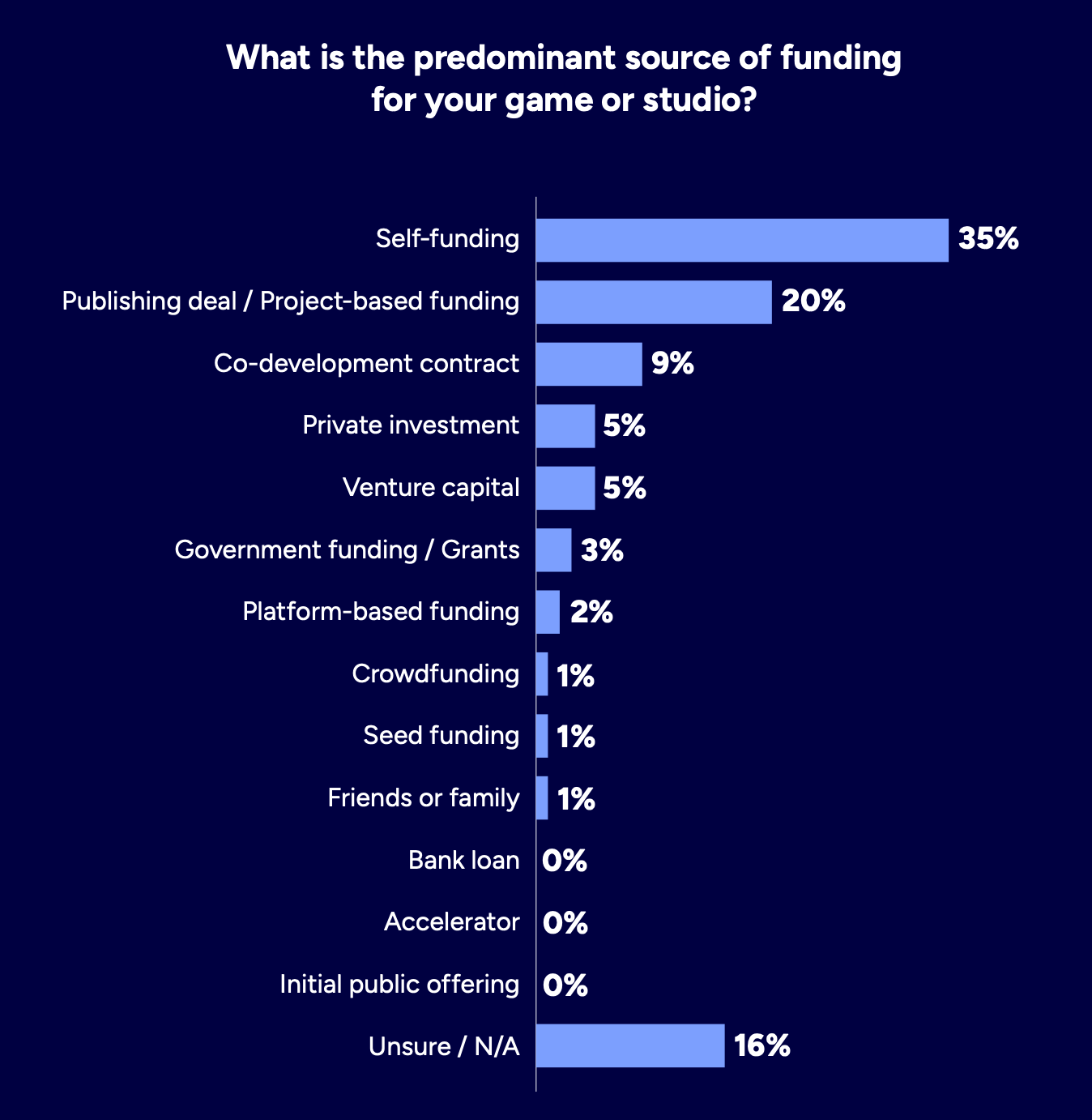

35% of developers are self-funded. 20% rely on publishing deals or project-based financing.

-

38% believe the tariffs introduced by the U.S. government in 2025 negatively affect their business. 39% disagree.

-

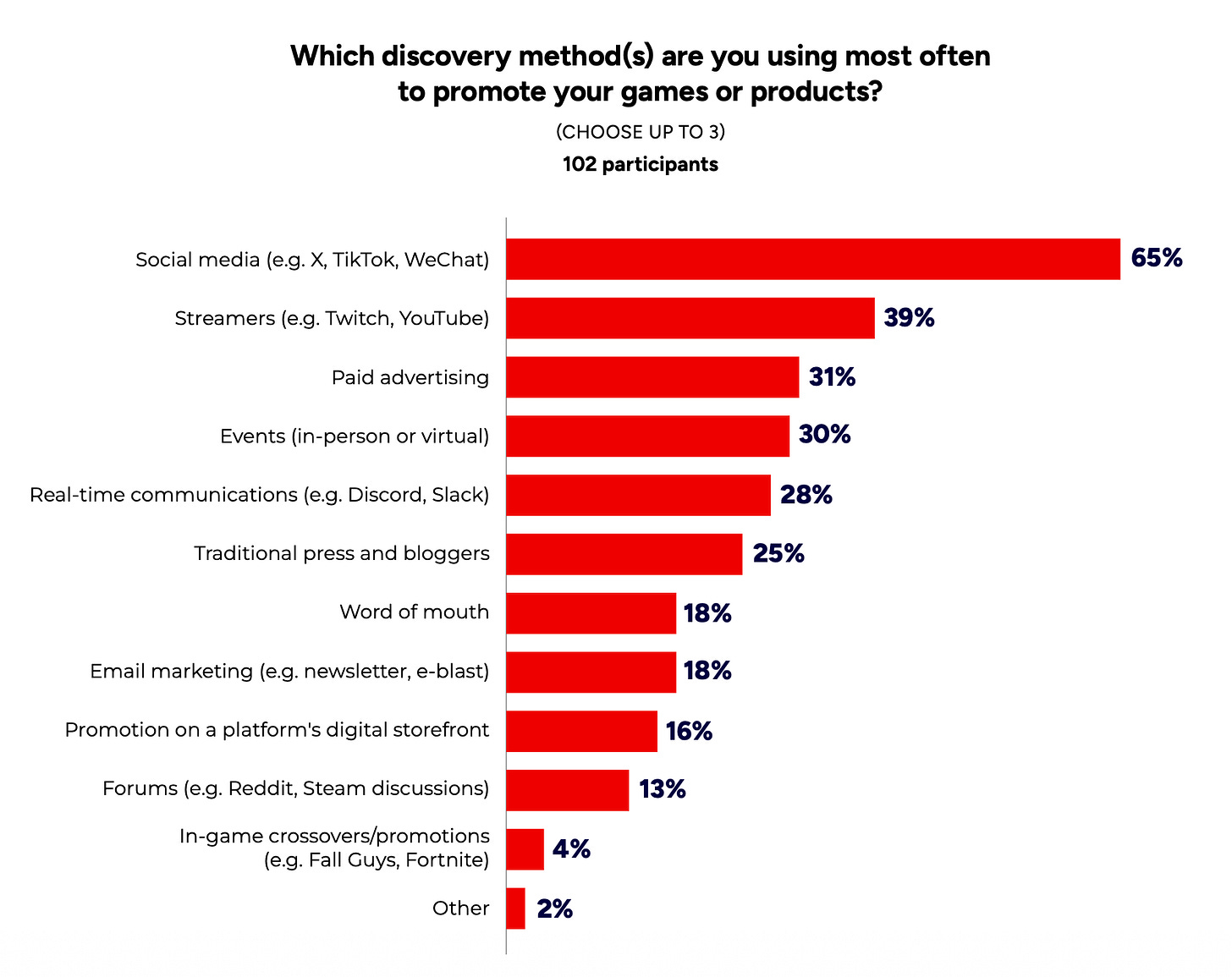

For marketing, the main user acquisition channels are social media (65%), streamers (39%), paid advertising (31%), events (30%), community platforms (28%), and traditional press and bloggers (25%).

A word from our sponsor

Boost your game’s revenue with Xsolla’s Buy Button, enabling secure 1-tap purchases via Apple Pay, Google Pay, and saved cards. Leverage Apple’s 2025 update, allowing external purchase links in the U.S., to reduce platform fees and increase control over monetization. Sync offers in-game events via API, driving player retention with dynamic bonuses, discounts, and loyalty rewards – all in a seamless, familiar payment flow that maximizes conversions.

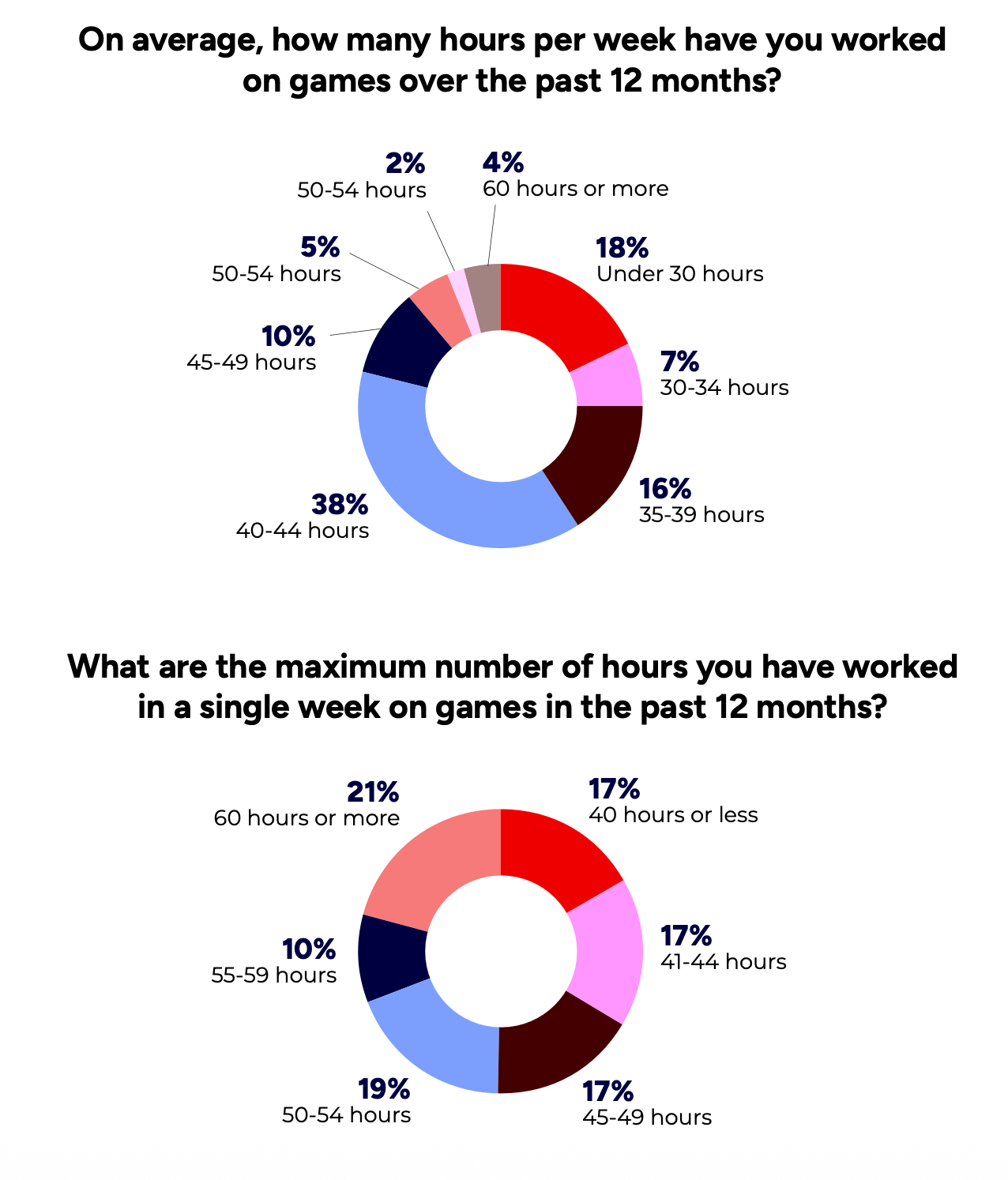

❗️I once ran an experiment to measure how many hours I actually spend on focused work, excluding chats, meals, coffee breaks, and short pauses. I was overestimating my real productive time. Most likely I am not unique, and a meaningful share of those reported 40 hours may not be fully productive time.

-

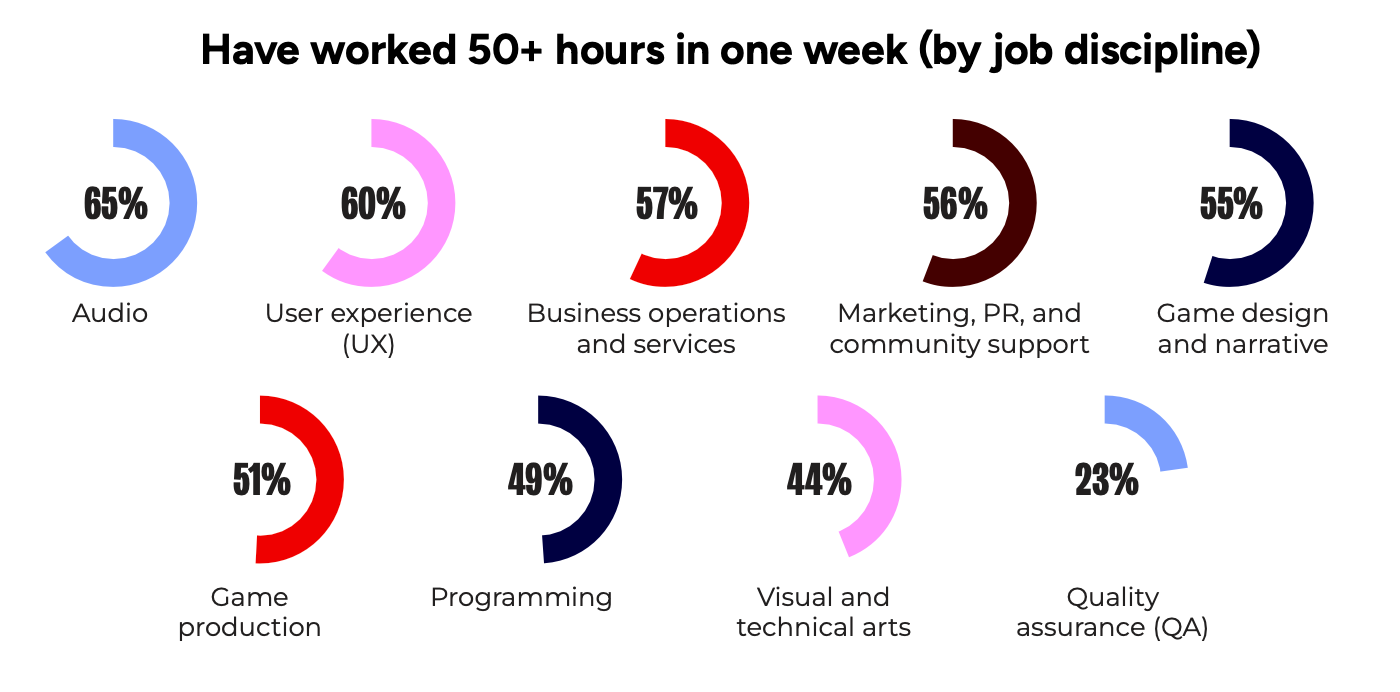

Among those claiming to work more than 50 hours per week, the highest shares are in audio (65%), UX (60%), and business operations (57%).

-

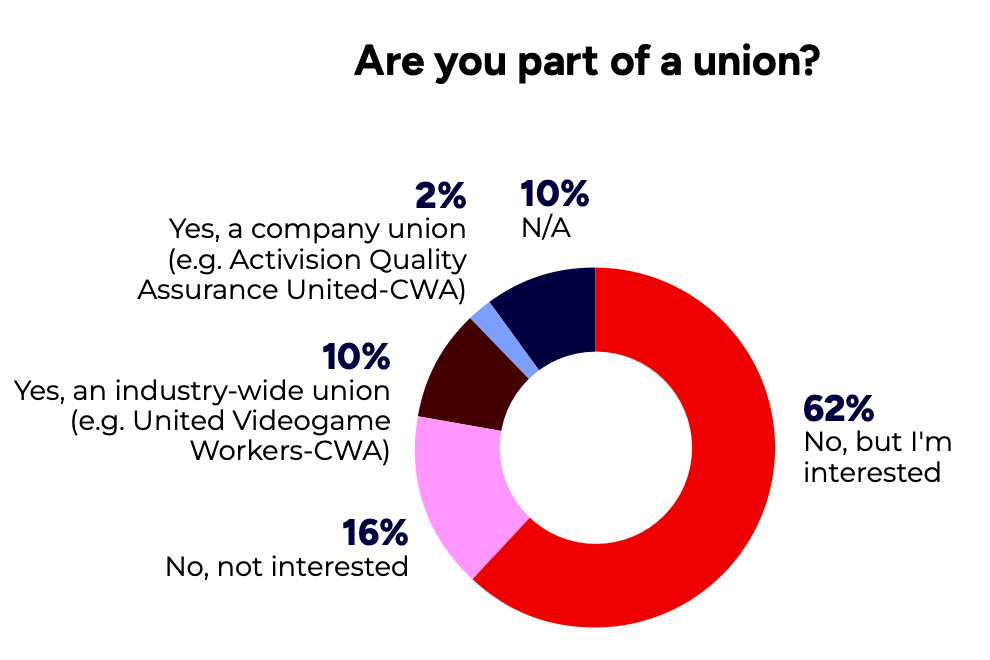

82% support the formation of unions in the game industry. Support is strongest among those earning up to $200,000 per year, those who were laid off in the past two years, and respondents under 45.

-

Only 12% are actually union members.

-

14% reported changes in their workplaces related to diversity and inclusion.

-

Among students in game-related programs, 47% noticed changes over the past year.

-

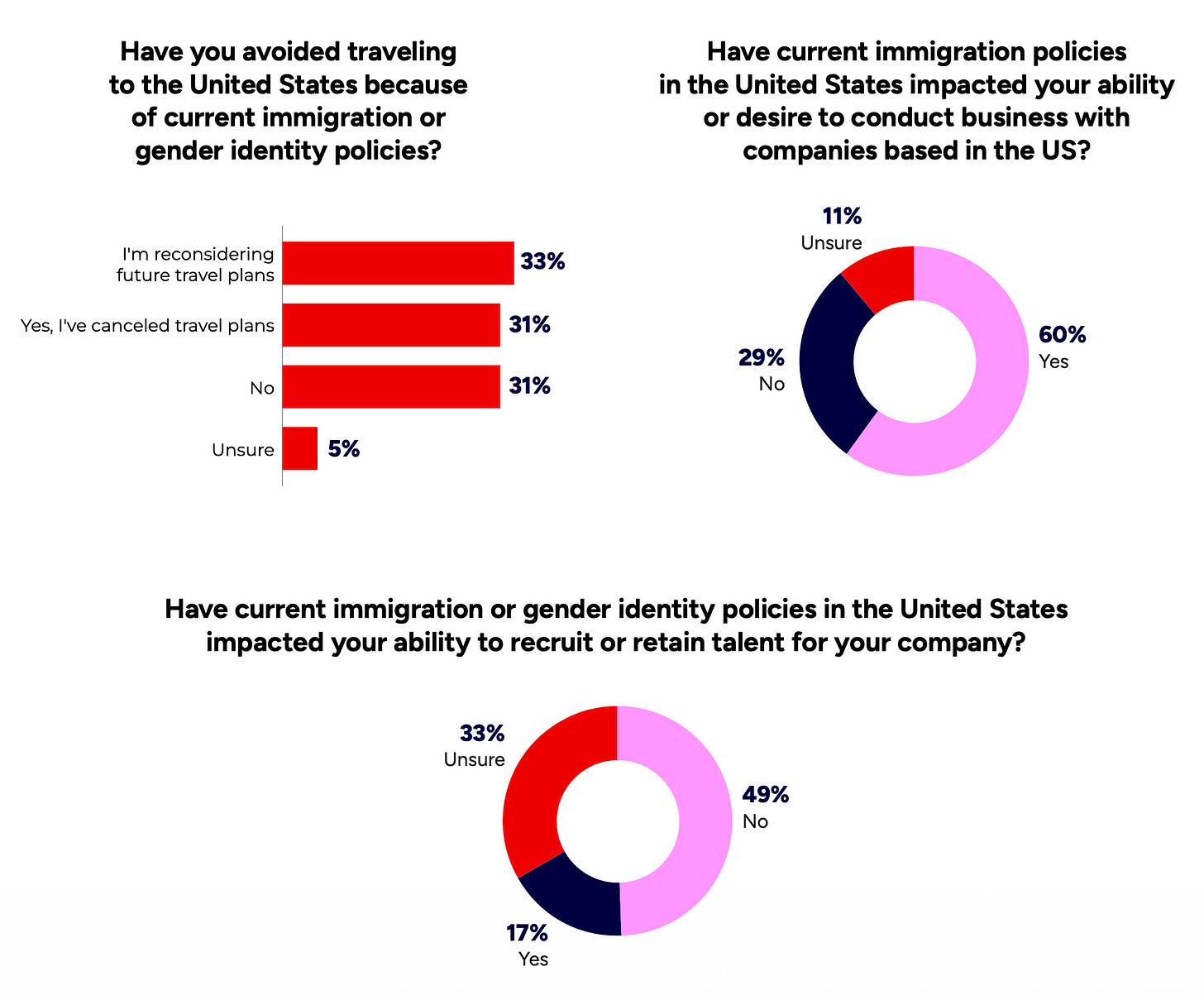

31% of respondents living outside the U.S. have already canceled trips to the country. Another 33% plan to do so.

-

60% said U.S. immigration policy has affected their ability or desire to work with American companies.

-

17% of U.S. respondents said it has become harder to hire or retain employees following recent legislative changes.

GameDiscoverCo is a great newsletter and insights platform. I read it, I like it, and I recommend signing up.

-

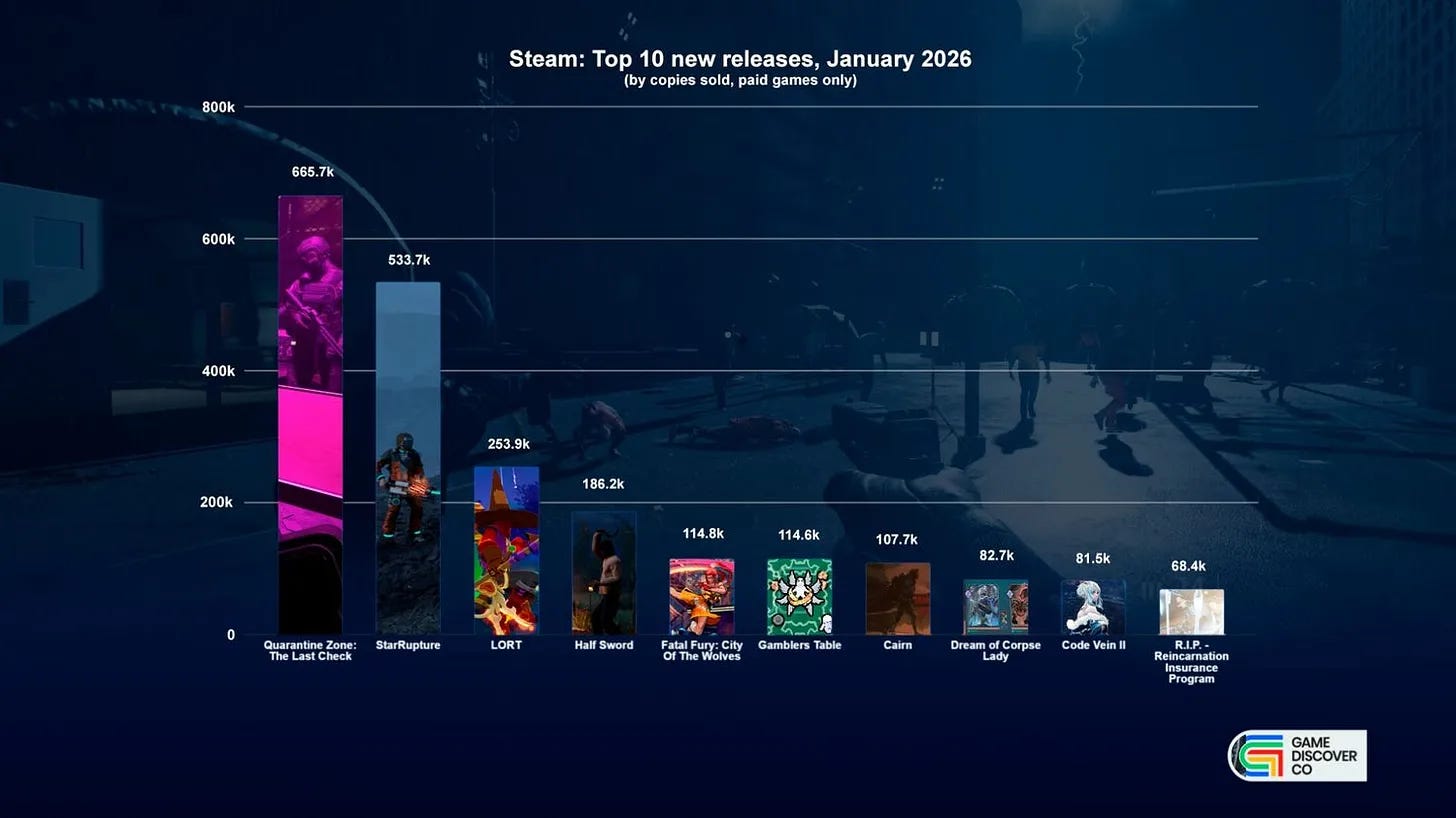

Quarantine Zone: The Last Check confidently took first place with 665.7 thousand copies sold.

-

StarRupture ranked second with 533.7 thousand copies, followed by LORT in third place with 253.9 thousand.

-

Cairn sold 107.7 thousand copies in January, although the developers announced in February that total sales had already exceeded 300 thousand.

-

January is traditionally not a month packed with major hits, but it did deliver several strong, smaller releases.

-

StarRupture generated $12.3 million and overtook Quarantine Zone: The Last Check, which earned $10.4 million, thanks to a higher price point.

-

Code Vein II ranked third, priced at $70 for the base edition.

A word from our sponsor

Transform your online store into an LTV powerhouse with Xsolla’s LiveOps tools – run dynamic, segmented campaigns to drive an 80% repeat purchase rate, and boost player retention by 15%+ using in-game synchronized offers and loyalty shops.

Time-limited promos, login bonuses, and referral programs can lift player engagement and help grow ARPPU by 20%+, all through an intuitive interface built for fast campaign launches, deep personalization, and maximum revenue impact.

-

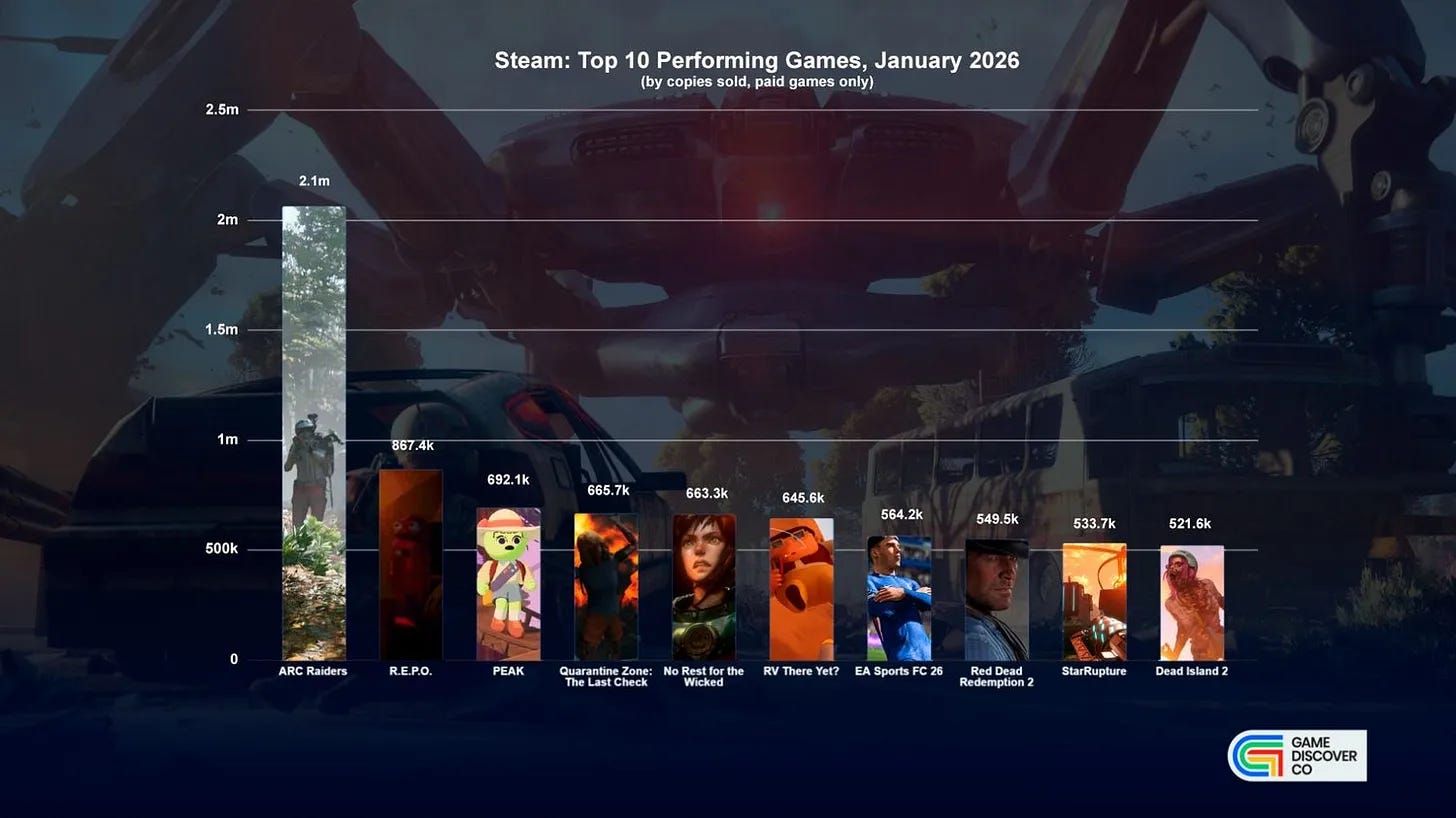

The ARC Raiders’ success story continues. In January alone, the game sold another 2.1 million copies, bringing total sales to 15 million.

-

Strong sales were also recorded for R.E.P.O., which added 867.4 thousand copies to reach 18.4 million total, Peak with 692.1 thousand new copies and 15.5 million total, and RV There Yet? with 650 thousand additional copies for a total of 5.5 million.

-

No Rest for the Wicked is worth highlighting separately. The game sold 663.3 thousand copies in January, bringing total sales to 1.5 million, following the release of its cooperative mode.

-

Counter-Strike 2 led revenue rankings by a wide margin with $163.9 million in January. ARC Raiders followed with $76.2 million, and PUBG: Battleground took third place with $56.3 million.

-

Where Winds Meet entered the Steam top 10 with $23.2 million in revenue.

-

New releases on PlayStation 5, such as Cairn and Code Vein II, sold fewer than 50 thousand copies.

-

The largest new release on Xbox Series S|X was Final Fantasy VII Remake Intergrade, which also sold fewer than 50,000 copies.

-

On Nintendo Switch 1 and 2, however, Final Fantasy VII Remake Intergrade sold over 100,000 copies in January.